Introduction

If the dot-com bubble seems like ancient history, maybe that’s because a lot has happened in 25 years. After tech-fueled stock market gains and venture capital investments both fell dramatically in 2000, the tech industry has enjoyed a strong run. Smartphones, cloud computing, the Internet of Things, and artificial intelligence are all major trends that have reshaped the way businesses think about technology and put it to use.

These big wins, though, are not exactly a story about the tech industry rising from the ashes of a burst bubble. In reality, the bubble was part and parcel of a larger arc of development. In her 2002 book Technological Revolutions and Financial Capital, Carlota Perez describes how investments made during an innovation-driven bubble provide a foundation for future invention and growth. In other words, the infrastructure that powered many of the now-defunct websites from the late 1990s became a critical component for the iPhone and Microsoft Azure in the 2000s.

Heading into 2025, there is some speculation that the economy is in the midst of an AI bubble. If this is true, what can we learn from history? What investments should be made today to ensure success tomorrow?

The AI bubble may be part of the larger information technology bubble that started with the introduction of mainframes, or it may be the start of something new. Either way, software—whether that’s AI algorithms, new app development, data analytics, or other initiatives—is defining the next wave of progress, and that changes the nature of investment. Another tenet of Perez’s framework is that investment cycles include not only capital expenditure on physical infrastructure but also changes to intangible constructs such as financing structures and government policy.

Many of those broader changes are outside the control of individual organizations, but there are two clear areas where non-capital investment will still be needed: workflow and skills. Between highly specialized software applications and a greater degree of automation, there is potential to completely reinvent workflow in a digital economy. The challenge, as with so many other technology implementations, will be in shifting learned behavior among the workforce.

The evolved workflow will drive demand for new skills. For several years, the imbalance between the supply of digital skills and the demand for expertise has been forcing companies to change their approach to talent acquisition and retention. Closing the gap will require continued reinvention of skills-based practices, and that doesn’t even account for the evolution and growth of demand.

While the details of future demand are difficult to predict, the general direction is clear. Businesses will have an ever-growing appetite for technology as a primary tool for delivering results, creating competitive differentiation, and meeting organizational objectives. There will always be fluctuations in hiring and employment, but the long-term future is bright for technology professionals.

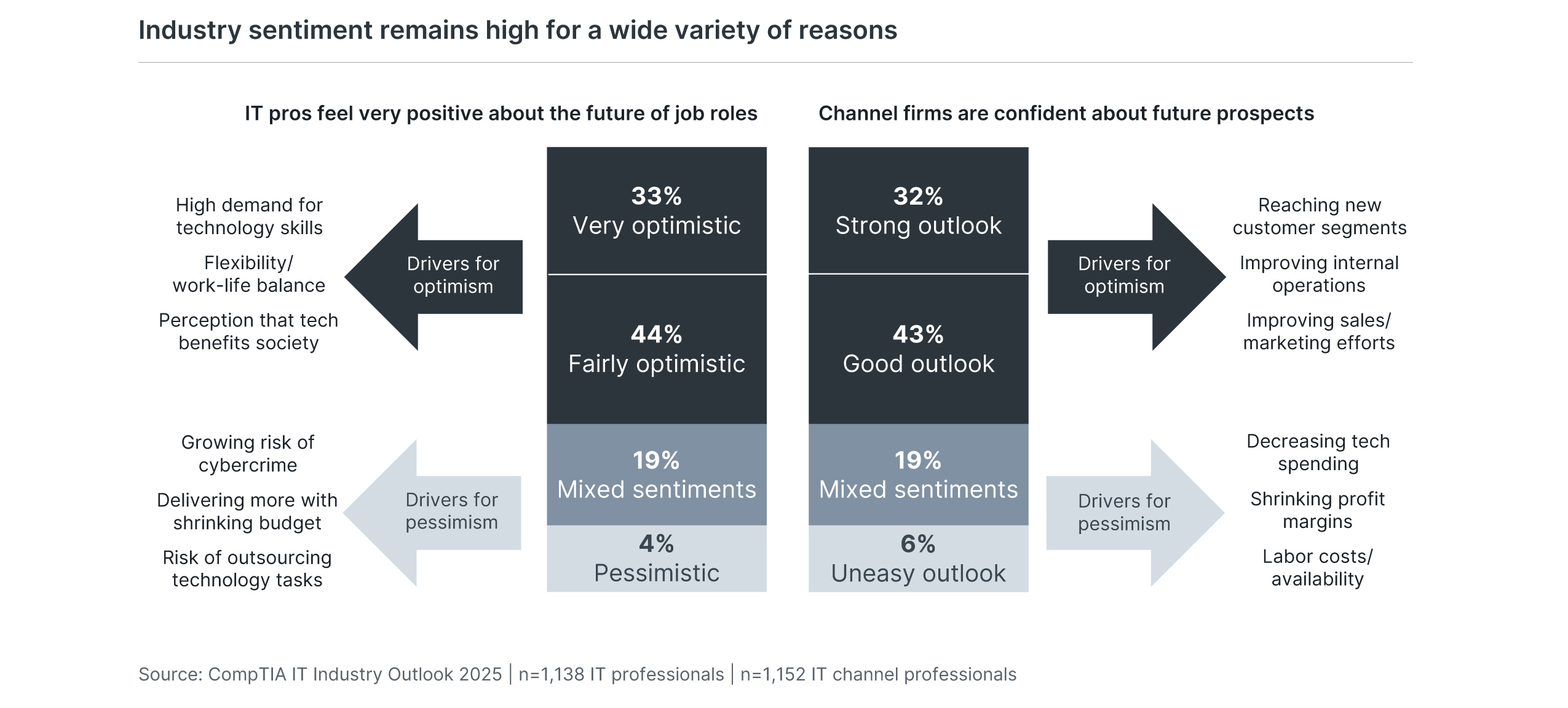

More than three out of four professionals in technical roles feel optimistic about their career potential. Tech skill demand remains high across all industries, and tech roles lend themselves well to flexible work arrangements. While companies struggle with their approach to cybersecurity or the shift away from a cost center mentality, there is a tremendous opportunity for IT pros to help their businesses accelerate digital transformation.

A similar number of individuals working in the IT channel have high hopes for their firms in the year to come. The IT channel and the larger ecosystem of technology enablement firms play a crucial role in bolstering the digital economy, and there will be continued evolution in the industry as new dynamics come into play between vendors, distributors and solution providers. Technology firms will aim to improve their business operations—especially including sales and marketing efforts—as they seek out new customer segments.

Although technology trends and components advance at a rapid pace, the transformation of business and society takes place on a longer scale. Appreciating that scale can help organizations respond to new concepts with a view to the future, building skills and operations that will help weather not only this next wave of progress but the many to come.

The hidden challenges of increased spending

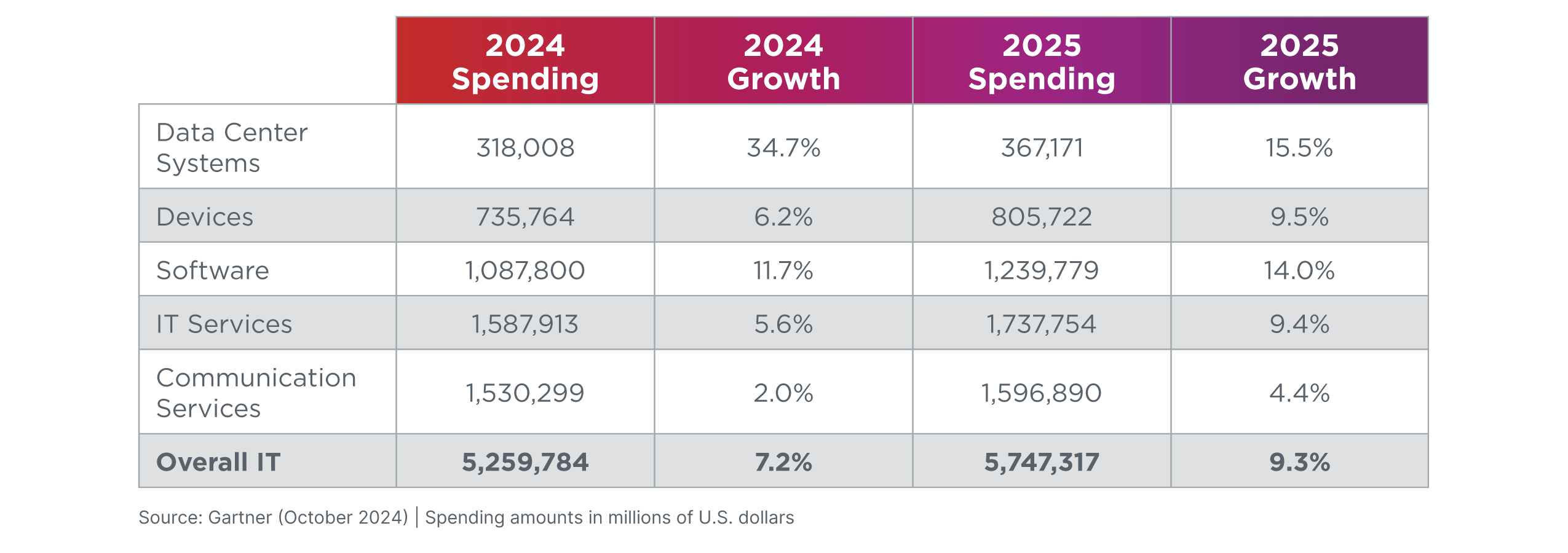

From a revenue perspective, it certainly doesn’t seem as though a bubble is about to burst. Gartner predicted that the total worldwide IT spending for 2025 would be $5.75 trillion, which would represent 9.3% growth over 2024 spending if the forecast is accurate. Healthy gains are projected in all five segments of Gartner’s spending breakdown, with only data center systems expected to show less growth than the previous year.

There are two significant caveats to consider in the global spending numbers. First, the push for AI functionality (along with ongoing pushes for data analytics and cloud-based architecture) will drive sizable investments by large cloud providers. Especially in the area of data center systems, small and medium-sized businesses (SMBs) will likely be reducing on-premises infrastructure buildout in favor of as-a-service offerings. This reduction will be more than offset by cloud behemoths, who will need major expansion to serve growing demand.

