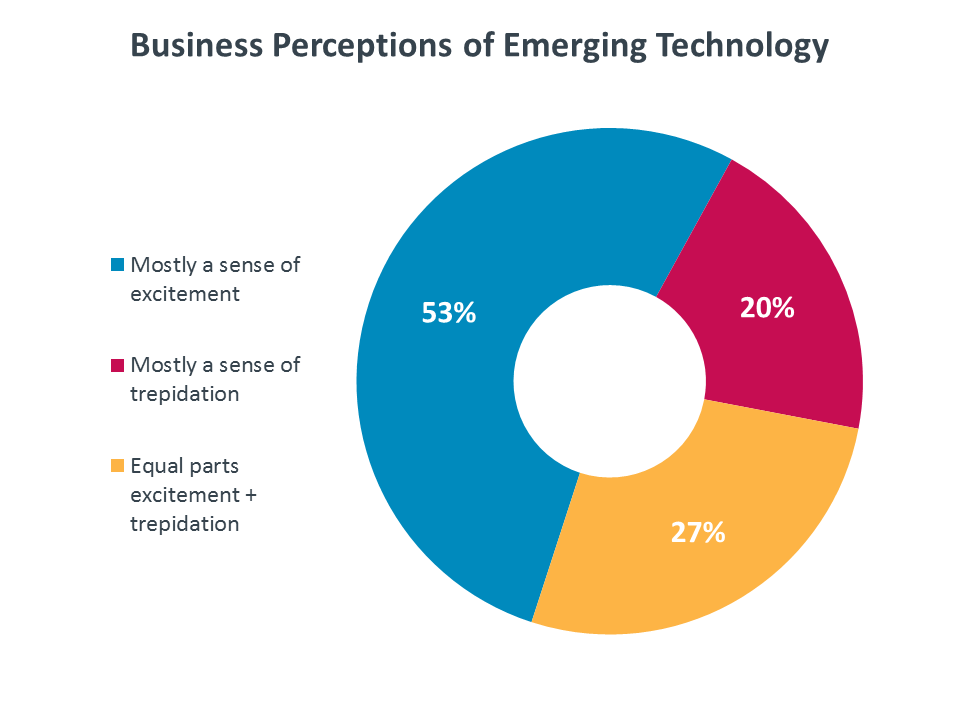

A scan of the 2018 horizon reveals a year that appears to be on the cusp of profound change. And yet, the closer a major leap forward seems, the more one is reminded of the last-mile challenges associated with next generation innovation. While there continues to be a sense of excitement for a future that is rapidly becoming reality, increasingly, questions and concerns are part of the mix as well. The trends unfolding will do so in an environment of higher expectations; namely, for business value, security, transparency, and equal access to opportunity. Against this backdrop, CompTIA explores the forces shaping the information technology industry, its workforce, and its business models in the year ahead.

The information technology (IT) sector is poised for another strong year, 5.0 percent growth projected

CompTIA’s IT Industry Business Confidence Index notched one of its highest ratings ever heading into the first quarter of 2018. Executives cite robust customer demand and the uptake of emerging product and service categories as key contributors to the positive sentiment. Revenue growth should follow suit. CompTIA’s consensus forecast projects growth of 5.0 percent across the global tech sector in 2018; and, if everything falls into place, the upside of the forecast could push growth into the 7 percent-plus range. According to IDC, global information technology spending will top $4.8 trillion in 2018, with the U.S. accounting for approximately $1.5 trillion of the market.

An evolving tech labor market will continue to present challenges, as well as opportunities

With employer demand for tech talent routinely outstripping supply, the year ahead will force more organizations to rethink their approaches to recruiting, training, and talent management. Additionally, questions surrounding skills gaps, diversity, alternative education/career paths and the future of work will demand more meaningful attention and resources.

Balancing incrementalism and transformations

Most organizations pursue incremental transitions, upgrading or adding technology piecemeal, followed by adjustments to workflows. CEOs and boardrooms across the economy are waking up to the fact that this approach is often inadequate in the face of rapidly changing industry and customer dynamics. This doesn’t necessarily mean chasing the latest shiny object or moonshot idea, but rather embracing an organizational mindset of proactively planning for a digital future.

12 Trends to watch for 2018

Building on previous iterations of CompTIA’s IT Industry Outlook, the trends to watch for 2018 revolve around technology, but that is really only one facet of the bigger picture. Complementary trends covering the business of technology, workforce dynamics, and macroeconomic conditions provide context and grounding.

Over the past several years, there has been much discussion around the “consumerization of technology.” This term applies mostly to the usability of technology. Plummeting costs and advanced user interfaces allow new applications to be used more broadly than ever before. Usability isn't the only thing changing, though; the bar is also lower for the creation of new applications, and this democratization has potential to disrupt entire industries and social behaviors. The toolset for building technology has been steadily growing more accessible; for proof, look at the vast array of applications available through mobile device app stores compared to the relatively limited selection of packaged software from previous decades. In 2018, though, a tipping point will be reached. As software becomes the driving force of many solutions, open source concepts allow far more people to build applications around blockchain, natural language processing, or context-aware computing. Hardware is also more of an open toolbox, as makers explore novel use cases using drones, robotics, and 3D printing. Technical literacy has risen steeply thanks to mass availability, and that literacy can now tap into a diverse set of options in order to create groundbreaking new paradigms.

