CompTIA’s State of the Tech Workforce UK provides an in-depth look at employment, economic impact, technology trends, salaries, hiring activity, and more across the regions and metropolitan areas of the United Kingdom.

See the full PDF report for details.

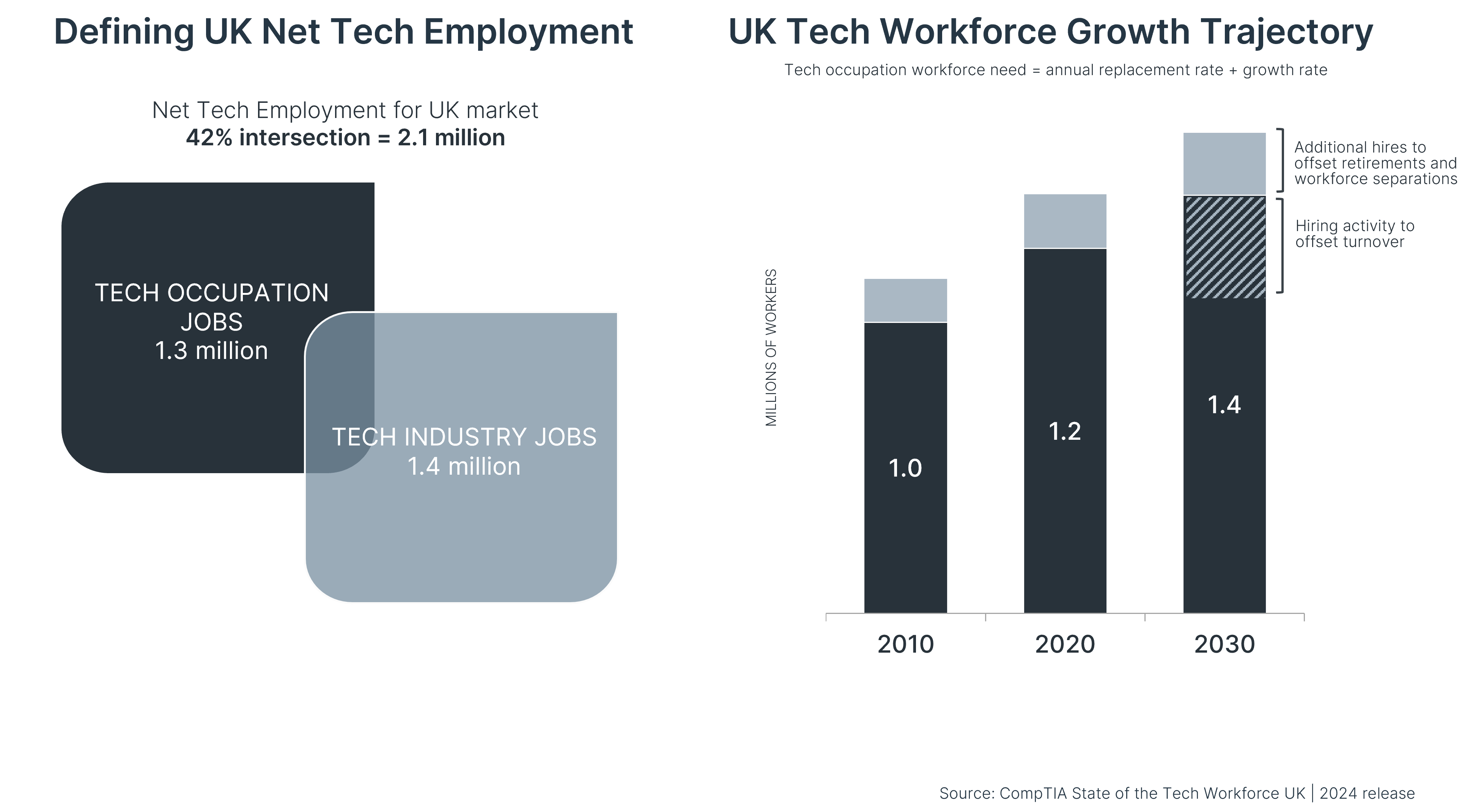

The tech workforce consists of two primary components, represented as a single figure by the ‘net tech employment’ designation. The foundation is the set of technology professionals working in technical positions, such as IT support, network engineering, software development, data science, and related roles. Many of these professionals work for technology companies (42%), but many others are employed by organizations across every industry sector in the U.S. economy (58%). The second component consists of the business professionals employed by technology companies. These professionals – encompassing sales, marketing, finance, HR, operations, and management, play an important role in supporting the development and delivery of the technology products and services used throughout the economy. Approximately 38% of the net tech-employment total consists of tech industry business professionals.

Net tech employment in the United Kingdom reached an estimated 2,130,745 workers in 2023, a 3.4% increase over the previous year. Net tech employment is projected to increase by 1.7% in 2024. Since 2018, net tech employment increased by an estimated 195,085 net new jobs. Net tech employment decreased slightly between 2019 and 2020 but has shown growth since then. Net tech employment accounted for approximately 6.4% of the overall UK workforce in 2023.

By 2030, projections from Lightcast put the base of tech occupation employment at approximately 1.394 million.