The second caveat calls back to a theme from the past: rogue IT (or shadow IT). While companies have made great strides in collaborating around technology procurement and implementation, the total technology budget has still become distributed throughout the organization. Business functions have technology spending embedded in line items that roll up to strategic initiatives, which makes it more difficult to isolate and identify the aggregate spend.

Taking things one step further, technology leaders within collaborative efforts are typically still the ones who answer for overall technology performance. One of the main drivers behind collaboration was the need for holistic cybersecurity and integration. Overseeing these items allowed technology leaders to exert influence, but it also placed them in a prime position for responsibility. Moving forward, CIOs and other technology professionals will need to double down on validating technology expenditure, even if they aren’t the ones doing all the spending.

1) The bar is set higher for digital transformation

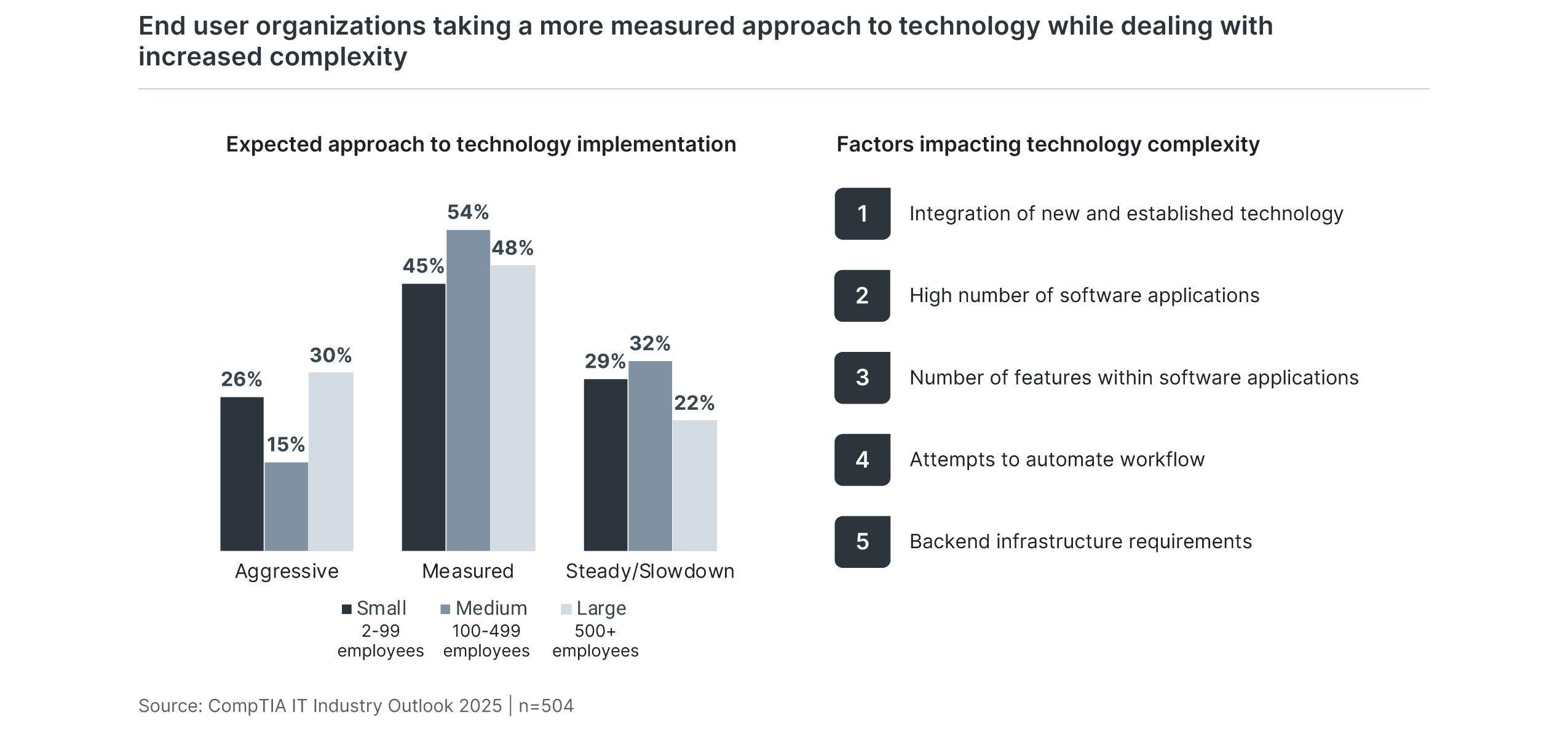

Even with large and growing appetites for technology, there are times when a reality check is needed. After heavy investments in digital tooling and resources after the pandemic, organizations will be hitting the pause button to evaluate the success of past initiatives and to determine their direction for the future. The explosion of cloud software, the ubiquity of connected devices, and the dependence on well-organized data have all created different versions of organizational debt. There is technical debt, where the architecture has grown faster than best practices for operations and maintenance. There is process debt, where workflows and decision making have become inefficient and misaligned with technology systems. And there is personnel debt, where the proper skills for maximizing technical capability have not been built. These different forms of debt add up to make technology implementations fall short of their potential. At the same time, the level of complexity is skyrocketing. The stability of foundational computing infrastructure for many organizations has allowed thousands of solutions to bloom. This is good news for individual business units that can now digitize their local operations, but it creates a digital house of cards for the technology team to maintain. Understandably, organizations are hesitant to throw more money at the problems without a solid strategy. Spending and hiring will not completely dry up, especially over a multi-year horizon. In the near term, however, companies will be taking a close look at the real benefits they have gained from prior investments, and they will be making adjustments to procurement and evaluation for new projects. Technology leaders will need to continue making strides in establishing a strategic approach in order to help their organizations stay on the cutting edge in sustainable ways. This will include developing new metrics to demonstrate the efficacy of technology, communicating costs and risks at a system level, and collaborating with business leaders to make the most of future investments.

The difficulty with hitting the pause button on technology adoption is that the market keeps moving. Pushing forward blindly will lead to more accumulation of debt, but too much caution can cause loss of market share or lack of competitive differentiation. It will be imperative to quickly build sustainable processes around procurement and evaluation.

While most firms are planning a measured approach to technology in the next year, both small firms and large enterprises show the most interest in maintaining an aggressive posture. The largest companies obviously have the structure and resources to manage and measure technology investments; several may have already gone through this reassessment phase. Smaller firms are more resource-constrained, but they may be feeling the pressure of moving toward the cutting edge after a more hesitant approach. These organizations will have to learn on the fly as they catch up while ensuring productive outcomes.

Communicating complexity will be a critical task for IT pros as they help their management teams navigate a new decision process. Some IT pros may feel that the organization generally overestimates complexity, lacking the skills to fully appreciate how the architecture is built. Others may feel that complexity is underrated across the organization, with a lack of understanding around the difficulty in integration and automation. Either way, the solution is essentially the same—an accurate description of the tasks needed to turn individual products into holistic workflow is key to solving the investment dilemma.

Complexity is driven by many factors, especially for companies with established technology that are pushing toward modern solutions. At the highest level, the fundamental driver of complexity—and misunderstanding—may be the desire to build a software-driven organization. Individual applications can capture the imagination of business teams and executives, but developing a seamless workflow and managing the necessary infrastructure are activities that contribute heavily to the cost of an aspirational vision.

