C loud computing occupies a unique spot in IT history. In its early incarnations, it was the latest in a series of new models for IT operations. Existing systems were migrated to cloud providers, and companies found benefits in cost and flexibility while working through issues around security and integration. Today, though, cloud offers a path for business transformation. Powerful new capabilities and complex automation can completely change not just the role of the IT department, but the entire organization. As such, cloud computing bridges two eras of enterprise technology, moving IT from a heavily tactical function to a valuable strategic asset.

Cloud computing is a critical part of today’s IT operations

Although cloud computing has ceded the spotlight to emerging trends such as artificial intelligence or Internet of Things, it

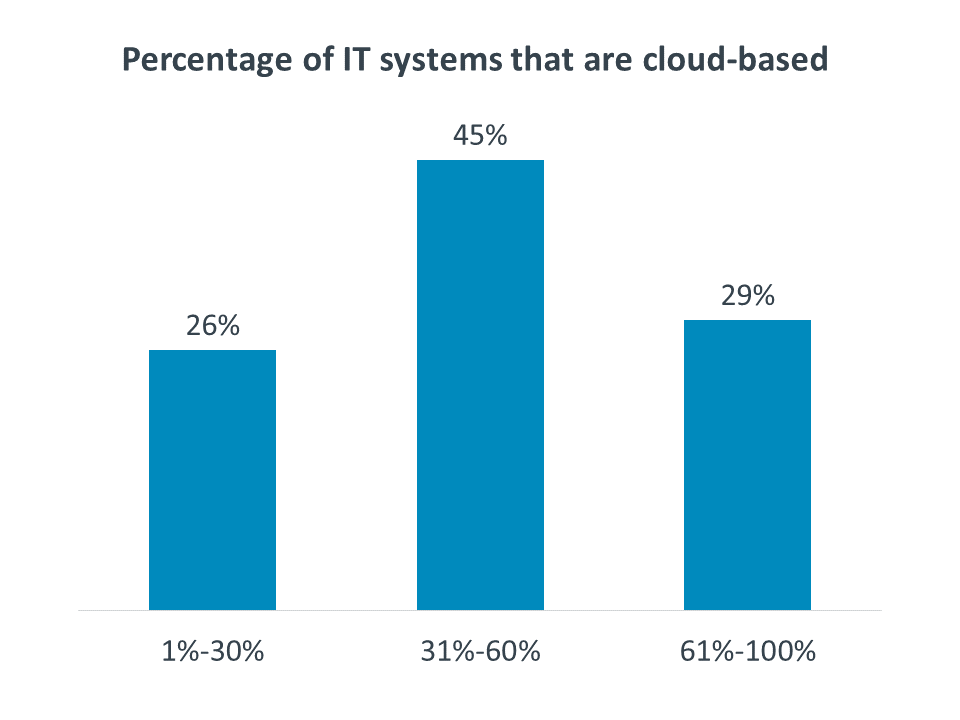

has become a foundational piece for modern IT architecture. Nearly half of all companies claim that 31% to 60% of their IT systems are cloud-based, and many firms are exploring optimization and orchestration to get the most out of the new models.

The IT function is evolving in a cloud world

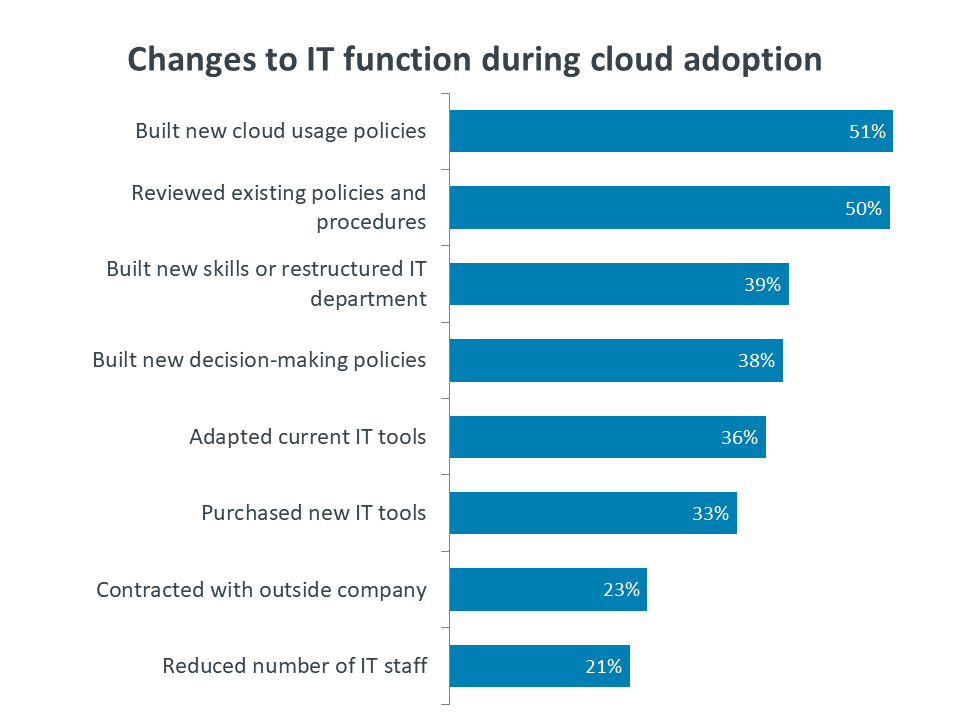

Rather than disappearing or shrinking as many feared, the IT function is transforming to handle more strategic work as routine pieces can be offloaded

to cloud providers. Common changes fall into three buckets: policies (51% of companies have built new policies for cloud usage), skills (39% of companies have added skills or restructured their internal team), and tools (36% have adapted IT tools

to manage cloud resources).

The challenges of cloud migration are outweighed by the benefits

As cloud adoption enters later stages of maturity, companies are encountering new hurdles. Integration is still the main challenge,

but the next two (workflow modification and policy change) highlight organizational issues that follow initial technical efforts. However, there is clearly a wide range of benefits, with smaller companies improving implementation, mid-sized firms

modernizing their IT environments, and large enterprises streamlining their processes.