CompTIA’s research in the cloud space includes a typical adoption progression for businesses. Starting with exploration, companies move into non-critical use, where day-to-day applications (though not the most important systems) are placed into a cloud model. Up to this point, most companies have been in these first two stages, learning lessons about system migration, integration with existing architecture, and cloud security. Many firms are now ready to take the next steps, moving into full production mode where there are few if any restrictions on the type of application that can live in the cloud. From there, the final stage is transformed IT, where the architecture has been rebuilt to maximize cloud characteristics rather than simply being forklifted. Unlike the first two stages, later-stage challenges are not primarily technical. Instead, companies must build or reconfigure the appropriate policies and workflow for a cloud-based approach. Those companies on the cutting edge of cloud adoption report that these challenges are even more significant than the hurdles in earlier stages, so the cloud discussions will continue evolving.

Building on some of the concepts that allow for democratization of technology, IoT devices are rapidly making their way into corporate spaces. From gathering new data to automation of infrastructure, companies are finding many benefits from adding connectivity and intelligence to physical infrastructure. Unfortunately, the relatively low cost of IoT devices is not reflected in the cost of system maintenance and optimization. Adding digital capabilities to everyday components drastically increases the scope of IT responsibilities. Additionally, new skills are needed for the different types of data streams being generated and the advanced analysis that companies want to perform. Automation will certainly help ease these burdens, but IoT strategies will still further complicate the already-difficult redefinition of the IT function.

Amid the wave of emerging technologies, artificial intelligence stands out as the one most likely to drive changes to the IT ecosystem. Technology solutions are growing more complex and technology demands are growing more specific. The answer to these issues is not found in constantly adding resources but in leveraging benefits of modern technology. AI requires significant compute resources (which can be procured in the cloud), various algorithms that allow learning (which can be baked into products or provided as a service), and contextual awareness (which can come from IoT devices or massive collections of data). By adding a layer of intelligence to the technical solutions they are building, companies can both manage a more extensive IT architecture and solve a broader range of problems. Not every company will necessarily need the skills to build new AI functions, but they will at least need the skills to manage AI components so that they are not just dealing with mysterious black boxes producing unexplained output.

With security incidents continuing to rise, it is clear that attackers are finding new sources of profit even as companies prioritize the protection of their digital assets. At a high level, the situation is not likely to change dramatically in 2018. However, there will be subtler shifts in methodology as companies consider their approach to security. Many businesses have increased investments in security, but these investments often follow an approach that utilizes technology to build a defense. Increasingly, firms will realize that they must also detect the inevitable breaches and respond quickly. Beyond the technical aspects, organizations will also begin building business processes that enhance security, and they will implement end user training to mitigate human error. In short, companies will shift their security mindset from technology-based defenses to proactive steps that include technology, process, and education. There is no doubt that companies are taking security more seriously, but now they must realize that modern security demands a different mentality rather than just more of the same.

It has come to be expected that technology gets better, faster, more capable, and of course, less expensive. Over the past two decades, technology has become so pervasive that it can be difficult to truly grasp its impact. Because of the scale and scope of benefits provided, the tech industry generally gets the benefit of the doubt, overlooking the occasional product flops, the folly of the dot.com era, or the usual frustrations that come with early stage products. However, signs point to changing expectations and a different environment unfolding. Questions surrounding security, privacy, and screen time continue to intensify. Concerns over market concentration and the power imbalances of gatekeepers loom. Reports of toxic corporate cultures and a lack of inclusiveness in certain quarters of the industry bring much needed attention to structural problems. Further advances in artificial intelligence and automation will likely ratchet up the level of scrutiny of their impact on work and society. To be clear, technology will continue to overwhelmingly be viewed as a force for good, but the industry will need to spend more time looking at itself in the mirror to ensure this sentiment continues.

According to estimates, 90% of all digital data in existence in the world today was created in just the past two years. This is a function of the ongoing digitization of information, and more recently, the mass deployment of sensors. Advances in distributed computing power and storage have enabled the collection of just about every data point under the sun (literally, in some cases, as in the ever-expanding use of satellite imagery data streams). These developments are ushering in what can be characterized as the insights economy. Data is obviously the foundation of an insights economy, but similar to other raw materials, it requires refinement and conversion into something of value. Machine learning and artificial intelligence are the levers that make this happen. Companies at the forefront of pulling these levers, for purposes of pattern recognition, predictive analytics, natural language processing, and computer vision, drive the insights economy. In the aggregate, these data-driven activities already account for a sizable portion of global GDP, a figure that will only grow as an insights orientation takes hold across every industry sector. As with anything, tradeoffs will need to be considered as the insights economy comes into focus. A prime example? Data network effects, whereby more data leads to better insights, which leads to even more data. And the aggregator of all that data holds immense power and influence as a result. This could further accelerate a winner-take-all dynamic and create even more pronounced data divides. Additionally, data privacy and ethical concerns are certainly well founded given the frequent lack of transparency and control over how data is collected and used. The sci-fi TV series Black Mirror does an eerily good job of portraying a point in the near future where a person’s all-encompassing data score dictates how they are permitted to interact with the world around them.

Aligning technology to optimally meet business objectives continues to challenge many organizations. This starts with shortcomings in developing a strategy and vision that covers not only technology, but also the people and process elements. Because most technology initiatives today span multiple functional areas and entail many moving parts – infrastructure, mobile environments, data, and integrations, projects can quickly derail without the necessary levels of commitment and resources. Increasingly, organizations are recognizing the importance of having a tech-savvy C-suite and boardroom. This doesn’t necessarily mean having deep technical knowledge, but rather having a feel for the tech landscape, knowing the types of questions to ask, and being able to push back on pursuits that may be a poor fit for the organization. Additionally, with the consequences of a single digital misstep becoming more severe, board-level engagement with cybersecurity and data governance is no longer optional.