2) Organizations begin counting the costs of AI

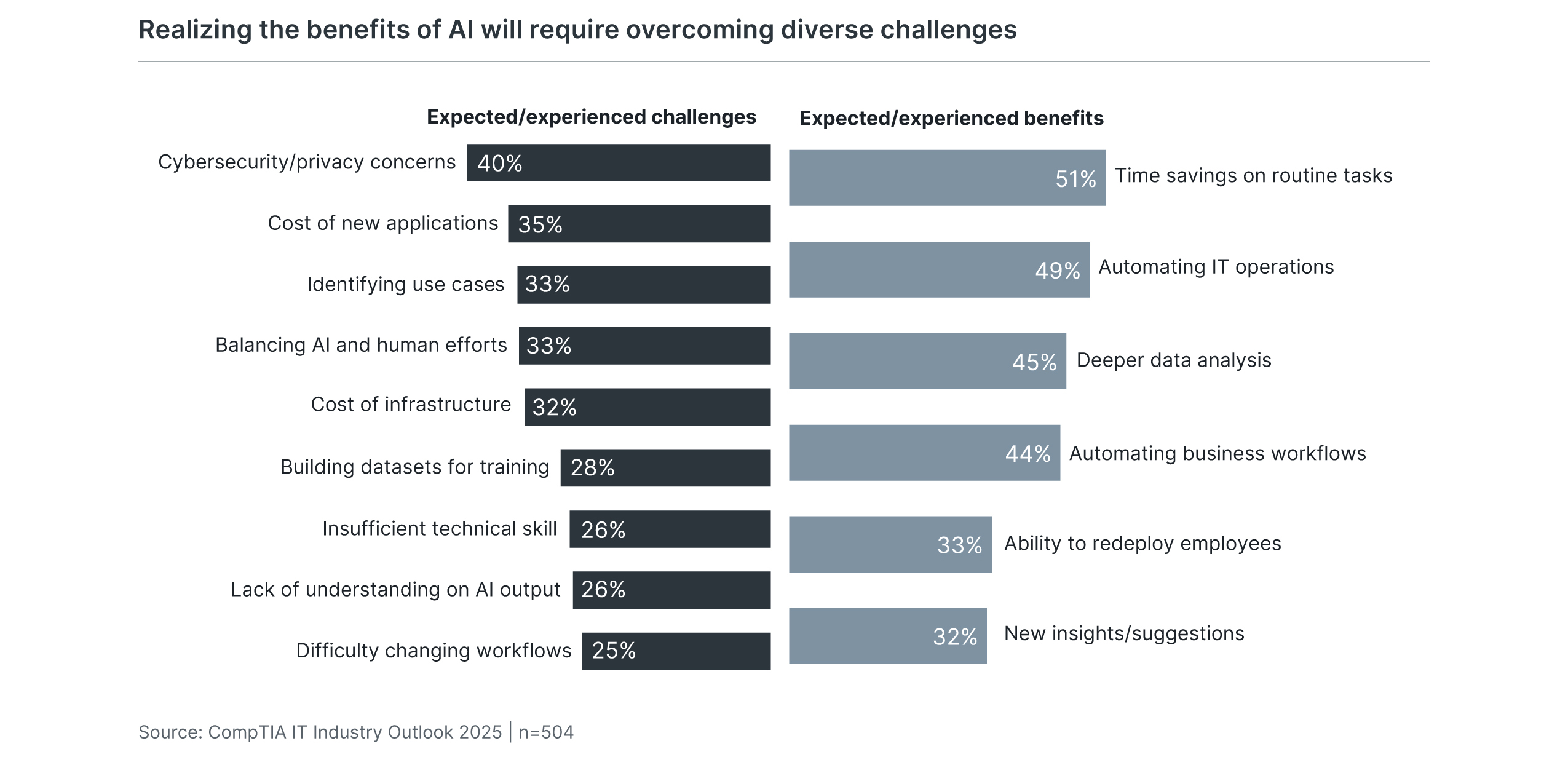

The fact that people are discussing an AI bubble suggests that AI hype is past its peak, just as CompTIA predicted in its IT Industry Outlook 2024 report. With that said, this clearly isn’t a situation where sentiment has turned sour overnight. There continues to be plenty of excitement around AI’s potential, at least among media and event planners, if not IT departments. Organizations are certainly experiencing benefits from AI, but many of those benefits are coming from efforts that predate the emergence of generative AI, using machine learning algorithms or natural language processing to improve workflow. AI is far from vaporware; there will clearly be real transformation as businesses figure out how to leverage the technology. However, AI is also far from being an instant success story. The tremendous potential that many can see is offset by the significant costs of implementation. Similar to the trends of big data and blockchain, the first cost that businesses encounter is the cost of infrastructure. Cloud computing provides an avenue for companies to avoid the full cost of infrastructure buildout, but nothing comes for free, and subscriptions or licensing add up quickly. Another cost is the difficulty of modifying workflow. AI capability can have straightforward value in a single application, but stitching multiple applications together in a complex workflow changes the equation. There are several other costs to consider, but one final cost unique to AI is the ethical question. Beyond workforce disruption or geopolitical threats, firms must grapple with what it means to have AI create content or make decisions. The path that leads to novel results in the short term may have downstream consequences for identity and reputation. Ultimately, as AI is changing the way that we work, it is also forcing us to reconsider what work even is.

CompTIA’s research on AI throughout the past several years has revealed several indicators for how this trend will ultimately play out in an enterprise environment. First and foremost, AI will primarily be an enabling technology, with most businesses acquiring AI as an embedded feature of other applications such as customer relationship management (CRM) or business productivity software. This means that AI will be another layer in a comprehensive technology stack, adding to the overall complexity.

As AI enters an organization through various applications, there will be different skill domains that emerge as complementary skill sets to existing acumen. Data, security, SysOps, architecture, auto coding and prompts are the primary domains where new skills are developing. These domains will evolve over time and may even change completely as adoption matures, and companies will have to remain agile in their talent development plans to keep up with the shifting skill landscape.

The reason talent development will continue to be a priority is that companies largely are not expecting AI to replace human effort. One of the most prominent challenges that businesses are currently facing or expect to face on their AI journey is balancing the results from AI algorithms with the experience and creativity of their employees. Broadly speaking, CompTIA’s research has consistently uncovered a desire to boost innovation through technology rather than reduce the workforce, and AI provides a tremendous opportunity for reimagining productivity.

There are many other challenges that companies face, from cybersecurity issues to data management, but there are clearly many benefits in store for those that solve these questions. Even in these early stages of mass AI adoption, organizations are seeing progress in making work more efficient and achieving some gains in the longstanding goal of automation. There will be refinement as businesses discover any side effects from AI usage, but the long-term view is that the rewards will be well worth the growing pains.

3) Tech providers take new steps to prove ROI to customers

As business leaders increasingly question the ROI on technology purchases, the bar for proving that the spend is justified has risen for channel firms. Whether proposing a new cloud infrastructure project, AI pilot, or hardware modernization, channel firms today need to inject more proof points and results-oriented talk into their pitches. Why? Customers have gotten finicky after seeing tepid results from tech investments of the recent past. Some report fatigue about yet another new thing that will transform their business. At the same time, the appetite for technology remains strong. This dichotomy is forcing many channel firms into a delicate dance with customers: on the one hand, trying to avoid the classic overpromise/underdeliver trap by offering up realistic numbers on ROI and other metrics while at the same time not taking the spreadsheet talk so far that it sucks joy out of a promising tech deal. Challenging as that is, this more balanced approach resonates with customers who need a bit more convincing about newer technologies, especially those who are not seeing the ROI they expected from past investments. Consider this shocker from a recent IBM study of 2,500 business and tech executives on the topic of AI: Fewer than half of respondents believe their organization is effective at basic IT services, and their confidence in the effectiveness of these basics is only half of what it was a decade ago. That’s stunning. It illustrates the potential difficulty of trying to sell AI or any cutting-edge innovation when customers are suspicious about the performance of fundamentals. Amidst this scrutiny, channel firms should frame their services in the context of the customer’s business, budget, and the outcomes they seek. Be very specific about what the technology can deliver and how long it will take to see results. Then, make good on measuring and monitoring the performance. The year ahead will no doubt feature the usual excitement over new tech developments and innovations, but it will also be marked by customers demanding more focus on brass tacks and results that justify their spending.

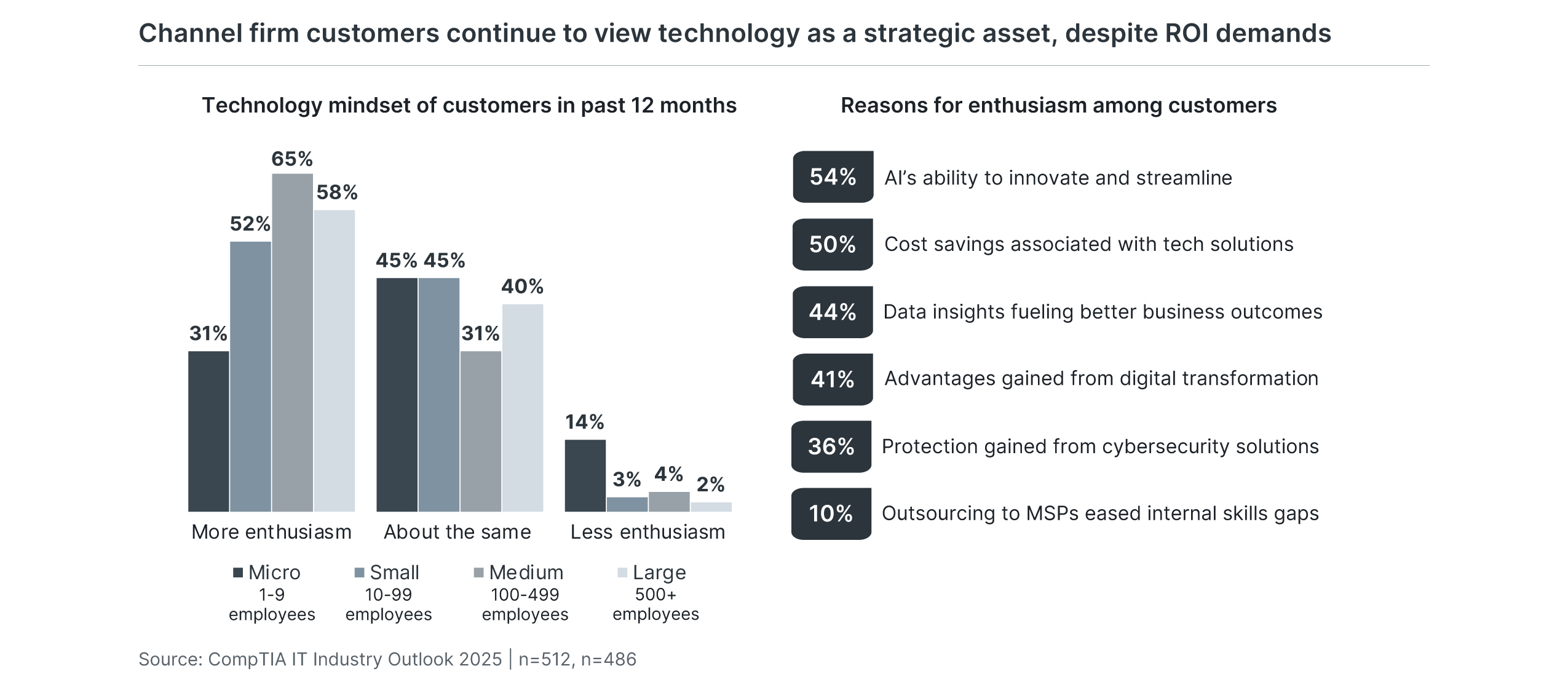

Selective though they may be with their spending decisions, today’s customers nonetheless remain hungry for many of the benefits that tech solutions can bring to their organization. In fact, more than half of customers have expressed greater enthusiasm in the last 12 months for technology to serve as a strategic asset to their business than in prior years, according to channel firms in this year’s study.

IT’s shift from cost center to a strategic piece of business operations has been happening for some years now for many organizations. Channel firms have benefitted from this new customer mindset for sure. Strategic IT has generated demand for comprehensive technology services and business consulting acumen and established a pathway beyond traditional product resale models. The impact of technology’s shifting role in end-user settings continues apace today as customers seek experts to help them with everything from crafting an AI strategy to establishing a strong cybersecurity posture.