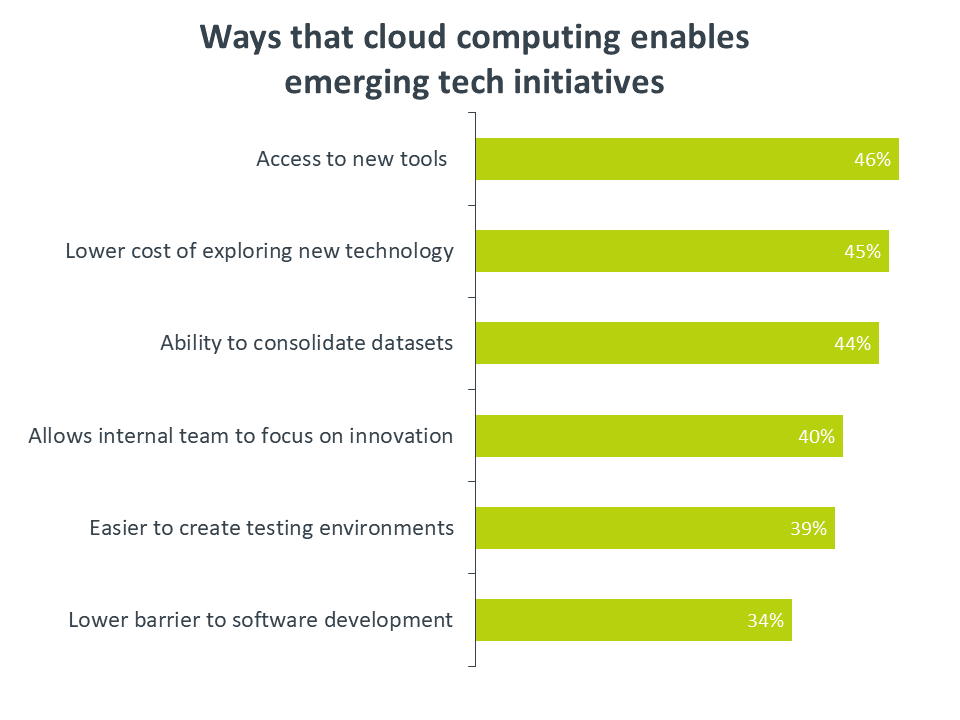

Cloud is a key enabler for emerging technology

The rising interest in cutting-edge trends is driven largely by cloud computing. By providing access to new tools or allowing companies to consolidate

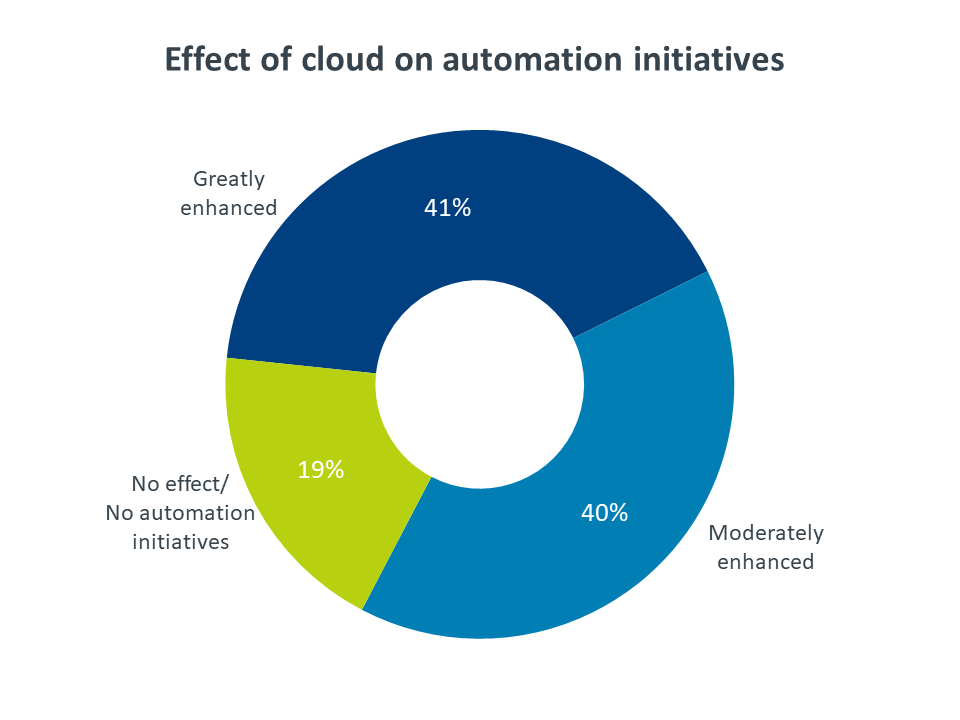

their datasets, cloud simplifies the process of exploring new topics and lowers the cost. In addition, cloud plays a role in stitching together technology for broad applications. Eighty-one percent of companies say that cloud has greatly enhanced

or moderately enhanced their efforts around automation.

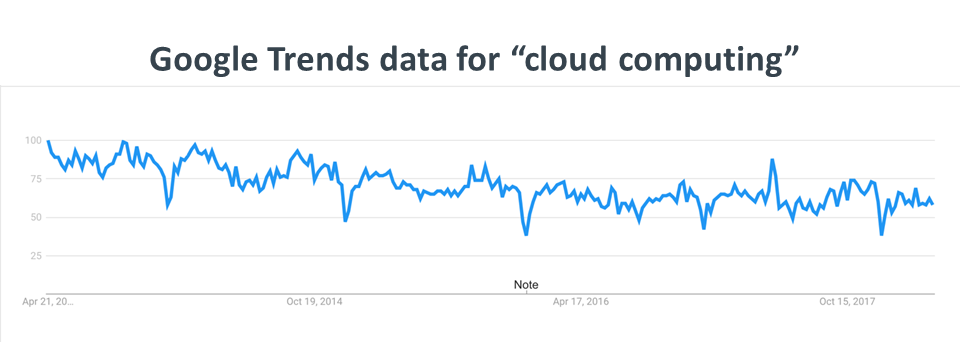

Cloud computing is rapidly moving from an emerging trend to an established technology. Especially for those that have been following the topic since its modern launch circa 2006, it may seem that cloud computing has given way to newer subjects that monopolize the hype spotlight. Looking at Google Trends information covering the past five years, interest in cloud seems to be on a steady decline.