The concept of ‘new collar’ jobs originated with IBM CEO, Ginni Rometty. It was a call to action to recognize the changing nature of middle-skill jobs and the need for new approaches to training and preparing the workforce of tomorrow. This change is largely a function of the intersection of technology and just about everything in the economy, from products and workflows to supply chains and job roles. With the rapidly expanding Internet of Things footprint, this trend will only accelerate, reshaping existing jobs and creating entirely new categories of knowledge workers and technologists. While there is still a case to be made for traditional four-year degrees, it has become clear that alternatives are needed. This may entail a skills-centered education and training approach (covering both hard and soft skills), validated by one or more recognized credentials, resulting in a jobs-ready candidate. The New Collar Jobs Act and CompTIA’s Chance in Tech Act, which promotes IT apprenticeships, points toward momentum in the form of legislative support and funding. Despite the momentum, it will take time and an ongoing demonstration of success in building a new collar jobs’ pipeline to cultivate buy-in from students, parents, and employers.

At ever-increasing scale, vendors from Amazon to Microsoft to Salesforce are leveraging their own online marketplaces to aggregate technology goods and services as a kind of one-stop-shop for customers. These marketplaces include technology solutions ranging from standard products to subscription-based cloud services and applications. A quick scan of Google’s GSuite Marketplace, for example, yields access to hundreds of independent software vendors’ cloud-based applications, spanning categories from ERP/logistics to human resources applications to CRM solutions. And with the click of a button, customers can install these solutions and roll them out into their businesses. In 2018, these IT shopping malls will only grow in influence as line of business workers take charge of more IT decision-making and purchasing. This is potentially bad news for the channel, as these marketplaces pose yet another competitive threat. But do they? The answer is both yes and no. The yes is obvious: with more options for customers to quickly and conveniently buy technology direct online, there’s less need for an intermediary. But savvy solution providers, MSPs and IT consultants are figuring out ways to co-exist and even exploit these marketplaces as an extension of what they offer or recommend to their customers. During a time when services dollars cannot be over-valued, certain channel firms will wisely play the business consultant role by helping customers vet the marketplace solutions that will best support their organization’s objectives. And if the customer ultimately self-procures the solution, so be it. The channel firm’s goal should be to provide accompanying business advice, application customization, integration, security and other services.

As channel firms transform from transactional product sales to recurring revenue models, they often grapple with how to price their services. It’s not an easy task. Subscription-based models are complex and can seem arbitrary compared to placing a specific percentage margin markup on a piece of hardware. Things are going to be tougher in the coming year as the new Accounting Standards Codification 606, which took effect in December 2017, makes its impact on the way companies recognize revenue and ultimately bill. Under the new standard, contract-based software solutions that include other offerings such as maintenance, security, implementation services etc., will have to be broken apart into individual transactions. How to price these various bits and pieces? It’s really anybody’s guess right now. Bottom line: the new rule is going to add complexity and more work for MSPs and cloud services providers in the year ahead. One possible source of help? PSA tools vendors such as Connectwise, Kaseya, et al, that already offer automated customer billing modules in their platforms may be able to address the new accounting requirements in their tools. Unfortunately, this will not help the many MSPs that do not use these types of commercial software packages, so they will need to navigate these new financial dictates on their own.

Today’s tech landscape exists as an ”as-a-service” world. From desktop-as-a-service, software-as-a-service, infrastructure-as-a-service, and beyond, the cloud has ushered in an era where any conceivable type of technology solution can be delivered much like the utility services that power your home. But it’s getting more complicated. A cornucopia of disruptive and emerging technologies is spilling into the as-a-service arena. Drones-as-a-service, for example, may sound like something out of sci-fi, but increasingly drone service providers are cropping up to support customer needs. Customers, for example, like AES Corp., a Midwest-based global energy company that wanted to use drones to conduct inspections of its facilities in the field. Drones not being a core competency, AES had two choices: learn a new skill or outsource. They tried the former, but ended up choosing the latter, partnering with a drone-as-a-service operator called Measure, whose company tagline is “We don’t make drones. We make drones work.” And that’s just the point: as more and more customers grow accustomed to consuming established and emerging technologies as a service, channel firms and other providers will need to make sure they are truly up to speed and not simply paying lip service to the “as a service” moniker. Customers want the flexibility the model allows, fast and reliable service, predictability and skill to back it all up. As 2018 marches on, channel firms have a tremendous opportunity to crack into some of these new markets that include authentication-as-a-service, analytics-as-a-service, artificial-intelligence-as-a-service, drones and more. But they will need to invest in skills training, workforce development, and more to take advantage.

As technology extends its reach to companies of all sizes, industries with changing technical demands, and nearly every aspect of modern society, the conversations around technology are also expanding. It has always been the case that technology solutions are built from a stack of different components, and technical professionals often focus on a subset of this stack rather than having deep expertise across the entire array. With interest and proficiency growing across the wide population, though, some classification of the technology landscape gives structure to discussions around strategies and expectations.

