The future is now. With increasing frequency, this assertion seems to find its way into commentary addressing the state of technology. Recent advances have made the leap from what is typically characterized as interesting or cool to what can only be described as mind-blowing. Pick your science fiction reference – whether The Jetsons, 2001: A Space Odyssey, or Minority Report, to name a few, and it’s not hard to see what was once considered futuristic technology all around us. CompTIA’s scan of the technology landscape points to another year of innovation, growth, and of course, a few surprises.

A notable milestone was recently attained. For the first time ever, the five most valuable companies in the world were all technology companies. While stock market valuations should be taken with a grain of salt, it did mean technology supplanted the behemoths of the energy, finance, healthcare, and manufacturing sectors.

By just about every measure, technology continues to shape the world around us in evermore interesting and sometimes unsettling ways. With the groundwork of cloud, mobility, data and connectivity laid, the year ahead will see evolutionary advances on many fronts. Digital business transformation remains a driving force for small and large enterprises alike. Those playing catch-up will face growing and potentially new forms of competitive pressures, while those on the right path will have the opportunity to explore advances in areas such as virtual reality, artificial intelligence, advanced analytics, the internet of things, and inevitably, a few unexpected breakthroughs.

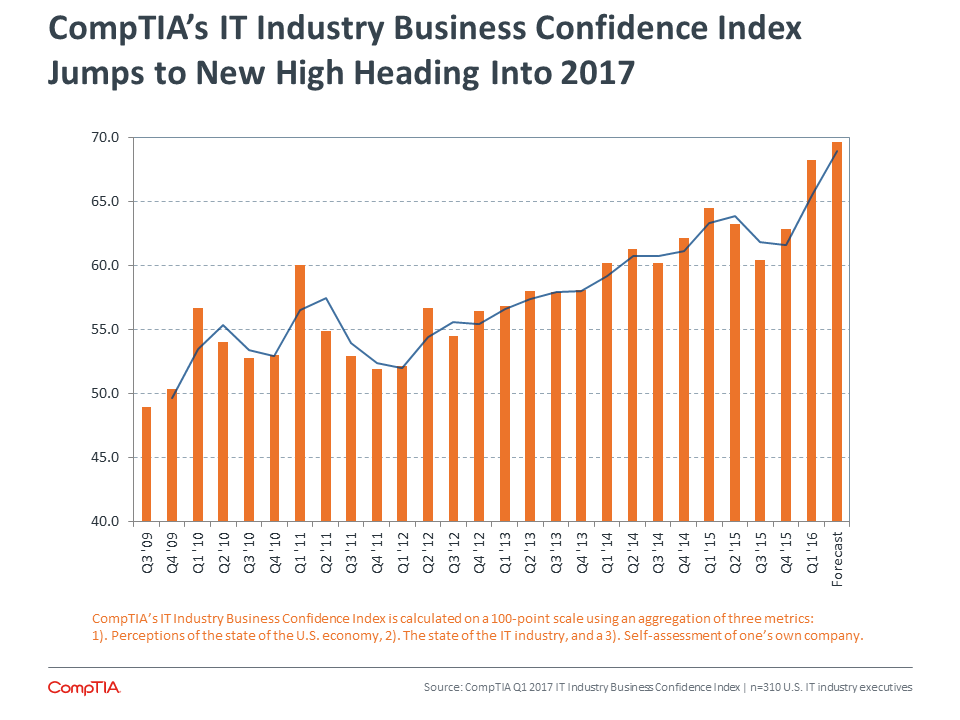

Complementing the innovation pipeline is a sense of optimism heading into 2017. CompTIA’s Q1 IT Industry Business Confidence reached a new high, signaling an economy on solid footing and a positive outlook among IT industry executives.

CompTIA projects global IT industry growth of 4.1 percent in 2017. If this growth materializes, it will push the $3.4 trillion global IT industry past the $3.5 trillion mark by year’s end.

CompTIA has described the evolution of IT in three stages: the mainframe era, the PC/Internet era, and the cloud/mobile era. There are many factors that define distinct eras, but the end result is a new foundational platform that supports new tools and techniques. Moving forward, new elements built from a cloud mindset will play larger roles. Software-defined components will lead to hyperconverged infrastructure. Blockchain will redefine database architecture. Artificial intelligence will provide a new layer for technology interaction. These changes, as with cloud, are primarily focused on the backend and will see initial adoption at the enterprise level before moving downstream into the SMB space. For all companies, though, the technology stack is growing, and there will be additional work in figuring out how to integrate the necessary pieces of a digital strategy.