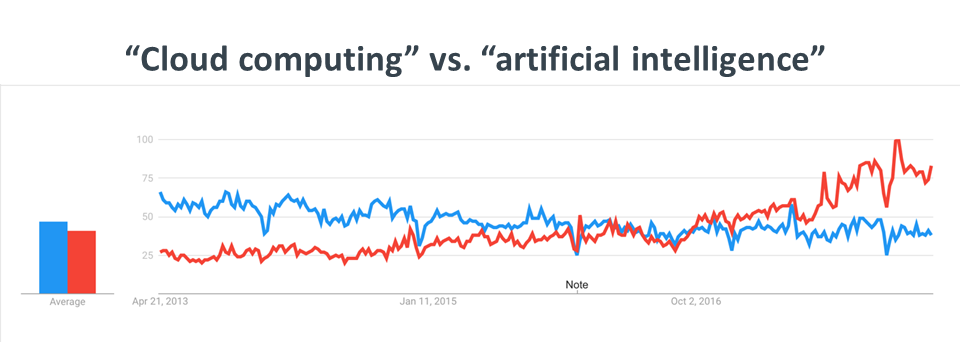

However, this data needs context. In CompTIA’s IT Industry Outlook 2018, cloud computing was one of four trends that are expected to feature heavily in IT conversations over the next 12 to 18 months, along with artificial intelligence (AI), Internet of Things (IoT), and cybersecurity. Interest in AI follows the expected pattern, recently surpassing interest in cloud.

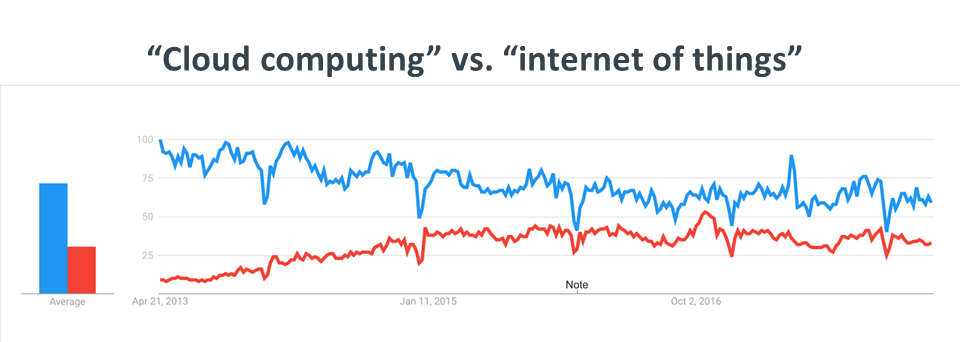

Internet of Things is another trend that has followed cloud computing on the IT timeline, but interest in IoT has actually never reached the same level as interest in cloud.

Cybersecurity, the most established of these four topics, clearly lags behind as well, although interest is rising (the spike in February 2016 is likely correlated with two executive orders on cybersecurity signed by then-President Obama).

Clearly, cloud computing is more than just a passing fad. Revenue projections are somewhat confusing since it is difficult to tell exactly what is included—IDC predicts $162 billion in worldwide spending on public cloud by 2020, and Deloitte projects $547 billion in global spending on “IT as a service” by the end of 2018—but there is a common thread running through every forecast: Cloud computing represents a a larger and larger percentage of overall IT spending. Most recently, there have been questions about edge computing and its impact on the cloud, but those questions are ultimately issues of proximity. The unique characteristics that have allowed cloud to flourish will continue shaping IT decisions even as edge computing grows more prominent.

As in past years, those unique characteristics remain somewhat unclear even as companies pursue new IT strategies more aggressively. The most important metric has always been whether a business is achieving its goals with technology, not whether they are adhering to a strict definition of cloud. Definitions are only important as they relate to goals. A company that believes they are using cloud resources since those resources are accessed over the internet may find that they need to explore new options if they want to start paying only for resources as they are consumed.

Companies are solidly in the middle of a cloud adoption progression. The vast majority of businesses (74%) have between 1 and 5 years of experience with cloud solutions. Within the stages of adoption that CompTIA has defined, most companies have activities in the middle two sections, such as “Integrating cloud and on-premises systems” and “optimizing operations across multiple models.”

More significantly, the percentage of IT architecture that is cloud-based is reaching critical mass. It is still unlikely for most companies (other than startups) to ever have 100% of their architecture in the cloud. But as cloud systems comprise the bulk of IT operations, that will force operational changes. This report explores the changes taking place within IT departments as new skills and new approaches are needed for cloud environments.