At the bottom of the tech pyramid, there are enabling technologies. These building blocks are often off the radar screen for most people, but sometimes a leap forward in capabilities will bring an enabling technology to the forefront. A traditional example of an enabling technology would be the TCP/IP protocol—a standard that powers the entire Internet, but not a piece that is wildly evolving on its own. Some topics in the spotlight today appear to be areas where companies need to build competency, but they are in fact enabling technologies that will eventually live in the background of innovative applications. 5G is the next-generation standard for wireless networking, promising lower latency, higher bandwidth, and stronger security. But beyond any infrastructure upgrades, most businesses will focus on new possibilities in workflow rather than specifics of the 5G standard. Similarly, blockchain became a huge topic when Bitcoin’s value skyrocketed in late 2017, but ultimately this technology will be used to fuel a new wave of transactions rather than being a core skill that every company must adopt.

The bulk of the tech ecosystem is comprised of established technologies. These solutions, built with enabling technologies, have proven their worth in the market and are productive tools used by a wide range of businesses. The most well-established examples are so commonplace that they generate few headlines and little hype. Servers, firewalls, virtualization, PCs, and SQL are all widely adopted, and IT pros continue to build their skills in these areas, but they rarely make any top 10 lists or keynote addresses. Cloud computing, smartphones, and social media are newcomers to this space, so interest is still high, but those have clearly become accepted as standard pieces of a modern architecture.

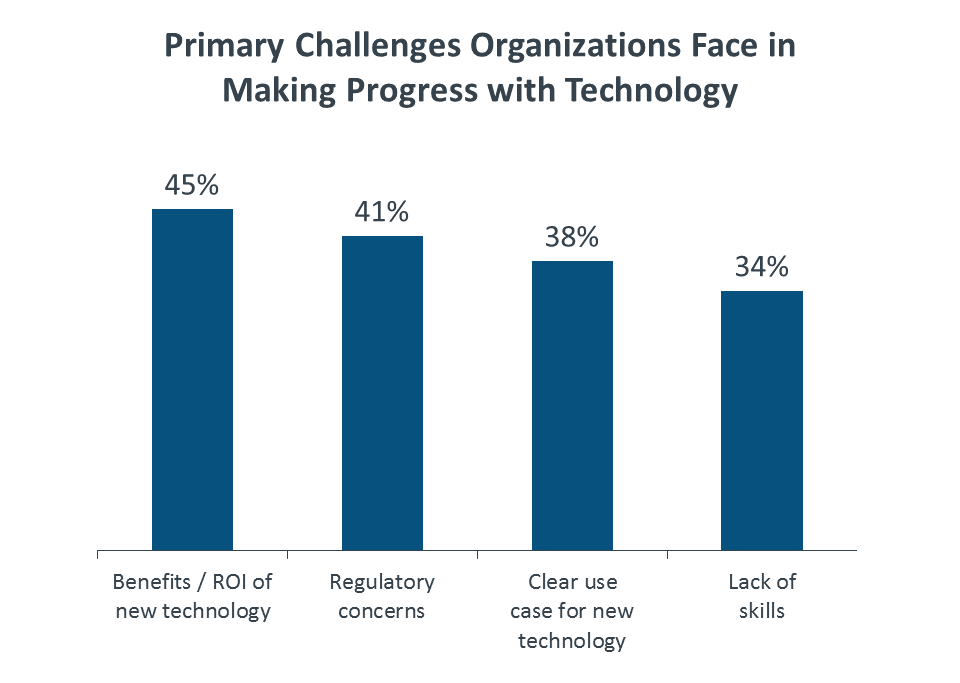

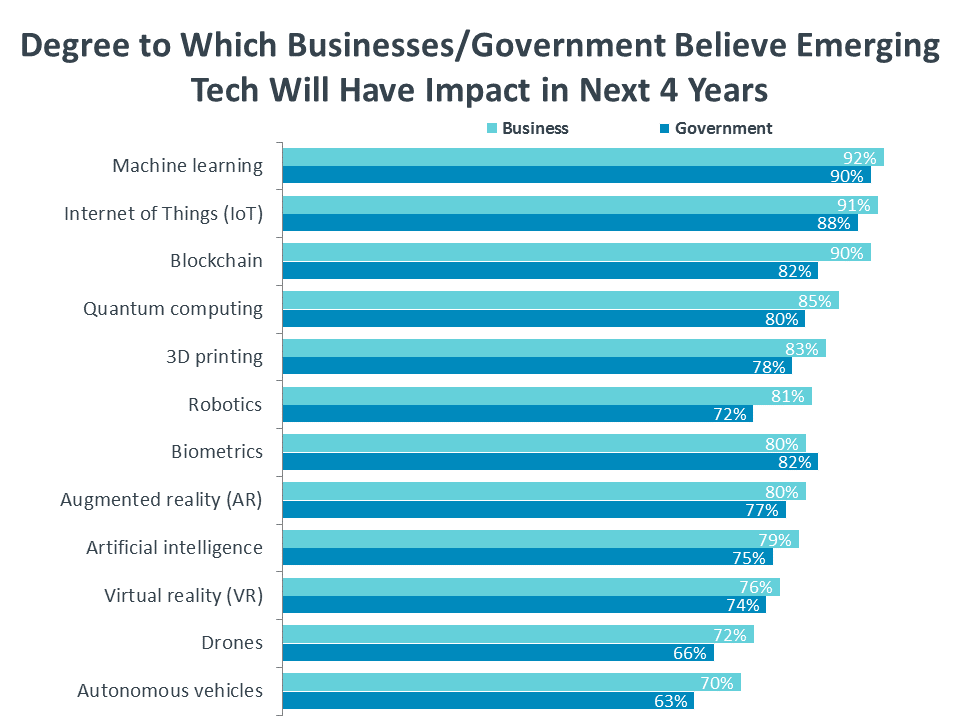

The final category is the one that receives the most attention as consumers and businesses try to stay ahead of the curve and build competitive advantage. Emerging technologies are on the horizon, holding the potential for disruption but still fighting hurdles to adoption before their full potential can be realized. Given the growing importance of technology and the general belief that the rate of tech progress is accelerating, there is a recent tendency to approach emerging technology as a single topic. In reality, this space can be broken into three separate components, each of which are useful to businesses going through digital transformation.