An interesting wrinkle is that customer zeal for technology is seemingly predicated on opposing goals: tech for innovation and growth vs. tech for cost savings and efficiency. At a closer look, however, these objectives aren’t in conflict. In fact, investment in a single technology alone often yields results on both fronts. Consider this example: Channel respondents report that AI’s potential as both an innovation spark and a way to streamline existing processes tops the list of reasons customers say they are excited about technology today.

In the year ahead, successful channel firms will continue making the case that technology investments serve the dual objectives of innovation and cost containment. They will also aim to prove relevant needs and demonstrate an ROI for their services. Many are doing so creatively today. For example, nearly six in ten channel respondents said they prove value by offering customers myriad options for technology consumption, i.e., subscription-based models for software, usage-based pricing for cloud services, or financing options for hardware and other infrastructure. Still, other channel firms are boning up on technologies specific to individual vertical industries to flex their niche skills. Another third is offering adjacent services like user education and training to augment their portfolios. Bottom line? Customers are as hungry as ever for technology but also far more discerning in what they choose to order.

4) The value of partnerships grows as channel ecosystem expands

One of the more ubiquitous buzzwords coined about the IT channel in the last five years is “ecosystem.” As it implies, the term portrays an interconnected environment flush with many players of many stripes. And it’s true. The channel has gone from a single linear chain of mostly hardware resellers to a collection of managed service providers (MSPs), tech consultants, referral partners, influencers, digital marketing firms, online marketplaces, telecom agencies, and more. Part of the reason so many channel business types have sprung up is that technology is more complex. A relatively straightforward menu of hardware and software choices has mushroomed into massive curricula of data services, e-commerce, AI, software as a service (SaaS), cybersecurity, cloud computing, and mobile devices. In this diverse and highly specialized environment, some channel firms find their capacity to be all things to all customers daunting. This is leading to renewed interest in partnering with other channel firms. Counterintuitive as working with the competition may sound, partnering works on several levels. Most notably, the practice helps channel firms fill in portfolio gaps, often for adjacent services such as digital marketing or web development, without having to build those skills internally. Similarly, quid pro quo referral arrangements allow, for example, a SaaS-based MSP to recommend a trusted cybersecurity services provider to their customer—and vice versa. Partnering is also a way to blunt stiff competition from online marketplaces like Google and Amazon by enabling firms to expand their technical capabilities, geographic footprint, and, in some cases, their sales effectiveness. What’s critical to making these arrangements work—and why failure rates have been high in the past—is formalization of the relationship terms. No more handshake deals; channel firms need to iron out the conditions of a partnership in a legal contract that covers all aspects of the arrangement, from liability issues that can crop up to who owns the customer relationship.

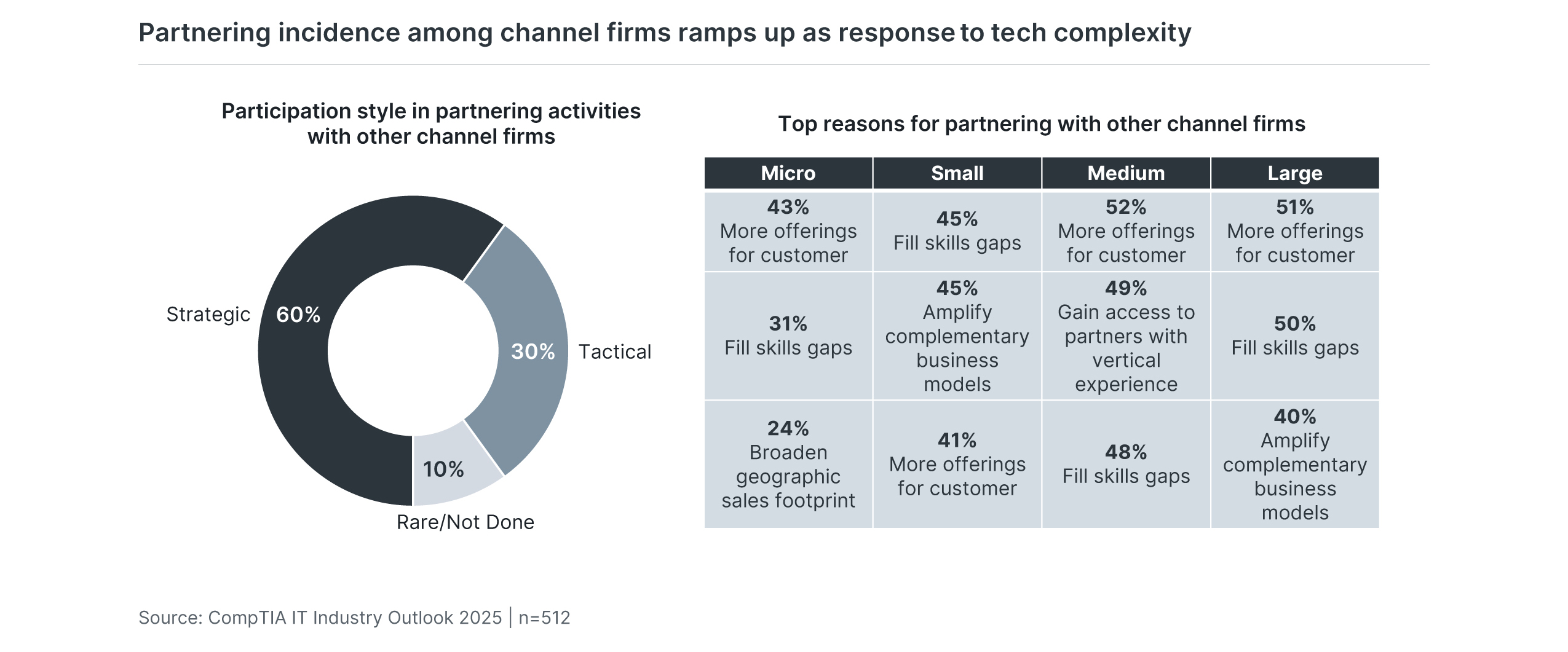

To partner or not to partner? For 90% of channel firms today, the answer to that question is a resounding yes.

While not a new phenomenon, peer-to-peer partnering is gaining more steam as a business practice today. Why? You can thank the challenges that have come with today’s highly complex technology solutions and delivery models. Consider the level of skill and resources needed to declare expertise in even one or two of tech’s main disciplines, say cybersecurity or data science. It’s not a low bar. Factor in the acumen to deliver adjacent services and infrastructure that support those two disciplines, and the bar moves ever higher. It’s understandable that many channel firms have skill or resource gaps that affect what they can offer clients.

Partnering is one solution to the problem, a kind of arrangement that ideally helps channel firms plug holes in their skills or portfolios by teaming up with other firms. Sixty percent of channel respondents describe their current partnering activity as a strategic and formalized part of their business operation, while three in ten say they work with others in a more tactical, less formal fashion. Just 10% report little to no partnering activity at all. Those who are partnering are happy with the results; 81% rate these engagements as positive or very positive.

Partnerships can take many shapes and forms. Beyond filling technical skills gaps for one another, companies also join forces to present a more comprehensive set of offerings to customers. In this case, one partner might be the face to the customer on a deal in aggregate, but some of the services or products in that deal are delivered by the other channel partner via a kind of subcontractor-type arrangement. Other partnering activities cited by respondents involve referral deals, whereby a tech consultant, for example, is paid a referral fee for recommending a channel firm to sell products or services. Still, others are eyeing access to vertical markets by teaming with one another.

The key to making these relationships work is formalizing them. It’s wise to cement the details of any partnership deal in a contract that addresses everything from expectations to liabilities. This will be especially important as these deals become more commonplace. And they are: Seventy percent of respondents said they expect an increase in partnering activity in the next 12 months.

5) Bespoke platforms become the focal point of software development

Software development has had an interesting journey over the years. Originally, the discipline was the domain of large enterprises, either those companies building software for external sales or those companies that could afford some degree of internal development effort. With the rise of open source, web presence, microarchitecture, and cloud platforms, software eventually became a skill that almost every company needed to have in-house. Web development was a primary objective, quickly growing in scope as more companies added e-commerce or other web-based extensions of their product portfolio. Customization and automation were also featured heavily, as businesses wanted to tailor off-the-shelf software to either packaged or SaaS formats. Today, the typical development practices at many organizations are facing pressure, not just from AI but also from low-code/no-code applications or third-party specialists. However, the same complexity that makes it difficult to realize AI’s potential across a full workflow opens opportunities for software developers. Companies have invested in a constellation of solutions, and consolidation can have a positive impact on productivity. The most likely course of action will be to double down on automation efforts, tying together applications in a way that enables smooth workflow, connects to a collective dataset, and provides holistic security. The end result of these efforts will be a conceptual platform tailored to the organization. This platform will be loosely defined, without a single code base that can be discretely packaged, but it will be the foundation for digital transformation. All future initiatives will need to consider the implications of connecting to the platform, and fine-tuning the platform’s operations will be a primary driver for improved efficiency. For many organizations, software development on its own has become highly complex. Turning that effort inward can leverage existing expertise to begin solving the problem.