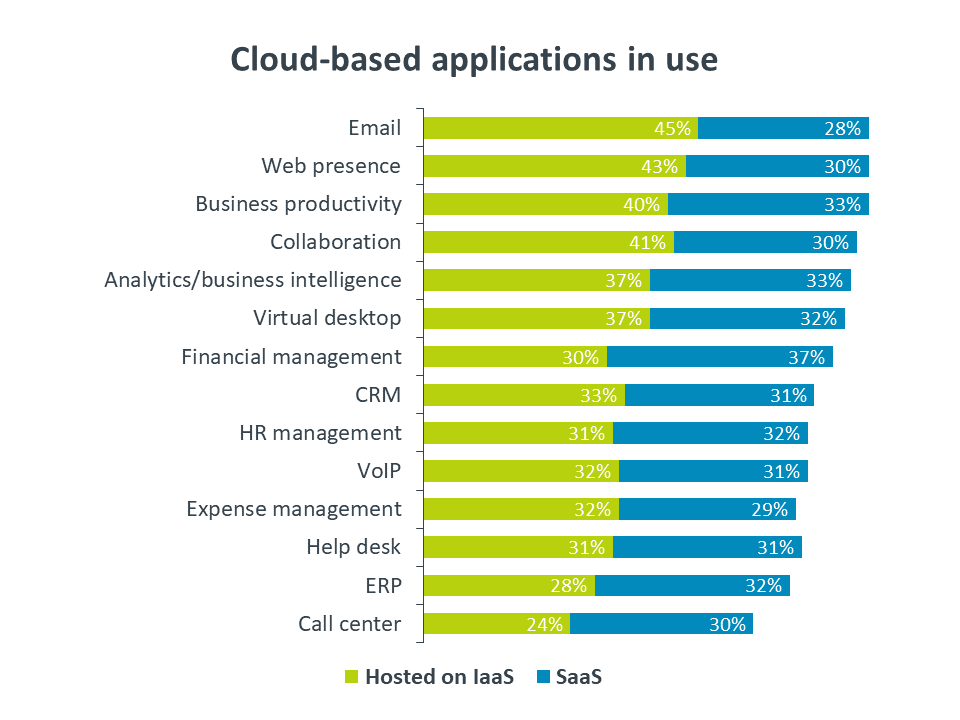

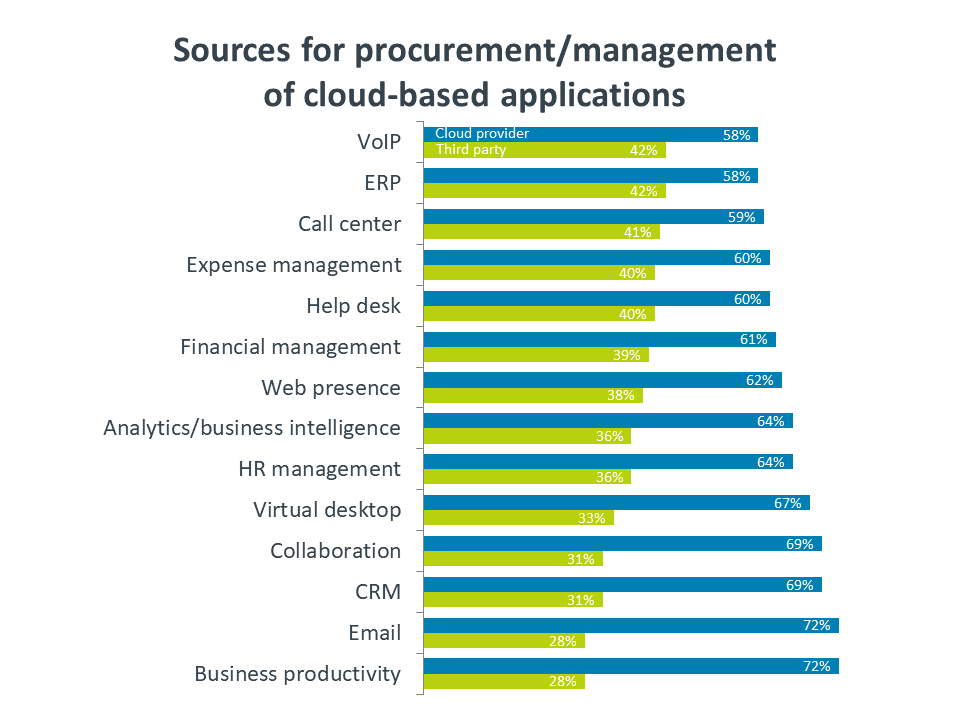

One of the most common questions asked during the cloud era has been “What type of work is being done in the cloud?” This question is popular because it has such broad appeal. IT professionals can understand what workloads are best suited to a cloud environment, and they can quantify specific benefits as they describe application migration to upper management. On the supply side, vendors can tailor their offerings for cloud architecture and technology services firms can focus their skills on the most common cloud applications.

As in previous years, a close examination of the data furthers the theory that companies hold broad interpretations of cloud systems. In the case of applications, the mix of IaaS vs. SaaS looks suspicious. Given the simplicity of using a SaaS-based application, it seems that SaaS usage should outpace hosting on IaaS, especially considering that many companies in the SMB space are exploring SaaS options for applications that were previously too costly to maintain on their own. There are likely many businesses which view any application hosted by a third party as an application hosted on cloud infrastructure.

Nevertheless, the list of cloud-based applications provides several useful insights. First, it is a useful proxy for the corporate application landscape. Email, web presence, business productivity, and collaboration are essential table stakes for today’s digital organizations, and any improvements in these applications will have broad impact. The bottom half of the list contains those applications that are seeing broader adoption since cloud simplifies the process. CRM, VoIP and ERP are prime examples.

In the middle are two applications that raise some questions. Analytics and virtual desktops make sense as cloud options since they are also tools that most companies might not have maintained internally. But their prominent position on the list is suspicious. In fact, a significant number of companies report that analytics was the first application they pursued in the cloud. It seems unlikely that companies would pursue cloud-based analytics before pursuing the more foundational applications, and it also seems unlikely that more companies would have cloud versions of these applications than have applications related to core business functions such as finance or HR.

One possible explanation is that companies have pursued analytics and virtual desktops based on the promise of massive benefits, but internal adoption has been slow thanks to issues with integration or workflow. This is the pattern companies saw with unified communication suites; actual usage does not necessarily track with up-front investment.

Another insight from the application list is that cloud is a critical ingredient in digital transformation. Looking at application adoption by company size provides another proof point to the theory that medium-sized businesses are a sweet spot for cloud computing. These firms have organizational challenges that require a more complex architecture but have not typically built the resource pool to manage such complexity.

Certain applications stand out as being more heavily adopted by medium-sized organizations (100-499 employees) than small companies (less than 100 employees) or large enterprises (more than 500 employees). Cloud software for financial management is in place at 75% of medium-sized firms compared to 66% of large companies and 61% of small businesses. Customer relationship management follows suit, with the numbers standing at 73% (medium), 68% (large), and 54% (small).

In fact, most of the applications in the second half of the list have similar ratios. Medium-sized companies are not just pursuing applications that had no prior on-prem equivalent, they are building a cloud-based architecture that gives them real advantages in their business operations. Born-in-the-cloud startups are certainly examples of small companies on the same path, and large firms can leverage their resources to mitigate gaps during legacy transitions, but a heavy use of cloud applications will clearly be a requirement for businesses competing in a digital economy.