The most common perception of emerging technology is a collection of different trends, any of which could eventually migrate into the bucket of established technologies. Some of these trends (like blockchain) may actually be enabling technologies, driving some confusion around how broadly skills will be needed or where the technology will appear in a solution stack. Other trends—like virtual reality, drones, or autonomous vehicles—clearly represent the type of endpoint tool that would be purchased by a consumer or business. The challenge in dealing with such a wide range of topics lies in developing the expertise to understand the pros and cons of each one. Limited resources further complicate this task.

A second way to approach emerging technology is to determine the desired objective that can be achieved using one or more different tools. For example, the complexity of IT infrastructure and demands for timely results drive a need for automation. Automation is not something that is purchased as a standalone item; instead, a company might employ IoT devices, artificial intelligence, and data analysis to automate certain functions. By focusing on the end goal rather than the discrete technologies, it can be easier to determine which pieces provide the most value.

Finally, companies can consider their internal structure and processes, making adjustments as necessary that will help with internal evaluation and adoption. This approach is closely tied to digital transformation efforts, where the real change occurs not from installing new tools but from changing the mindset and behavior of the organization. Larger companies might build internal innovation labs or cross-function teams that evaluate options and drive cultural change. Smaller companies might reconsider their use of technology partners in order to build a team with the right skill set. At the end of the day, businesses need to find some way to cut through the noise around technology and organize their priorities so that they can invest in the correct tools and skills to remain competitive in the digital economy.

Revenue generation alone isn’t key to long-term growth and the overall health of a business. Reality is that even the best sales results will have diminished impact if a company’s profit margins are leaking because of inefficient internal processes, poorly gauged ROI, or exorbitant customer acquisition costs.

As the channel makes the turn to new business models, it is more essential than ever that firms optimize operations for maximum efficiency in order to reap the full benefit of its revenue intake. This includes fine-tuning the business across a range of areas, from sales, marketing and finance to human resources and supply chain logistics. For many, this means taking a serious look in the mirror. The key to operational efficiency requires an unflinching examination of how well – or not – operations run today, especially before taking the plunge into a new business model.

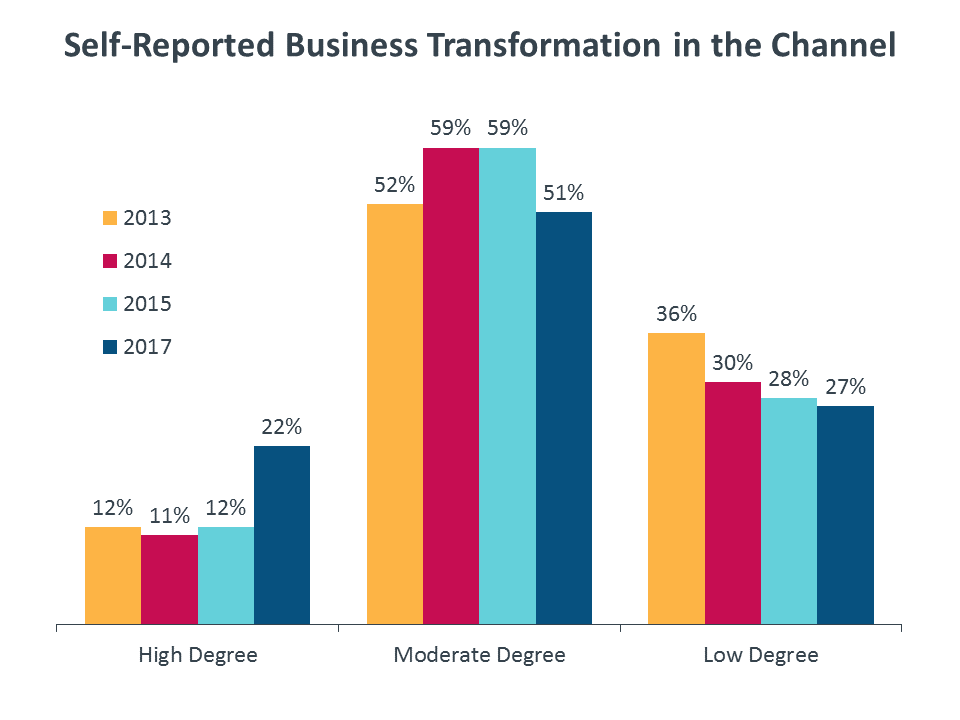

In December 2017, CompTIA research took a look at how channel firms self-assess their current state of operational efficiency, asking respondents where they see areas of success and challenges, and what actions they are or will be taking to shore up their businesses. As a baseline, the majority of respondents in the study reported undergoing a moderate or high degree of business transformation, which likely includes transitioning to a recurring revenue model such as managed services, specializing in a vertical industry or other niche, or becoming a business consultant focused on helping customers adapt to the digital economy.

Based on topline results, 2 in 10 respondents assessed their current state of operations as very efficient, with another 39% deeming themselves mostly efficient at present. Thirty-six percent ranked themselves in the middle of the pack in terms of efficiency, with some areas in good standing and others not. Finally, 7% acknowledged having mostly inefficient operations.