Among the components of net tech employment, the tech sector side of the equation grew at 4.1% year over year, while the occupation side across all industry sectors experienced a gain of 3.1% year over year. Looking ahead, tech sector and tech occupation gains are projected to be 1.9% and 1.5%, respectively.

Tech occupation employment over the next 10 years is expected to grow higher than the rate of overall employment across the economy.

The top four metropolitan areas employ a little more than 704,000 tech industry and tech occupation workers, or about 1 in 3 tech workers in the nation. The London and Manchester areas saw the highest increases in net tech employment year over year. At more than 7%, London, Edinburgh, and Leeds have the highest concentration of net tech employment as a percentage of their overall employment bases. Compared to the national tech employment concentration benchmark of 6.4%, seven metro areas had the same or higher rate, confirming the importance of technology to a far-reaching set of cities across the UK.

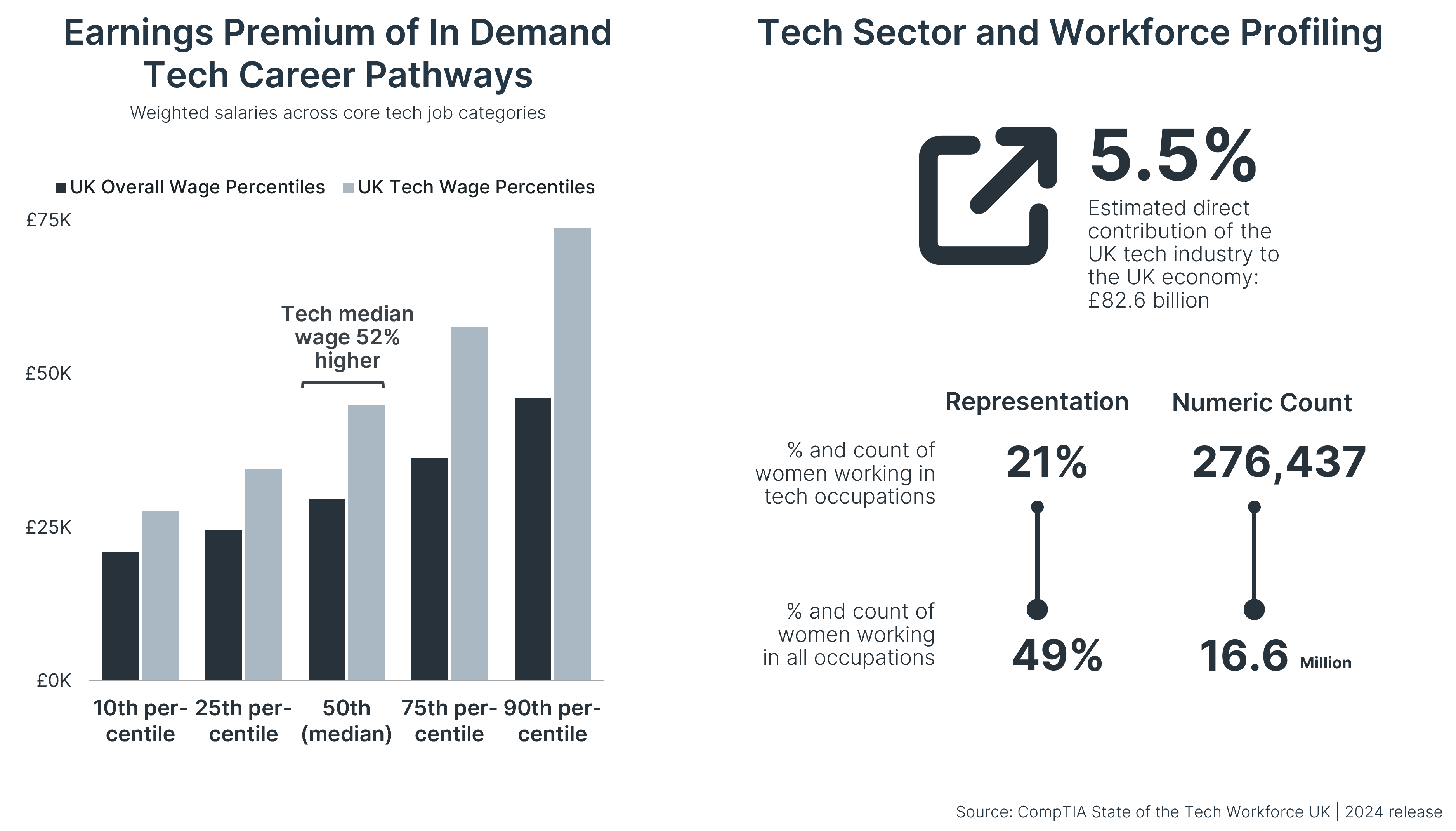

Across all the tech occupation categories covered in this report, the median salary, also referred to as the 50th percentile or midpoint, was an estimated £44,949 for the most recent year of available data. This figure is 52% more than the median wage across all occupations of the UK labor force, reflecting the premium in earnings associated with in-demand tech job roles.

Please note this is an excerpt, and the full report contains more detail.

Read more about tech industry sectors.