The primary implication for IT professionals is the new center of gravity around workflow and skills. Infrastructure employees that once felt the threat of job loss have discovered that their job was never really about the upkeep of servers, it was about the provision of workloads. In a cloud environment, that provisioning requires many traditional skills in virtualization and networking along with demand for new skills in areas such as devops, application security, and containers. Especially as the cloud components of an architecture expand, the ability to maintain a consistent IT platform is extremely valuable.

CompTIA’s previous cloud research found that companies were refining their interpretations of which work was actually being done in cloud systems. Even though some businesses continue to hold loose definitions of cloud computing, the past few years have seen many firms come to a better understanding about what constitutes a real cloud offering and therefore how much of their architecture is truly cloud-based. This initially caused an apparent step backwards in cloud adoption as knowledge was clarified, but momentum has definitely picked up again.

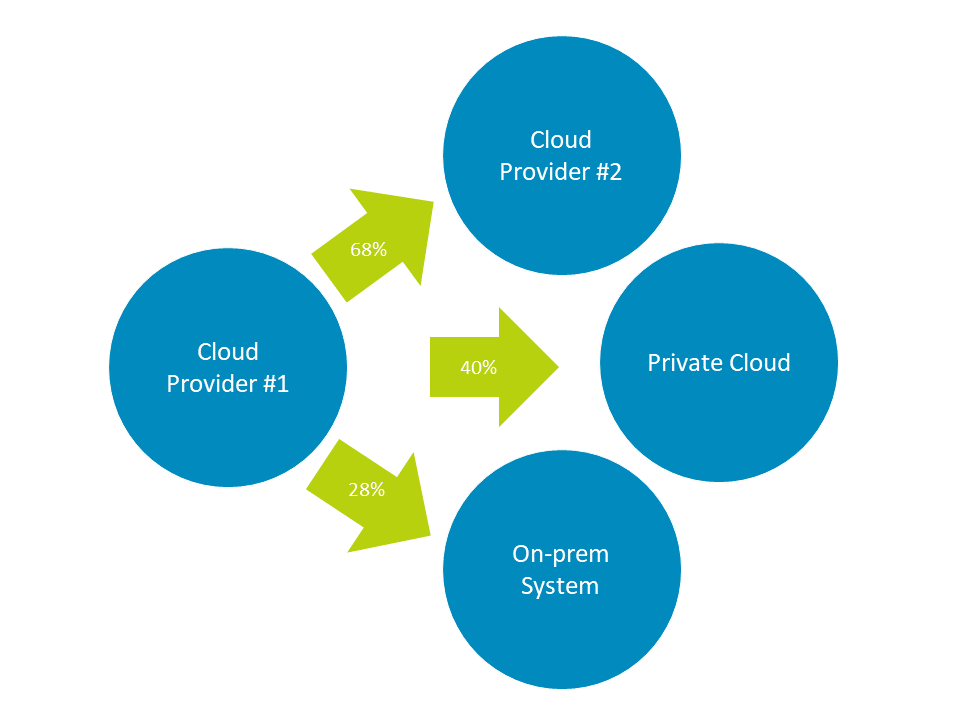

After an initial migration of certain applications to the cloud, the next stage of evolution is determining which model is the best option for each application. This means examining multiple cloud providers, exploring hosted or on-prem private clouds, and accepting traditional on-prem solutions depending on the situation.

The vast majority of companies—83%—have performed some type of secondary migration. Most of those have been a move of either infrastructure or applications to a second cloud provider. There are a variety of motivations here. Better offerings or features top the list, with 44% of companies saying this was the reason for their move. Security followed close behind, with 41% of companies citing concerns with their original provider. Other common reasons for a move are high costs (37%), more open standards (35%), and problems with outages (30%).

Although private cloud is definitely a term that inspires much debate, it provides a good balance of flexibility and control when executed properly. That execution clearly takes some level of specialized skill. Fifty-four percent of companies moving into a private cloud solution had to retrain existing IT staff, and 52% needed to contract with a new IT solution provider with experience in this area.

Finally, just over a quarter of companies that have performed cloud migrations have moved some number of systems back on-premises. Here, the motivation is overwhelmingly tied to security. Six out of ten companies moving systems from a public cloud provider to an on-prem solution say that they needed better control over security or compliance. The next most common driver is difficulty with integration (45%). It is notable that these two issues are the primary problems that companies run into when business units procure solutions without including the IT team in the decision process. Some percentage of initial cloud migrations were likely the result of business units procuring software on their own, and now these applications are being brought back into the broader corporate structure.

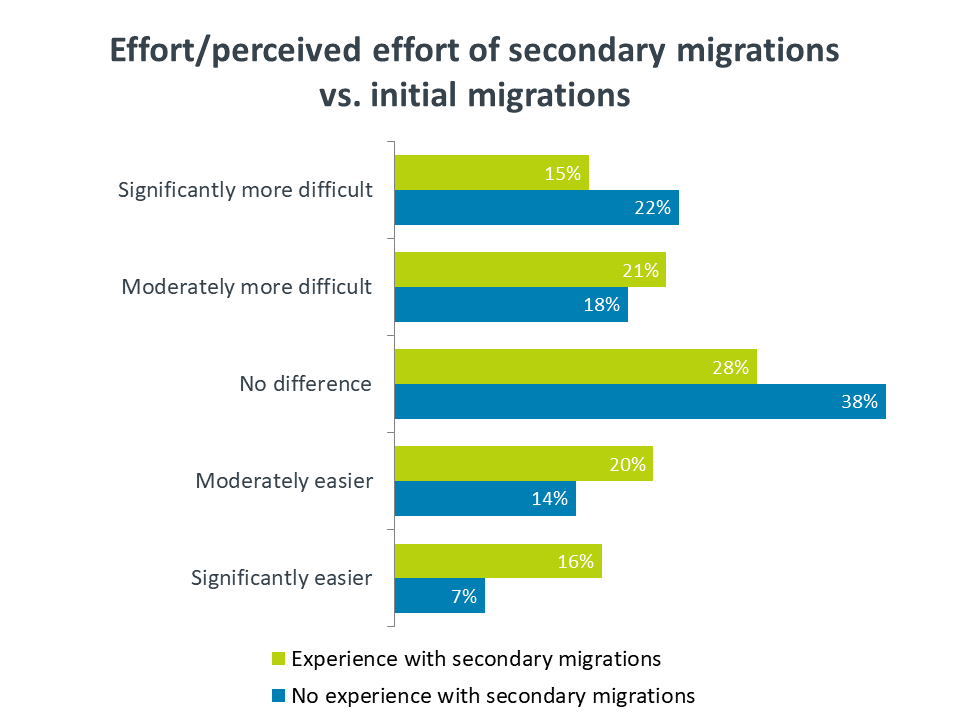

As secondary migrations take place, companies must account for the effort in moving systems. Here, there has been a shift in the level of effort needed compared to the level of effort expected by companies who have not yet started secondary moves. A few years ago, companies that had not been through the process mostly believed that secondary migrations would require less effort than initial migrations. Companies with some experience reported that secondary migrations were as difficult, if not more difficult, than the original move.