Not surprisingly, the companies that reported experiencing a high degree of business transformation were more likely to assess their operational efficiency in the superlative. Thirty-six percent of this group described their business as very efficient; that compares to just 13% and 15%, respectively, of firms that report either a low or moderate degree of business transformation. It’s likely the early movers are far enough down the road in their transition to cloud and other business models that they have smoothed out the operational speedbumps that inevitably arise in business model shifts.

Of best practices that respondents believe are critical to improving efficiencies, the top two are calculating ROI/time to profitability before embarking on new projects, and creating repeatable processes across the company. More than half of respondents cited these actions as imperatives.

In terms of challenges, profit margin leaks are a concern for channel firms across the board. The No. 1 impediment to maximizing profit is pricing pressure from customers, a problem cited by half of respondents. Increased pricing pressure is attributed to expanding customer alternatives and negotiating strength, and new types of competitors.

Counterpoint: A Tale of Two Channels

For the past several years, the drumbeat has gone that MSPs and other channel firms must move swiftly toward selling to line of business buyers, regaling them with business application and vertical industry knowledge. Smart advice. And a host of newer partner types have aligned themselves with the thousands of ISVs in the software-as-a-service world to do exactly that. But that’s not the totality of the MSP and channel space. Infrastructure needs are going to continue to exist and most importantly, exist in the minds of IT departments vs line of business executives. And so everything might be in the cloud these days, but people still need devices to work on. And those devices still need to be managed and maintained. That’s why 2018 will feature large numbers of MSPs that stick to the traditional, managing, monitoring and securing their customers networking and device infrastructure.

The global information technology industry surpassed $4.5 trillion in 2017, according to the research consultancy IDC. If growth expectations materialize in the year ahead, spending will eclipse the $4.8 trillion mark.

The United States is the largest tech market in the world, representing 31% of the total, or approximately $1.5 trillion for 2018. In the U.S., as well as in many other countries, the tech sector is one of the most significant contributors to GDP. See CompTIA’s Cyberstates report for more detailed economic impact analysis.

In the aggregate, the Asia-Pacific region, which encompasses Japan, China, Australia, India, and surrounding countries, accounts for one-third of the total. APEC has increased its share of the global IT pie, driven by the rise of countries such as China and India, and the slower growth rates experienced in parts of Europe and other markets. By 2032, China is projected to claim the mantle of world’s largest economy.

The vast majority of technology spending stems from purchases made by corporate or government entities. A smaller portion comes from household spending, including home-based businesses. With the blurring of work and personal life, especially in the small business space, along with the shadow IT phenomenon, it can be difficult to classify certain types of technology purchases as being solely business or solely consumer.

Breaking the IT market down into its components, the traditional categories of hardware, software and services account for 53% of the total. The other core category, telecom services, accounts for 30%. The remaining 17% covers various emerging technologies that either don’t fit into one of the traditional buckets or span multiple categories, which is the case for many emerging as-a-service solutions that include elements of hardware, software, and service (e.g. IoT offerings).

The allocation of spending will vary from country to country based on a number of factors. In the mature U.S. market, for example, there is robust infrastructure and a large installed base of users equipped with computers, devices, and bandwidth. This paves the way for investments in the software and services that sit on top. These two categories account for nearly half of spending in the U.S. market compared to about one-third of spending globally. Countries that are not quite as far along in these areas, tend to allocate more spending to traditional hardware and telecom services. In some cases, not having legacy infrastructure makes it easier to leapfrog ahead and adopt newer generations of technologies.

Another important dynamic in understanding the global information technology industry is the flow of tech goods and services from source country to consuming country.

For the most recent year of available data, U.S. exports of tech products and services were an estimated $309 billion in 2016. Exports account for approximately $1 out of every $4 generated in the U.S. tech industry. For many tech bellwethers, exports account for an even higher percentage of sales, with some generating more than half of their revenue overseas customers. See CompTIA’s Tech Trade Snapshot.

| $ Billions | % of Total | |

| 1. Transportation / motor vehicles | $276 | 19% |

| 2. Tech products | $202 | 14% |

| 3. Chemicals | $185 | 13% |

| 4. Agriculture, food & beverage | $138 | 9% |

| 5. Machinery | $125 | 9% |

Last year, CompTIA’s IT Industry Business Confidence Index (BCI) recorded the best year in its history. The high water mark occurred during Q4, when the Index crossed the 70-point threshold for the first time ever.

Heading into Q1 2018, the BCI fell off its record high just a bit, but remains in lofty territory. All three components of the Index are performing well, including the rating of the economy, which has been a drag on the aggregate rating in year’s past.

As commonly seen in the CompTIA BCI, executives from large and medium-size technology companies are most bullish on the state of the market and their companies’ prospects. The smaller and micro-size firms, which may be more sensitive to local conditions or have a less diverse base of customers, lag slightly, but are still solidly positive.

Corroborating this optimism, the Conference Board’s Consumer Confidence Index reached its highest level in 17 years. Relatedly, the NFIB Index of Small Business Optimism recently recorded its highest level in 34 years.

On the macroeconomic front, the U.S. Bureau of Economic Analysis reported a notable uptick in U.S. GDP growth during the second and third quarters.

A note of caution, the Q1 reading of many indices, including the CompTIA IT Industry Business Confidence Index, has historically been positive, which then sometimes diminishes as the year progresses. This may stem from the optimism many companies experience with the start of a new year – the clean-slate mentality. Moreover, in an interconnected global economy, what may appear to be a minor blip in one country can quickly cause problems for trading partners elsewhere. With the ever-present challenges of commoditization, currency fluctuations, demanding customers, and new competitors, positive sentiment can quickly take a turn for the worse.