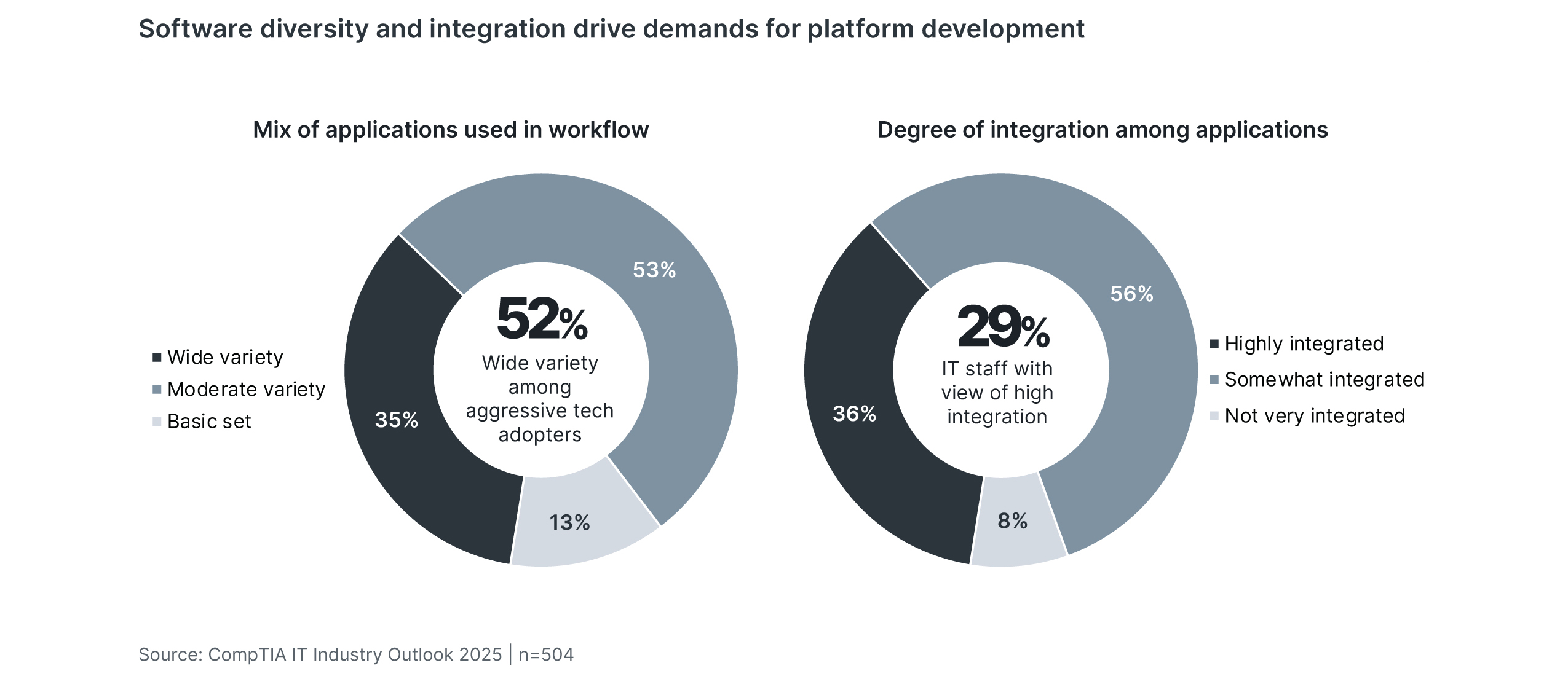

One of the biggest advantages of cloud-based software is the ability of small developers to build niche applications. The research firm Sapient Insights Group defines six major categories, 55 classes of applications, and over 2,750 vendors in the HR space alone. In theory, the monolithic enterprise resource planning (ERP) packages of the past can now be replaced by best-of-breed programs for every aspect of operations.

In practice, things are more complicated. The potential beauty of an ERP system was having everything talk to each other in a seamless flow. Even that was difficult to achieve in many implementations, and pulling it off across a myriad of individual solutions is a monumental task.

The variety of software applications is definitely on the rise, especially among those firms that are taking an aggressive approach to tech adoption. While there seems to be a correlation between the number of applications and a high degree of integration, the low number of IT staff reporting high integration (as opposed to IT management) suggests that the problem is far from solved.

Building a custom internal platform brings the chaos under control. Rather than delivering value in a tight window, each application becomes part of a broad solution. The platform provides a high-level context for cybersecurity initiatives, and data structures can be designed to serve the collective whole.

Of course, each of these potential benefits doubles as a barrier to progress. Defining handoffs and connecting disparate application programming interfaces (APIs) are already hurdles for ongoing automation efforts. Many companies are struggling to define a cybersecurity strategy, and data management is in the early stages of adoption, especially for smaller firms. Focusing development efforts on a tailored platform is a simple idea that will prove incredibly difficult.

6) Cybersecurity risks renew calls for tighter MSP controls

Cybersecurity risks have everyone on edge these days. Business executives regularly fret about hypothetical data breaches and ransomware attacks, wondering if it could happen to them. Some of these executives turn to outside technology providers for help, including tapping MSP businesses known for remotely managing and securing customer IT operations. In a world where data protection is more critical than ever, working with an MSP requires a high degree of trust from the customer. And yet, how do customers know what they are getting when choosing an MSP? Unlike other service professions, such as electricians or accountants, that must be formally licensed, the MSP industry remains largely unregulated or guided by any enforceable set of standards other than individual service level agreements. For customers, this means taking a leap of faith, even if the MSP in mind comes highly recommended from a trusted party. This leap is even scarier in today’s fraught cybersecurity environment.

Consider that MSPs have been recent targets of some high-profile hacking incidents because of their access to multiple customer networks. All this leads to the following question: Should there be universal criteria or credentials that a company must attain to market itself as an MSP? It’s a hot debate that’s raged in the community for years. Sticking points include determining the criteria required for professional licensing (i.e., an internal security operations center (SOC), a specific ratio of technicians to customer seats, a certain percentage of certified employees, etc.) and then choosing the body to oversee these standards and enforcing compliance. There’s also a question of who needs to meet the criteria: the MSP business itself or individual practitioners. Both sides in the debate have cogent arguments, but one of the most compelling of them posits that formal MSP standards would help distinguish true MSPs from less-capable masqueraders that give the managed services industry a bad reputation. Either way, the discussion is sure to pick up steam in the year ahead as cybersecurity concerns persist.

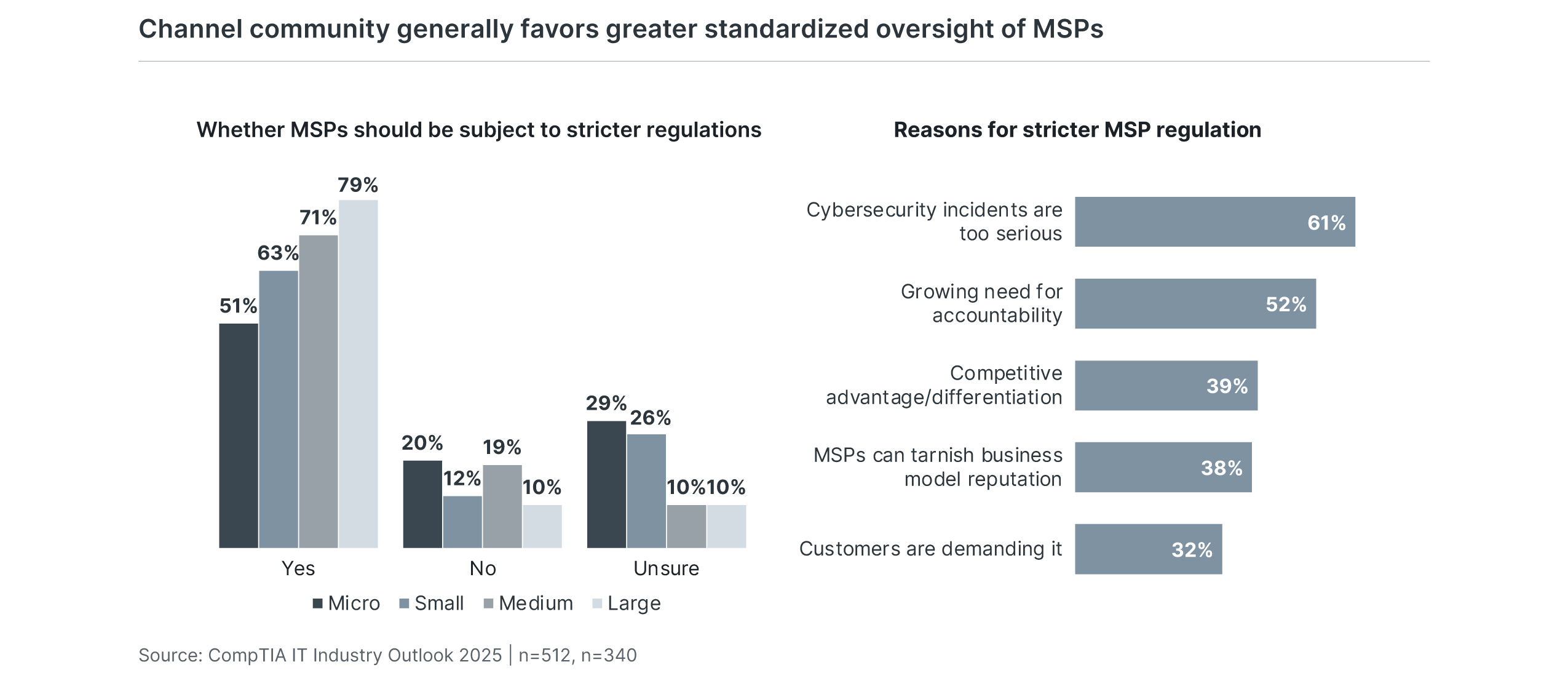

The majority (67%) of channel firms today believe that the MSP business model should be subject to greater, more formalized oversight. But as so many things are in life, the devil is in the details. As it stands today, 51% of firms believe the MSP industry is already guided tightly by a set of best practices and standards, while 44% describe that guidance as loose at best. The key word here is “guided” because today’s MSP best practices and standards aren’t mandated by the government or other professional/trades groups like those for an accountant or electrician. Most of what is in place today is by choice and on the honor system. That has created an inconsistent MSP landscape where customers are on their own to determine whether a provider carries adequate cyber insurance, manages their own SOC, employs certified technicians, and checks other boxes that would count toward some semblance of “official” MSP status.

The calls for more MSP oversight in the form of official licensing or regulatory status seem louder today. A range of reasons accounts for the uptick in volume, including increased pressure for accountability around cybersecurity incidents, the desire for competitive advantage, and the need to satisfy customer demand for more reputable MSPs. Of all the items on the checklist of what an MSP must have, respondents cited four as most critical: cyber insurance for their own business and on offer to customers; a set percentage of certified technical staff; legal expertise on staff; and an internally managed SOC.

None of these requirements comes cheaply. The cost to meet them would surely be prohibitive to a subset of the thousands of companies that call themselves MSPs today. And that’s just one reason why the list of potential challenges to universal licensing or regulation is so long. Consider just a few items cited by respondents beyond the cost of compliance: Who should be subject to professional licensure, the MSP business or the MSP professional? What body enforces these standards? What is a universal definition of an MSP?