Now, there is a more even distribution of both expected effort and actual effort. Obviously there have been lessons learned over the past few years, and companies have a better sense of what to expect. Beyond that, cloud providers are continuing to improve their capabilities. Even as these providers aim to keep clients in their ecosystem, improved tools and broader use of open standards give end users a better chance to avoid lockin.

Cloud-based applications bring IT changes as business units become more involved in technology decisions, and multi-cloud models bring changes as IT has to monitor and optimize a more complex architecture, but these are just the beginning of the changes that ultimately redefine the IT function. The role of IT has been a major question mark during the early stages of cloud adoption, and while it is clear that IT will play a new, more strategic role within the digital organization, the specific details of that role are still being determined.

The most common type of change that is occurring within IT operations is the creation of new policies or a change to existing policies to establish procedures for cloud environments. This makes sense as companies are becoming more mature in their cloud practices. Later stages of adoption are marked more by changes to policy and workflow than technical hurdles. While 46% of companies with less than three years of cloud experience have changed existing IT policies, that number jumps to 56% for companies with three to five years of experience and 54% for companies with more than five years experience.

As expected, security tops the list of policies that have been created or modified. Seventy-one percent of companies have focused on security policies, far above the other policy changes such as corporate data and approved vendors for cloud use.

From a tooling perspective, the features being added or purchased highlight how cloud can change operations. Monitoring is a major focus, with 61% targeting performance monitoring and 60% targeting simultaneous monitoring of cloud and on-prem environments. Other important features include self-service capabilities, mechanisms for compliance audits, and connections to finance systems.

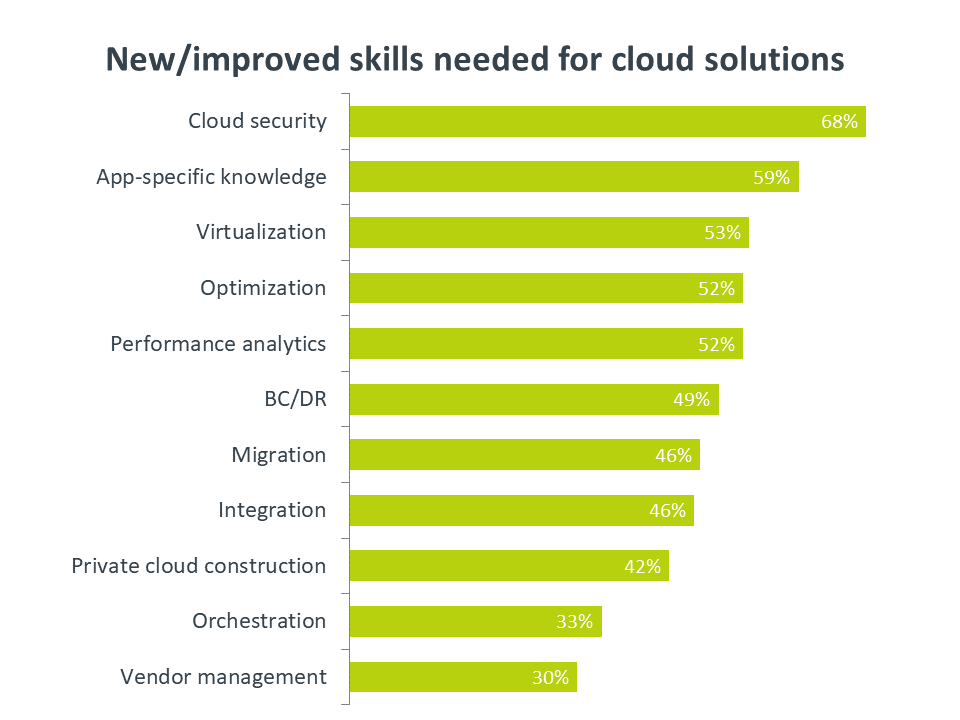

While skill-building does not top the list of cloud-driven IT changes, it may be the change with the largest impact. New policies are important for corporate governance and new tools enable optimization, but new skills change the entire dynamic of the IT function.

The need for cloud security skills is well documented, as companies recognize the need to secure applications and data that move outside a corporate perimeter, and this security must be layered on top of the cloud provider’s solution. The next two skills on the list provide deeper insights into the nature of a cloud-centric IT function.

Application-specific knowledge such as expertise with the Amazon Web Services toolset or Salesforce.com suggests a demand for specialization. Companies are looking for individuals who can tweak tools to provide tailored solutions.

On the other hand, demand for virtualization skills suggests that companies need individuals who understand the foundational structure of a cloud system. Virtualization is certainly not a new trend, but it remains a skill that many companies are seeking to improve.

The tight clustering of skills in the middle of the list indicates that a number of companies have a broad mix of needs. Obviously not every company has the wherewithal or the necessity to have separate individuals focused on each of these fields. However, many of these categories—like virtualization—are extensions of traditional skills. Existing server administrators and network administrators will be in familiar territory as they pick up the cloud additions to their existing skill set, then deeper training and certification can focus on areas that are more cloud-specific such as optimization or performance analytics.