CompTIA projects the global information technology industry will grow at a rate of 5.0% in 2018. The optimistic upside forecast is in the 7.2% range, with a downside floor of 2.8%.

Growth expectations for the U.S. market are in line with the global projection. As the largest market in the world for IT products and services, U.S. forecasts and global forecasts will always be inextricably linked.

CompTIA uses a consensus forecasting approach. This “wisdom of the crowds” model attempts to balance the opinions of large IT firms with small IT firms, as well as optimistic opinions with pessimistic opinions. The results attempt a best-fit forecast that reflects the sentiment of industry executives.

Other factors that influence revenue growth projections include currency effects, pricing, and product mix. The tech space is somewhat unique in that prices tend to fall, which may result in large numbers of units shipped, but modest revenue growth. In the year ahead, the product mix will be an especially important factor, as the high growth rates of emerging categories are expected to more than offset the slow growth mature categories.

| Gartner | 4.5% worldwide forecast |

| IDC | 5.3% worldwide forecast |

| Forrester | 5.8% U.S. forecast |

Note: research consultancies tend to update their forecasts periodically to reflect new information, so these figures should not be viewed as static. Additionally, differences in forecasting methodologies, such as using current or constant dollars, should be taken into account.

Small businesses are commonly described as the heart and soul of the U.S. economy. This is more than hyperbole as SMBs account for the vast majority of the nation’s business entities, while serving as a key driver of job growth and innovation. Success as a small business owner means overcoming challenges on many fronts. Increasingly, these challenges, as well as the corresponding opportunities, revolve around technology.

Top SMB priorities for the year ahead – customer retention, expansion into new markets, business process improvements, innovation, and workforce development, will require the right mix of people, process, and technology to ensure optimal results.

Not surprisingly, SMB spending is highly correlated with firm size. About 1 in 3 SMBs report spending more than $100,000 annually, with the remainder spending a lesser amount. Forty-percent of SMBs acknowledge their investment level in technology is lower than it should be. According to Gartner, SMBs account for about 44% of IT spending globally.

SMB opinions of the perceived ROI they get from technology vary. Perceptions of ROI roughly follow a bell-shaped curve. In the aggregate, 6 in 10 SMBs rate the ROI of the technology in use at their firm as good or excellent. IT executives tend to give higher ratings than owners and business executives, while medium-size SMBs gave higher ratings than micro SMBs.

The data could be viewed in two ways. On the one hand, the tech sector is unique in that it regularly delivers better, more capable products at ever-lower prices. An argument could be made that users may be under-valuing the return they get from technology investments.

On the other hand, when accounting for total cost of ownership (TCO) factors, ROI perceptions may be more understandable. When small businesses were asked about the reasons behind perceptions of low ROI, responses were fairly evenly distributed among the options. This is a likely indicator there is a degree of nuance in “reading the tea leaves” for what drives or inhibits positive perceptions of ROI.

As the role of technology expands, so do the decision-factors related to how it is managed. While most small business owners would love to have a deep bench of highly skilled IT professionals, the reality is few are in a position to do so. While a strong majority – nearly 8 in 10 – have at least one full-time IT employee on staff, many SMBs operate in “just trying to get by” mode, whereby tactical and strategic roles are fluid.

As expected, IT staff size is highly correlated with firm size. Averages range from about one IT staff person employed by micro SMBs, to eight for small SMBs, and 15 for medium SMBs.

To address bandwidth constraints or skills gaps, small businesses routinely turn to outside expertise. Seventy-five percent of respondents report using a technology partner, such as a solution provider, VAR, or MSP, at least occasionally during a typical year. Among this segment, 20% are frequent users of technology partners, while 23% are regular users.

It should be noted, among the segment of SMBs most satisfied with their IT, there is a much higher utilization rate of technology partners. This should not necessarily be interpreted as causation, but it is reasonable to assume that businesses that recognize when they need help, and are willing to pay for it, tend to be in a better place with their IT than those that underinvest.

Analysis of the tech workforce begins with an important distinction. As depicted in the Venn diagram below, there are two components to the tech workforce.

All workers employed by U.S. technology companies represent tech industry employment. In 2017, an estimated 6.1 million workers were employed in this category, an increase of 2.0% over 2016. For 2018, the growth outlook should roughly mirror the previous year.

Tech industry employment includes technical positions, such as software developers or network administrators, as well as non-technical positions, such as sales, marketing, and HR. Note: CompTIA’s IT Industry Outlook includes workers employed by companies with payroll, also known as employer firms, plus self-employed technology workers.

The other component of the tech workforce consists of the technology professionals working outside of the tech industry. While the tech industry is the largest employer of technology professionals, with 44 percent of its workforce meeting this criteria, the majority of technology professionals work in other industry sectors, such as healthcare, finance, media, or government.

In 2017, nearly 5.4 million individuals worked as technology professionals across the U.S. economy. This represents an increase of 2.1%, or nearly 110,000 net new jobs. Growth in the tech occupation category is also expected to hold steady in the year ahead.

Because technology now permeates every industry sector and an increasing number of job roles, the lines have blurred noticeably, making it more difficult to precisely quantify the tech workforce. The expanded spheres circling the Venn diagram is one way of thinking about the new segments workers that cannot be adequately accounted for due to limitations in government data sources. See CompTIA’s Cyberstates report and the Appendix for more details.