And yet, the drumbeat continues. Given the critical nature of cybersecurity and data protection and an MSP’s central role in protecting customer networks, it makes both business and consumer sense that some formalization of standards, whether that’s professional licensing or some other regulation, remains on the table.

7) Data team formation enables analysis and AI

Data is one of the most important assets in the age of digital business. Companies use data to learn more about their customers, fine-tune their internal operations, and make predictions about future initiatives. Of course, such a powerful asset comes with a host of new challenges. As organizations are exploring modern infrastructure with cloud systems and mobile devices, they have to secure data in multiple phases rather than assuming it is safe behind a secure perimeter. Companies are also realizing that more advanced data practices, such as scientific modeling and training for AI systems, require a robust data management strategy. Many firms have data silos across different departments, and building a comprehensive storage plan with a well-defined dataflow process is the first step in preparing data for innovative usage. Just as cybersecurity specialists branched out from infrastructure generalists, data specialists are being developed and placed into dedicated teams. For data management, database administrators focus on maintaining foundational data structures, and data engineers manipulate and prepare data for interpretation. On the interpretation side, data analysts perform data mining and standard analytic techniques, while data scientists use machine learning and statistical methods to craft complex models. Overseeing the entire process, data architects set strategy and ensure business alignment. In the same way that data is spread throughout an organization, many of these skills may currently be spread between technical teams and business teams. In order to capitalize on all the potential of this valuable asset, businesses will begin gathering these skills together and structuring teams that oversee all aspects of data. The specific organizational structure will likely differ from one company to another, especially in the short term, as firms determine the best course of action given their current staffing. Whether a data team ultimately reports to a chief data officer, a traditional chief information office,r or some line-of-business executive, these skills will quickly become some of the most highly demanded in a tech labor market that is already tight.

Today, 56% of organizations say that they have dedicated data specialists in a technology department as part of their team handling data operations. Predictably, this is weighted toward medium-sized and large companies, but 45% of small firms claim to have these resources in-house, suggesting that many companies may be considering business analysts who certainly work with data but may not dive into the technical aspects.

When it comes to deep technical work, generalist IT workers are still carrying most of the burden. Overall, 54% of companies say that generalists are part of the data strategy, and the distribution is much more even across company sizes. From here, data personnel become more uncommon, including dedicated specialists in a business department (38%), outside firms covering a range of technology issues (22%), and technology firms specializing in data (21%).

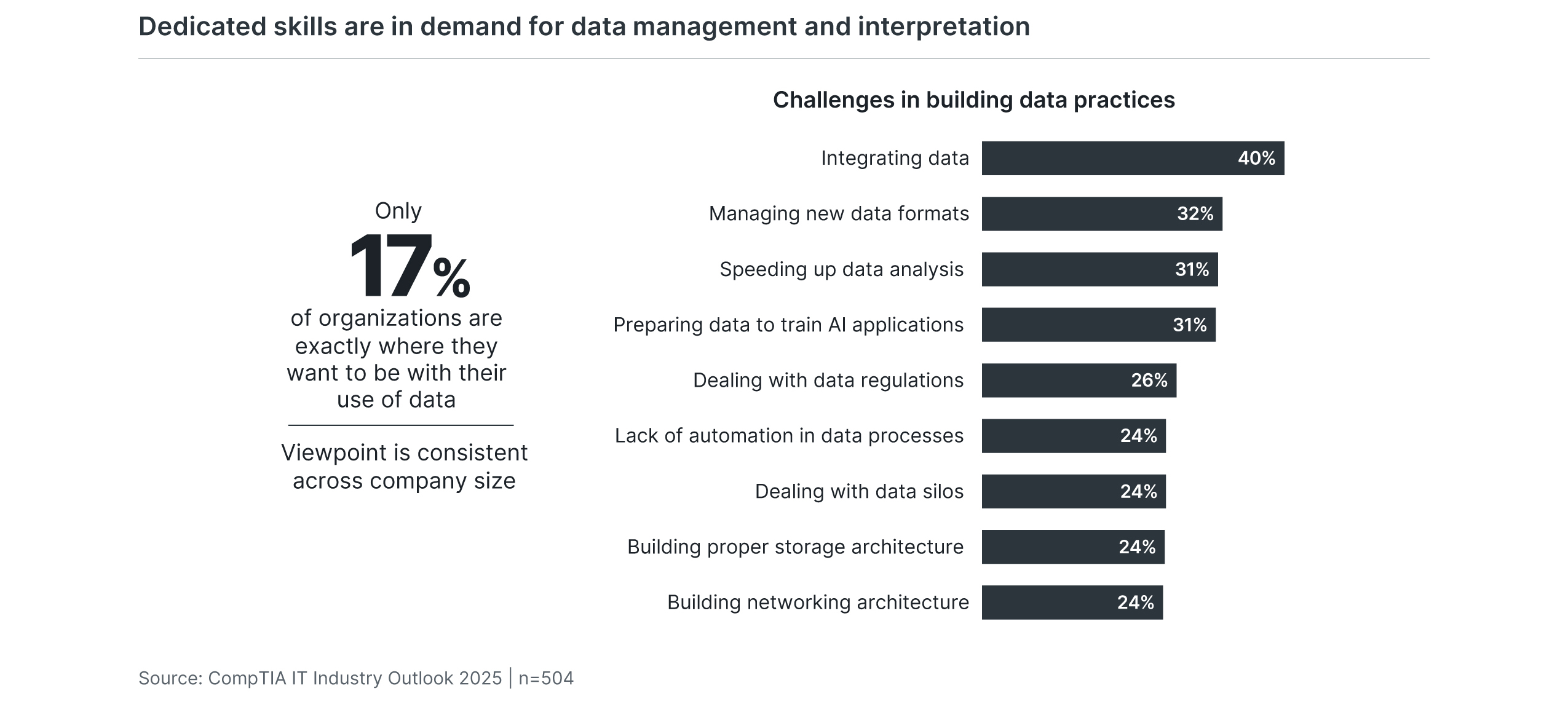

Regardless of the incidence or location of data professionals, organizations see plenty of room for improvement in their data operations. Following the theme of connected workflow, data integration is clearly the top challenge in building a robust data practice. AI is already having a strong impact on data strategy, and infrastructure issues pop up once again as companies build out the basic foundation. The list of challenges presented in the survey was specific to data handling, but data security has also been cited as a top priority in other CompTIA research.

The list of data skills in demand reflects both the focus on advanced data tasks and the necessity of supporting/adjacent functions. The most in-demand skill is data analysis (77% citing moderate/significant improvement needed), followed by data visualization (75%). Companies clearly want to gain new insights and make these insights available to decision-makers. To get there, though, firms are starting to recognize that they also need data architecture (74%), data infrastructure (72%), and data security (70%).

8) Skills-based frameworks drive new waves of HR innovation

With the challenges companies are facing in building the technical talent they need, there has been a significant effort in reimagining the processes for talent acquisition, development, and retention. The theme for most of these processes has been a skills-based approach, defining the specific skills needed for each job role and then developing a methodology for closing skill gaps. The area where this approach has gotten the most attention is in hiring, with many companies dropping degree requirements in their job postings. Although this move away from degree requirements has had mixed results in actual hiring to date, it allows companies to begin exploring the changes needed in HR practices to support a skills-based approach. CompTIA’s Workforce and Learning Trends report has tracked HR attitudes and behavior around a skills-based approach for several years, with the most recent report showing that 49% of HR professionals feel that a skills-based approach is a new and compelling method for talent management. The report also shows that the investments being made in restructuring HR process must soon start showing outcomes. Other CompTIA research has found that the top challenges in utilizing a skills framework include the learning curve for managers and maintaining consistency across departments and stages of a career journey. All of these data points suggest that an overhaul of the HR function is on the horizon. Along with the initial cost of developing a skills taxonomy, companies will be reconfiguring the tools used to assess skills and drive workforce decisions. This activity will rapidly extend beyond the hiring process to include upskilling of technical talent and reskilling of other employees who may be seeking a career change. HR departments will look for new technology solutions to help organize and automate these activities, but those solutions will have limited use if the underlying workflow is not clearly defined and communicated throughout the organization.

Fitting in with the theme of cautious investing, organizations expect to mostly hold steady or drop slightly in their hiring plans, with 39% expecting to explore new hiring in 2025 compared to 41% who were expecting to explore hiring in 2024. The primary method for closing skill gaps continues to be training existing employees, with 66% expecting to provide training options in 2025 compared to 59% in 2024.