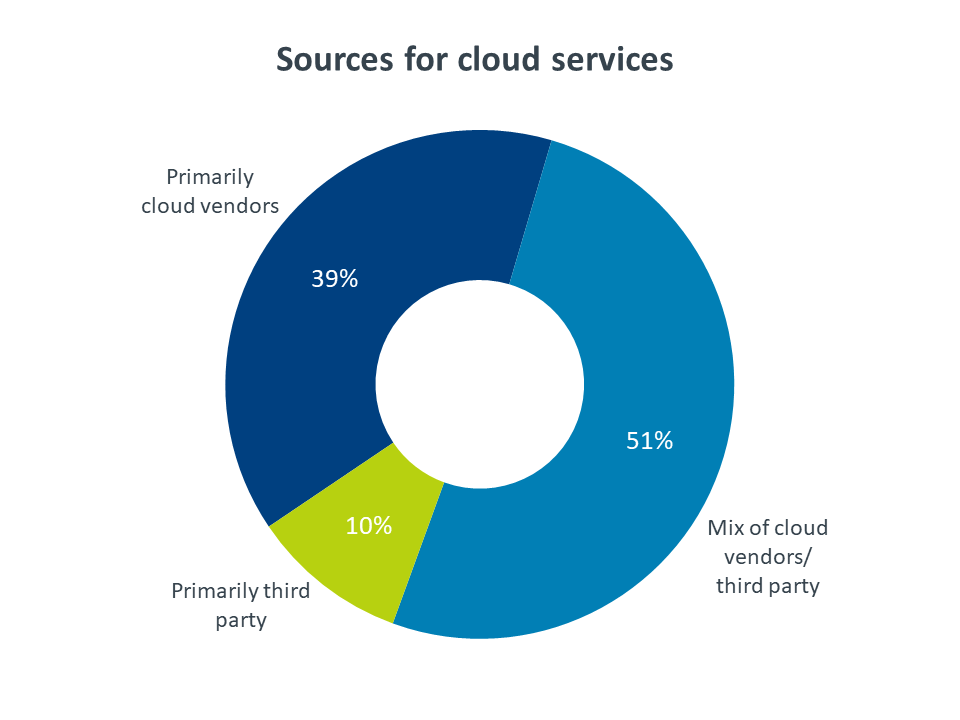

As cloud drives changes to the skills of an internal team, it also drives changes to the nature of external relationships. Overwhelmingly, companies working with cloud solutions have some direct relationship with the cloud vendor, whether those relationships are the primary source of cloud services or whether the company also has some third party partnerships. Contrast this situation with the way companies might have built out their datacenters. In all likelihood, there were far fewer direct connections to vendors of datacenter equipment or packaged software.

This increased ability and tendency to source cloud solutions directly from vendors has been cause for concern among third-party firms that have traditionally provided product distribution. While cloud is a more recent phenomenon, the disruption of distribution is generally a ripple effect of the internet. IT as a service is more complex than the end deliverables of the newspaper industry or the music industry, where digital distribution has been changing the landscape for decades.

The good news for third parties is that sourcing the product is only the first step in a cloud solution. Unlike a datacenter, where monitoring and maintenance were relatively less important than the original installation, cloud systems require more secondary activity, from integration to customization to analytics. Large companies, which are more likely to be pursuing a range of activities related to cloud operations, use a mix of vendors and third parties more frequently than their smaller counterparts.

The subtle shift towards later stages of the lifecycle can be seen in the types of activities that third party firms are doing. Among those companies that have contracted with an outside company for cloud initiatives, the most popular services are not the initial steps of consulting and migration, but secondary services such as integration and education. Interestingly, ongoing monitoring and management is ranked last on the scale. Given that many technology service firms have focused on these activities for hosted or on-prem datacenters, this may represent a field of opportunity as businesses move even deeper into cloud adoption and explore the optimal operation of their architecture.

Past experience with managed services may not be enough to win new contracts, though. The top factor driving companies to select a third party was not prior relationships (cited by 21% of companies using outside firms), but rather a proven expertise with cloud solutions (32%). Next on the list was the ability to integrate cloud solutions with on-prem systems (25%). Clearly, businesses are finding that their existing contractors may not have the level of expertise they require, so technical service firms may need to pursue new skills at the same level as internal IT teams.

One key area for upskilling is around cloud-based applications. Many third parties today may have strong client relationships based on application delivery and support, especially business productivity and email. Yet across the board, more companies are working directly with vendors on procuring and managing applications. Especially as ongoing management becomes more complex, technical service firms can add value by offering customization or optimization of applications in cloud environments.

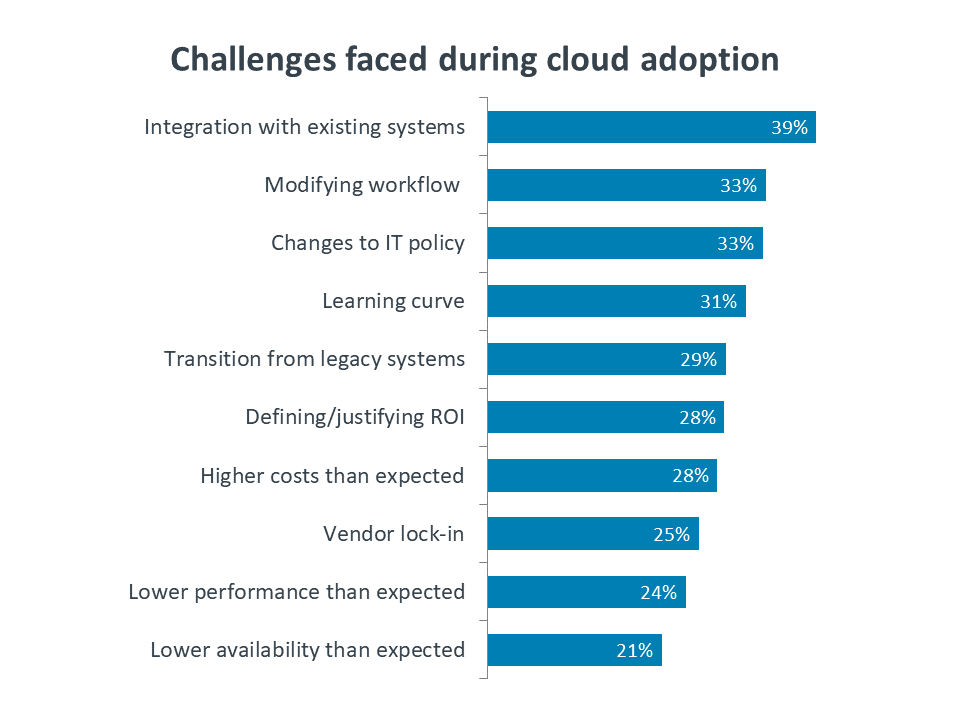

With all the disruption that cloud computing can introduce, it is no surprise that organizations have to deal with a variety of challenges. Again, even the list of challenges shows that companies are moving into later stages of adoption; unexpected issues related to cost, performance, and availability all rank near the bottom. Not only are companies learning lessons from early adopters, but they are also moving past these early-phase headaches.