Software has been a driving force in the tech sector and the broader economy; a trend that has accelerated in the past few years. From mobile apps and SaaS to open-source languages and platforms, software continues to “eat the world,” as noted by Marc Andreesen. As such, demand for software development skills make it the largest category of tech occupation and one of the fastest growing. Arguably, categories such as web developers and data scientists could be included under the software development umbrella, making it even larger. Beyond software, categories such as IT support, CIOs, and cybersecurity analysts are growing at a brisk rate, reflecting the needs of organizations pursuing digital transformation.

| Tech Occupation Categories | 2017 Jobs | YoY % Change |

| Software Developers, Applications | 898,689 | 3.4% |

| IT Support Specialists | 733,210 | 2.2% |

| Systems Analysts / Systems Engineers | 649,390 | 2.0% |

| Software Developers, Systems | 454,735 | 2.4% |

| Computer and Information Systems Managers | 405,314 | 2.7% |

| Network and Computer Systems Administrators | 403,294 | 1.3% |

| Computer Programmers | 341,388 | 0.1% |

| Other (IT project mgr., software QA, gaming etc.) | 322,810 | 2.3% |

| Web Developers | 264,238 | 2.8% |

| Network Support Specialists | 224,159 | 1.5% |

| Network Architects | 170,700 | 1.3% |

| Computer, ATM, and Office Machine Repairers | 159,733 | -1.1% |

| Database Administrators | 122,162 | 1.7% |

| Cybersecurity Analysts | 101,051 | 2.5% |

| Computer Hardware Engineers | 75,439 | 1.1% |

| Information / Data Research Scientists | 28,716 | 2.0% |

| TOTAL | 5,355,029 | 2.1% |

According to CompTIA research, nearly 4 in 10 U.S. IT firms report having job openings and are actively recruiting candidates for technical positions. Hiring intent is most concentrated among large- and medium-size firms.

Among hiring employers, more than half indicate it’s due to expansion, while a similar percentage indicate the need for new skills in areas such as software development, IoT, or data is driving the hiring at their firm. Thirty-four percent do acknowledge the hires are replacements for workers that voluntarily or involuntarily left the company, which becomes more prevalent during a strengthening economy.

Fifteen percent believe hiring will be significantly more challenging in 2018, while 33% expect it will be moderately more challenging. The remaining group expect the hiring landscape to be similar or slightly better than 2017.

Top 5 Factors Contributing to a More Challenging Hiring Landscape in 2018

Over the past three years, median wages for U.S. IT occupations have increased an average of approximately 2% annually. Factors such as location, employer type, and skill area can greatly impact wages, so this data should be viewed as top level guidance only. Database administrators, CIOs, cybersecurity analysts, computer hardware engineers experienced the largest percent change gains of median wages. In a reversal of prior years, the data suggests more gains accrued to workers at the 10th and 25th percentile. For example, entry-level cybersecurity analyst at the 10th percentile had the highest year-over-year increase at 4.8%.

Job posting data from Burning Glass Labor Insights provides another window into hiring intent. While job posting data has its limitations, it’s useful in providing a real-time gauge of employer demand for IT occupations, along with the underlying detail of skills, credentials, and experience requirements.

While job postings are down from their high point of 2015, the data indicates the number of employers actively recruiting for tech talent remains in a healthy range. During 2017, nearly 2.3 million job postings were made by U.S. employers. Note: there is not a one-to-one relationship between job postings and actual hires. For difficult-to-fill skills, an employer may have to issue multiple job postings in multiple markets in the course of finding the right candidate.

In the early stages of an emerging technology, labor needs are typically handled in a hybrid manner, whereby existing staff take on new “sand box” responsibilities. As the technology matures, a software engineer, for example, may then specialize in an emerging field.

Emerging Job Roles to Watch

Machine learning trainer / scientist

AI developer

Industrial IoT engineer

Geospatial and mapping specialist

Blockchain developer / engineer

Digital designer

Cybersecurity architect

Penetration tester

User experience (UX) designer

Solutions architect

Full stack developer

Technology project manager

Robotics engineer

Drone operator / technician

Note: this is not meant to be a comprehensive list, nor is it based on the actual number of job openings. The list provides examples in various categories for illustrative purposes.

CompTIA’s IT Industry Outlook 2018 provides an overview of the trends shaping the information technology (IT) industry and workforce. Portions of the insights found in the report stem from an online quantitative survey of IT industry executives. The survey was fielded during December 2018 and generated a total of 674 responses, distributed as follows: United States n=446, Canada n=121, and the United Kingdom n=107.

The margin of sampling error proxy at 95% confidence is +/- 3.9 percentage points. Sampling error is larger for subgroups of the data. As with any survey, sampling error is only one source of possible error. While non-sampling error cannot be accurately calculated, precautionary steps were taken in all phases of the survey design, collection and processing of the data to minimize its influence.

Forecast methodology note: CompTIA’s industry growth projections are depicted as current dollar forecasts. They do not factor in the effects of inflation or currency movements, which can impact the relative value of goods sold from year to year. As a forecast of revenue, other distortions may occur as well. For example, scenarios where unit sales of a product may increase significantly, but the average selling price falls, could result in flat revenue growth even though market share is expanding.

CompTIA is responsible for all content and analysis. Any questions regarding the study should be directed to CompTIA Research and Market Intelligence staff at research@comptia.org.

CompTIA is a member of the Market Research Association (MRA / Insights Association) and adheres to the MRA’s Code of Market Research Ethics and Standards.

Read more about The Business of Technology.

Tags : The Business of Technology