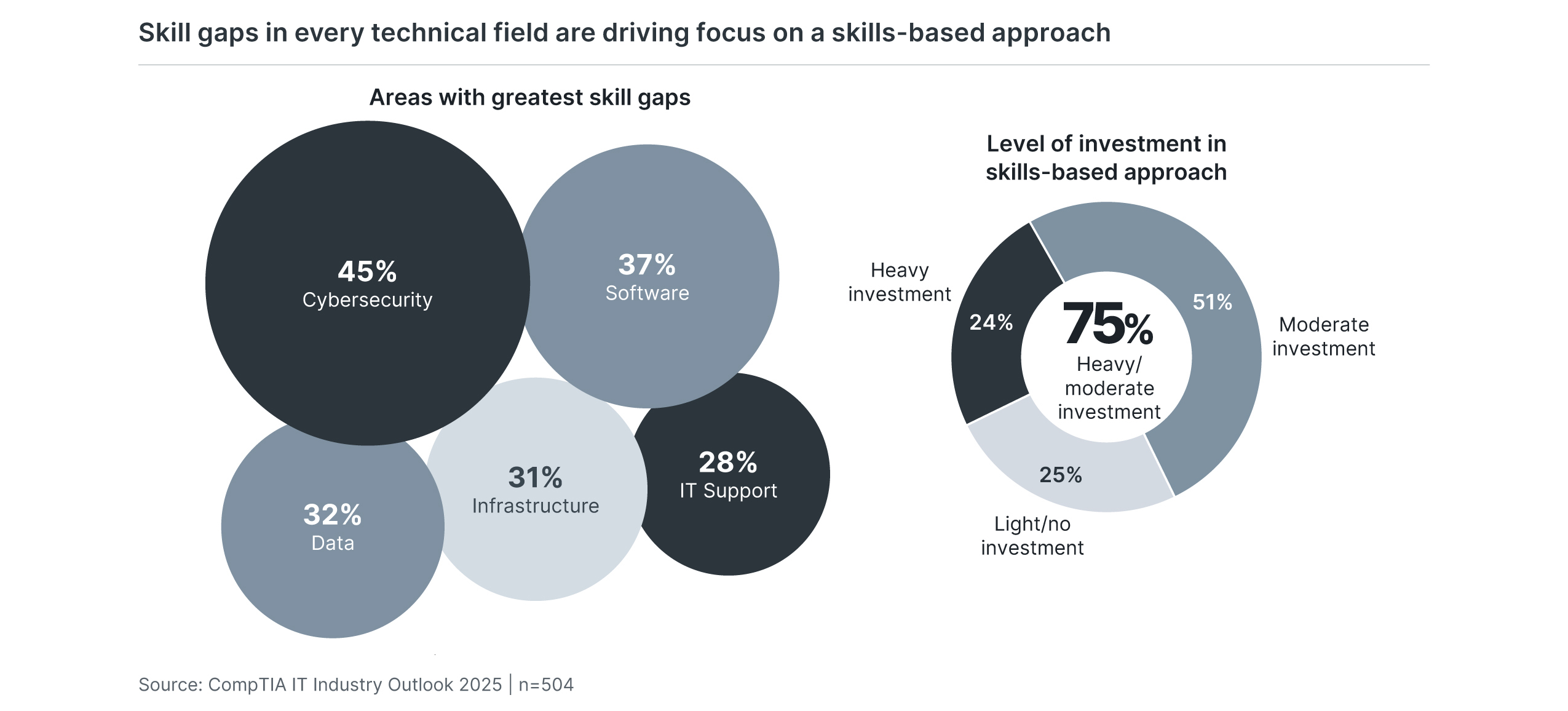

Although cybersecurity and software development lead the list of estimated skill gaps, there is relative balance across all families of tech job roles. Companies are still largely targeting early career (3-5 years’ experience) or mid-level (5-10 years’ experience) in their hiring plans, but the imbalance between supply and demand will force more consideration of entry level roles, even if these roles may require definition in areas like cybersecurity and data.

Whether businesses are training or hiring, there will continue to be investment in a skills-based approach. Three in four companies to date have invested heavily or moderately in the frameworks and methodologies needed for skills-based assessment and activity. Those investments, like technology investments, will soon be coming under scrutiny and will require more formal descriptions of the outcomes being achieved.

Only 19% of companies feel that their existing HR systems are extremely well-aligned with a skills-based strategy, with another 50% saying that their HR systems are mostly well-aligned. The HR processes most in need of attention are performance management, candidate screening and hiring procedures. HR workflows may be part of a long list of workflows that need to be reevaluated and redesigned with modern technology, but they are perhaps among the most critical since they fuel the very skills needed to forge new paths in a digital landscape.

9) SMBs eye workforce upskilling to gain competitive advantage

The topic of skills factors into myriad conversations across the tech workforce and business landscapes today. One discussion that will be getting more attention in the coming year is what is happening with skills development among SMBs, both those in the IT channel and their customers, who mostly happen to be small too. For years, the prevailing wisdom has been that most SMB channel firms tend to be technology generalists, focused primarily on providing basic infrastructure services ranging from device and network management to the installation and updating of software. A similarly minimalist line of thinking has gone for SMBs on the customer side: They often lack an internal IT department or operate a very rudimentary one and, therefore, don’t need to foster in-house tech skills beyond the most basic. The more blanket assumption has been that larger channel providers and enterprise customers are the ones that require staff with sophisticated skills across disciplines such as software development, AI, data science, and industry verticals. That viewpoint is changing today, however. As technology continues establishing itself as a strategic business asset and competitive differentiator for all companies, the bar on skills development is rising for SMBs. It’s a good bet that many of these smaller firms are already starting to upskill their current tech employees for job roles or duties that feature cloud computing, software development, cybersecurity, and data. Driving this quest to attain higher-level tech skills is demand. Channel executives today will tell you that even the smallest of customers are on high alert about cybersecurity or have been curious about AI’s potential for their company. And they want to know that their tech provider can help them. To maintain a competitive edge, more SMB channel firms should begin down this path of upskilling. The first steps include evaluating their current skills, then identifying gaps and areas of demand, and finally making requisite investments in training.

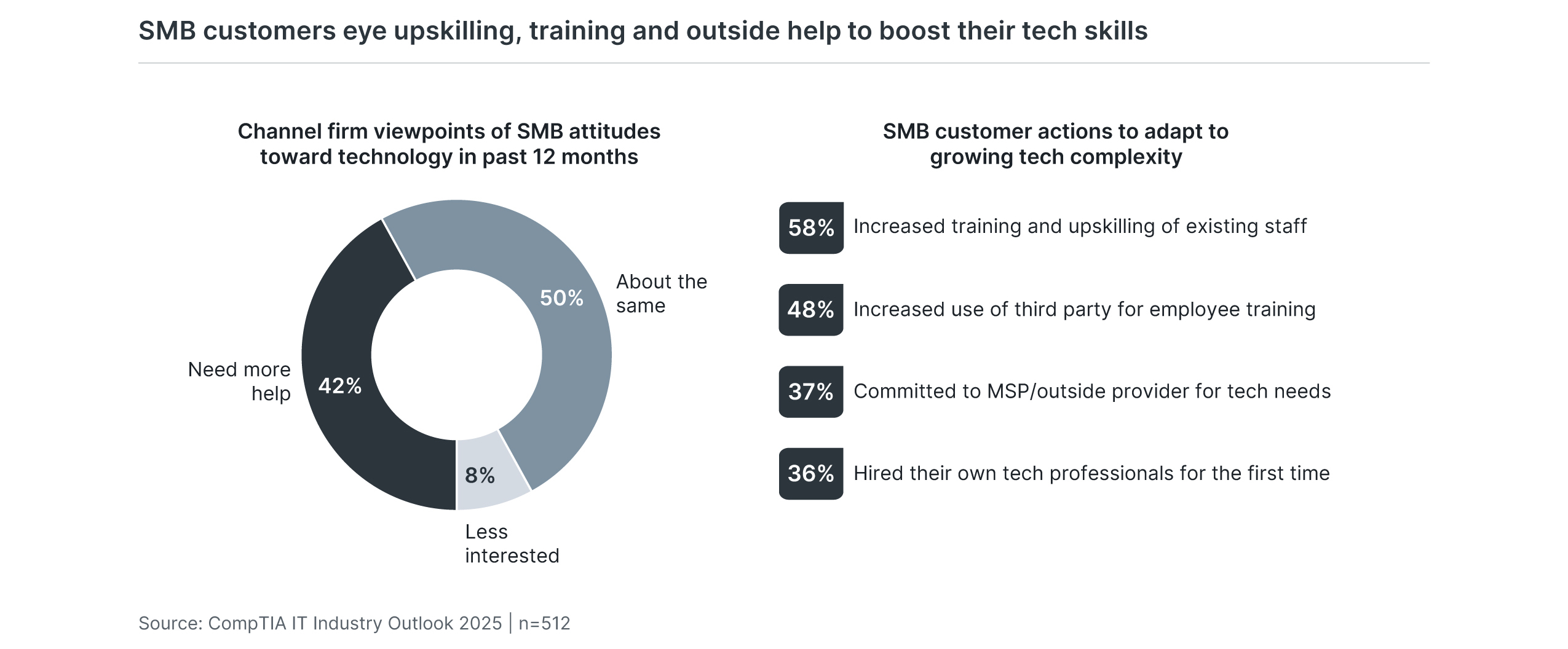

Among channel firms whose primary set of customers fit the traditional definition of an SMB business, most (57%) describe their clients’ tech skills and acumen as intermediate level. By intermediate, they mean their SMB customers have a general understanding of today’s tech landscape and are adept at working their individual devices and applications. Typically, these same organizations do not have their own IT staff and are cautious about introducing new technologies.

A third of channel firms, however, say their SMB clients are experts possessed with a solid understanding of today’s technology landscape and their own company’s needs. These firms have an IT department and express a willingness to innovate and deploy more sophisticated tech solutions. To differing degrees, both customer groups are ripe for improving skills for today’s complex tech solutions. Likewise, SMB-sized channel firms that sell to them should be thinking along the same lines, expanding skills to match customer needs.

To boost those skills, channel respondents report that SMB customers are taking a dual approach: upskilling their own staff while also tapping third parties for help. Some are opting to outsource completely. Thirty-seven percent of channel firms said their SMB customers have committed to an MSP to gain access to today’s advanced tech skills without having to hire or retrain their own employees. In fact, 42% of respondents said their SMB customers have sought more help from them than in previous years for making decisions about newer technology solutions.

What are the solutions and skills that customers are most looking for today? Top of the list, not surprisingly, is cybersecurity expertise, followed by skills in data, managed services, and digital transformation. For channel firms, each of these solution areas is challenging, particularly cybersecurity, where the stakes are much higher than in the past and far more complex in terms of remedies and preventive techniques. Bottom line? Large organizations don’t own the market on advanced technical skills. As such, more SMB firms, both channel and end customers, should put themselves on a pathway to take advantage of today’s newest solutions.