Instead, businesses now have to contend with making cloud solutions a functional part of the architecture. Integration has become a major challenge, and this task will only become more complicated as multi-cloud models proliferate. This problem goes hand in hand with painful transitions from legacy systems, as IT pros figure out exactly which systems should be migrated to the cloud, which systems should be rebuilt for the cloud, and which systems are best left alone (at least for the time being).

Another set of challenges that go together are modifications to workflow and the learning curve associated with cloud solutions. As business units become more reliant on technology and gain greater independence around technology decisions, it becomes more important to ensure that users are getting the most out of the systems. Workflow and behaviors have always been a hurdle to tech adoption. Another way that IT can add value is in driving education around best practices so that cloud initiatives provide the maximum benefit.

Of course, those benefits are the rationale behind any willingness to solve cloud problems and deal with disruption. The reason cloud has been so unique within the history of IT trends is the speed with which companies of all sizes started realizing benefits. Extreme flexibility led large enterprises to see how their IT operations could be made more efficient, and extreme accessibility led small companies to see how they could expand their infrastructure.

At this point in the cloud era, the list of benefits for different companies is becoming more varied. For most companies, cost savings is the number one benefit. Cloud costs have been an area of debate, with early adopters expecting cost savings, then being surprised as the cost equation varied from workload to workload, and now eventually realizing that savings tend to be the norm as cloud grows in scope across the overall architecture.

Benefits of cloud computing for small companies

For small companies, the benefits revolve around the lack of resources. Simple implementation is preferable when there are limited funds for technical support, and business unit independence is obviously desirable if the company only has business units and no technical team.

Benefits of cloud computing for mid-sized companies

Mid-sized companies, on the other hand, have more resources at their disposal and more infrastructure already in place. Modernizing the existing environment ensures that the company remains competitive, and adding capabilities or features allows for continued growth.

Benefits of cloud computing for large companies

The most notable difference with large companies is that they do not view cloud as simply being the better option for a variety of reasons. They are more aware that a specific ROI must be shown for investments, and their benefits likely have dollar amounts attached rather than being broadly stated goals.

As described in the market overview, cloud computing is moving from an emerging technology to an established technology, with other topics capturing more attention from those that are focused on the cutting edge. However, cloud is not completely disconnected from these newer trends. As the driver for a new way of imagining IT operations, it is also the foundation for emerging tech initiatives.

With cloud/mobile as a new platform for technology creation and application, there are a host of emerging trends at various stages of development. Consistent with CompTIA’s previous research on emerging technology, adoption remains relatively low, especially for any systems operating at production level. The most common emerging tech at that level is Internet of Things, with 22% of companies claiming production-level capabilities. As expected, the adoption numbers are skewed towards larger companies, but even then there is a high degree of optimism. For example, it is hard to believe that 16% of companies actually have production-level quantum computing systems.

What is more believable is the impact cloud computing is having on allowing companies to widen the scope of technology possibilities and accelerate the plans they are putting in place. First and foremost, companies engaging with cloud providers are being given access to powerful tools that the providers can create based on their own internal expertise. From data analytics to mobile backends, end users can get the benefit of advanced toolsets without having to make a full investment or build all the skills required for doing the work in-house.

The ability to avoid large capital expenditures for new technology initiatives and the ability to use cloud infrastructure to optimize IT (such as consolidation of datasets) leads to an overall lower cost for exploring new technology. This is a cost benefit of cloud that is tied more to the strategic side of IT than the tactical. Rather than cutting costs on existing IT activities, cloud is making it more cost-effective to push into areas that have never been considered before.

This same mentality extends to the IT team. Instead of reducing the IT workforce immediately after migrating workloads into the cloud, companies are utilizing their technical talent in more innovative ways. Some companies may be forming distinct teams whose purpose is emerging tech exploration, and other companies may simply be giving more bandwidth to their IT pros so that they can evaluate new ideas.

This tendency to redirect the IT team as opposed to trimming resources should give IT pros more confidence as they explore another part of emerging tech that is typically associated with job loss: automation. By combining different pieces of emerging technology, such as IoT, AI, and big data, businesses are finding more and more ways to automate processes for improved results. Once again, cloud undergirds many of these efforts. This is another aspect of cloud that improves with age. Forty-eight percent of companies with 3-5 years of cloud experience say that cloud has greatly enhanced their automation efforts, compared to 39% of companies with 1-3 years of cloud experience and 26% of companies with less than 1 year of cloud experience.

Cloud computing has drastically changed the IT landscape. From offloading routine work to redesigning IT operations to accelerating efforts around emerging technology, cloud has driven companies towards a new appreciation for the relationship between technology and the business. For IT professionals, cloud has evolved from a potential threat to a game-changing tool. Building cloud skills will allow IT pros to add new value to their companies as IT becomes a more strategic part of business success.

This quantitative study consisted of an online survey fielded to U.S. workforce professionals during April 2018. A total of 502 businesses based in the United States participated in the survey, yielding an overall margin of sampling error proxy at 95% confidence of +/- 4.5 percentage points. Sampling error is larger for subgroups of the data.

As with any survey, sampling error is only one source of possible error. While non-sampling error cannot be accurately calculated, precautionary steps were taken in all phases of the survey design, collection and processing of the data to minimize its influence.

CompTIA is responsible for all content and analysis. Any questions regarding the study should be directed to CompTIA Research and Market Intelligence staff at research@comptia.org. CompTIA is a member of the market research industry’s Insights Association and adheres to its internationally respected code of research standards and ethics.

Read more about Cloud Computing.

Tags : Cloud Computing