10) Wide-reaching global issues influence tech business decision-making

Twenty years ago, journalist Thomas Friedman hit the market with his seminal book on globalization, The World is Flat. Friedman’s main take was that the playing field of the world economy was leveling out competitively, particularly with respect to workers in developing nations and multinational companies’ outsourcing practices. Arguably, globalization has run through several new waves since that book’s debut, and the topic is no less relevant today than it was then. You can, in part, thank the inexorable march of all things digital for keeping global matters top of mind for many companies in the tech industry and IT channel. The critical interconnectedness and interdependency of the global economy was on full display during Covid when supply chain issues stymied the flow and production of goods, including in the semiconductor industry as CompTIA’s IT Industry Outlook 2023 explored. Today, while we still see ripple effects from the supply chain calamity, it’s largely over. But its impact shined a spotlight on the opportunities and challenges of doing business across the global economy. Right now, tech businesses are scrambling to address skill gaps and adapt to an aging workforce, grapple with the impacts of AI and automation, and defend against competitive changes brought on by the rise of Big Tech online marketplaces. Considering these challenges, some are going to look to new markets, including overseas. In particular, the ever-growing demand for new tech worker skills may drive companies to global regions to access a broader talent pool. Some US-based MSPs, for example, have been contracting with IT support centers abroad as a more affordable way to provide the 24/7 services they promise customers. Regions outside the United States are also looking beyond their borders to pick up business with neighboring countries, as is the case in Europe or with the US market.

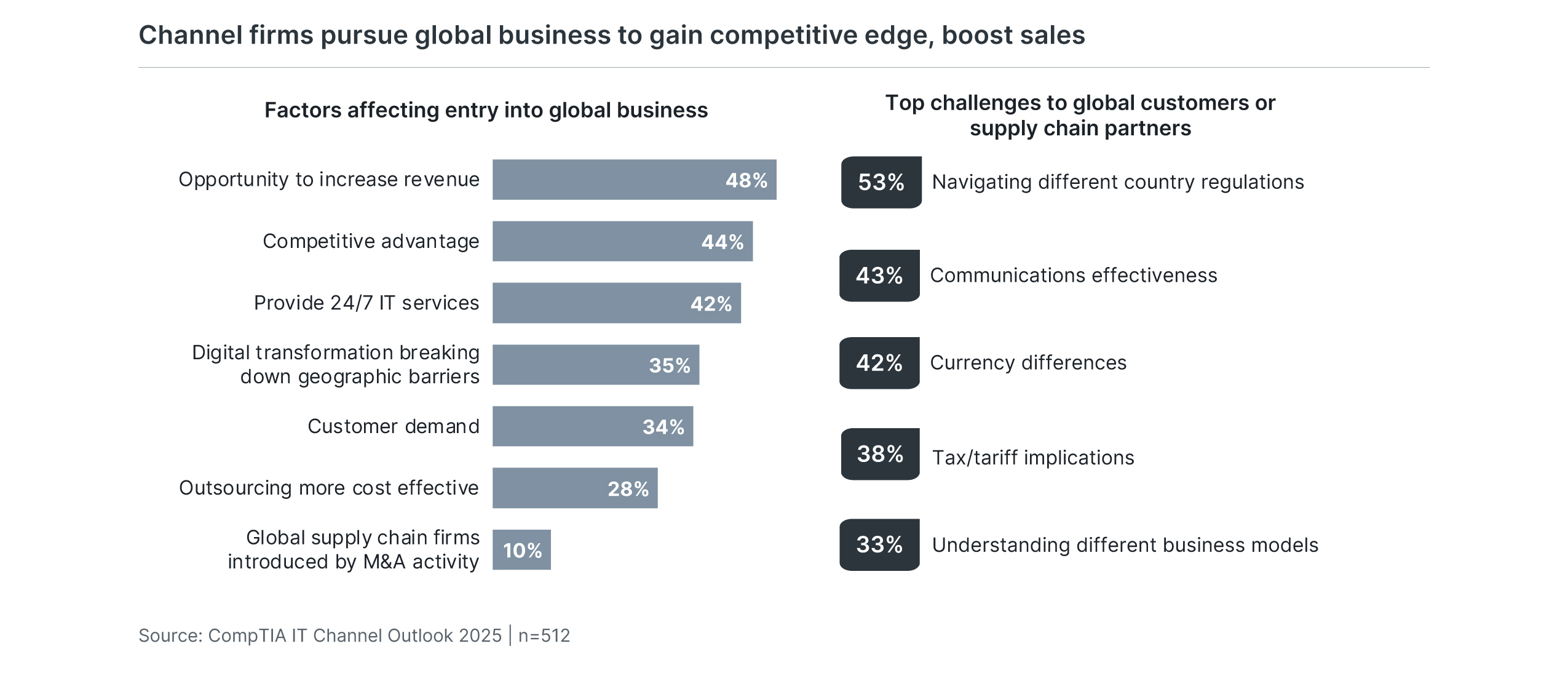

Channel companies with international ambitions have a variety of objectives in mind. They are looking to boost revenue, differentiate themselves competitively, meet customer demand, and/or improve their own operational efficiencies through personnel scale and business hours that span many time zones. Still, others have been pulled into the global market by virtue of a merger or acquisition or through a key vendor partnership.

Consider these telling statistics: In the last year, 47% of channel firms said they have done business with end customers in another country, 52% with a vendor, 48% with a distributor, 46% with an outsourced service for workforce help; and 48% with a consultant.

Of those dealings, channel firms report high levels of satisfaction with the experience. Seven in ten described their global business experience as positive (including 19% that characterized it as very positive). Twenty-seven percent deemed their experience a mixed bag of good and not-so-good, but only 4% reported an outright negative experience.

Positivity aside, deciding whether to do business in other countries is not trivial. There are hurdles in terms of understanding regulatory, data, and privacy laws across countries, navigating cultural differences, and anticipating that political unrest and economic uncertainty in various regions could pose risks that affect trade policies and tariffs. Other respondents point to the challenge of understanding how different business models operate in various countries and the obvious communication difficulties that can arise from language barriers.

Yet in today’s world, where cloud computing and digital transformation have decentralized the technology behind the world’s economy, global expansion is finding a place among a portion of channel firms and other tech providers looking for an edge that drives their business forward.

Conclusion

Never a dull moment. That’s certainly true of the tech industry. For those working as IT professionals today, involved in the making or selling of tech solutions or just starting to explore tech as a career, one thing above all is certain: this is a path of constant change.

But with constant change comes opportunity. There are new frontiers around AI and data to explore and exploit while ever-growing needs in cybersecurity, cloud computing, and software continue to mount. To take advantage of these opportunities, skills development is going to be paramount in the years ahead. Both as an individual pursuit and an organizational imperative, skills attainment, if done right, will help position people and companies well for future competitiveness and growth. CompTIA’s IT Outlook 2025 has identified several areas where the role of skills will be central: all things AI, the formation of data teams, changes in software development, and the growth aspirations of SMB-sized companies and MSPs.

To understand which skills are critical to developing, one must first grasp general market trends and the direction in which the tech industry and tech occupations are heading. There are many key questions to consider.

- What technologies and services are truly in demand, and what is waning?

- What do customers want? What do employers want?

- What does laying the groundwork and foundation for the future look like as a business in the IT channel, a tech vendor, or an IT pro looking to build a career?

These are heady questions. And just a few that will come into play in the year ahead. Practically speaking, CompTIA sees an industry and workforce landscape that covers not only the new and exciting but also the foundational. Consider something like IT infrastructure (think networks, hardware, basic software) that can frankly be viewed as bland when compared with the genuine whiz-bang excitement generated by AI. The fact is that without a strong foundation in servers, secure networks, data management, etc., the promise of AI falls flat. You must have both. This reality will drive business growth in the channel for its many different provider types and carve out extensive career paths for IT pros.

That diversity of needs should be considered a win-win for all. The common thread through them is having relevant and applicable skills, both on the technical and business side. Skills evolution is part of that constant change theme in the industry, and frankly one of the more exciting aspects of a technology-based career.

Please note this is an excerpt, and the full report contains more detail.

Methodology

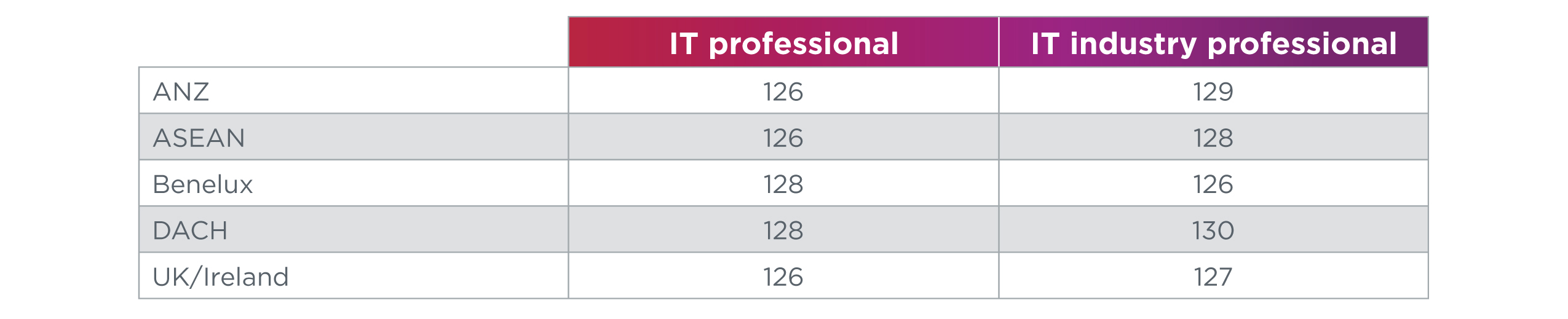

This quantitative study consisted of two online surveys fielded to IT professionals and IT industry professionals during October 2024. A total of 504 IT professionals based in North America and 512 IT industry professionals based in North America participated in the surveys, yielding an overall margin of sampling error at 95% confidence of +/- 4.4 percentage points. This survey was also fielded in ANZ, ASEAN, Benelux, DACH and UK/Ireland. Sampling error is larger for subgroups of the data.

As with any survey, sampling error is only one source of possible error. While non-sampling error cannot be accurately calculated, precautionary steps were taken in all phases of the survey design, collection and processing of the data to minimize its influence.

CompTIA is responsible for all content and analysis. Any questions regarding the study should be directed to CompTIA Research and Market Intelligence staff at research@comptia.org.

CompTIA is a member of the market research industry’s Insights Association and adheres to its internationally respected Code of Standards and Ethics.

Read more about tech industry sectors.