The DDoS attack on DNS provider Dyn placed security back in the spotlight thanks to the nature of the target and the use of connected security cameras as botnet attackers. However, another theme emerged from the aftermath of that attack: massive security incidents are not yet driving companies to revolutionize their security approach. The headline-making breaches of the past three years have not put companies out of business, and research studies show that most firms are not fully prepared for a cyberattack. Unfortunately, the event that creates a tipping point will need to have greater consequences before there is a broad shift in transforming security technology, processes, and education. Perhaps that event will come in the fallout from Russia's alleged intrusion into the U.S. political process. Until the tipping point comes, though, mega-breaches will still make headlines as businesses play catchup on recent technology moves and try to stay ahead of the adoption curve.

In A Functional IT Framework, CompTIA found four primary domains that form the overall IT function: Infrastructure, Development, Security, and Data. Of these, data is currently the least likely to be handled by a standalone team. But that may change soon. As the demands on data grow (in both quantity and complexity), database administrators will move out of the Development function, where many currently sit, and will join with other data specialists to harness the power of organizational data. These data teams will focus on aggregation, analysis, and visualization, and they will be the most likely to interact directly with business units, perhaps operating in a matrix style in order to most effectively connect the dots.

Beyond the buzz and the backlash, the Internet of Things is primed to be a massive disruptor. As physical objects gain intelligence and connectivity, new opportunities will rise across all industries. The transition will take time, though. The pace of technology has accelerated, but the complexity of IoT and the regulations and protocols required for integration will drive a long adoption cycle. The breadth of potential applications has allowed many companies to get their feet wet in this space, and the lessons learned from cloud initiatives will help businesses consider security implications and hidden costs as they continue discovering the benefits of connected systems. Beyond individual business applications, one of the prime drivers for IoT will change everyday life. Smart City initiatives will bring about societal change as they also pave the way for large-scale technology efforts.

While the predominant tech trends feature cutting-edge concepts, these concepts require a strong technical foundation. There is growing evidence that many companies have work to do in order to establish this foundation: network upgrades are often a part of cloud migrations, the demand for PC support is rising even as companies pursue mobility solutions, and data management practices are being refined prior to applying advanced analytics. The situation involves both equipment and skill. Cloud and mobility have changed the picture for on-prem equipment, but in most cases have not completely eliminated options. Similarly, the demands for routine skills may be dropping, but the demands for support still exist as employees are asked to do more with technology. The models for providing the basics are changing, but one way or another many firms need to address lower-level issues before building higher-level functionality.

No longer dominated by resellers of products, much of today’s channel is shifting to a services focus and specializing across vertical industries and/or solutions niches. In the year ahead, more channel firms will be developing their own intellectual property too, whether that is a piece of custom code or a business process they replicate across customers. And the players will keep changing: digital agencies, marketing firms, accountants and other non-traditional partners are selling or recommending IT solutions, a development that has upended the traditional competitive landscape. The SaaS ecosystem alone is reinventing what it means to be “in the channel,” with a new take on vendor relationships, selling strategies and compensation demands. And consider Amazon’s recent decision to enter the managed services market serving enterprise AWS customers. From a competitive standpoint, this move could be the catalyst that prompts today’s MSPs to retool their businesses beyond the basics to more advanced services offerings. That would be a wise move, because Amazon some day in the future may well expand into the SMB market with an attractively priced set of those basic services. Competing on price with this giant would be a fool’s errand.

Channel firms are becoming more finicky when it comes to partner program tastes. What they once valued as essential from a vendor benefit standpoint is less relevant in today’s services-based market. Especially among partners heavily invested in consulting work and services, traditional incentives such as sales spiffs, upfront discounts and backend rebates are not what endears them to any one vendor over another. Indeed, while vendor-provided margin once accounted for a majority of their revenue, channel companies today credit their own sales and marketing activities for driving the bulk of sales. What does this mean for vendors? Time to revamp partner programs.

With nonstop news stories about the rise of the Millennials, you would think that the channel, like other industries, would be teeming with young blood and next-generation entrepreneurs. It is not – at least not yet. One look around a channel conference is all the proof you need of that. But with an estimated 40% of the channel universe expected to retire over the next 10 years, the industry needs to look at ways to shepherd younger people in to fill the void. Consolidation and a smaller channel may be inevitabilities in the “as-a-service” world, but that need not discourage new entrants. In fact, many of today’s ”born in the cloud” channel firms have been launched by members of younger generations. It’s incumbent upon the aging veterans to help ensure that continues.

Despite all the talk of consolidation, the number of vendor-based cloud companies is proliferating today. Telecom providers, thousands of SaaS ISVs, and public cloud behemoths such as Amazon Web Services, among others, count among the ranks. For the channel, this voluminous market is expanding opportunity for vendor management. While seemingly obvious, a vendor manager acts as liaison between end customers and cloud-based vendors/service providers. The indirect channel is accustomed to this role, but today the task holds new meaning as customers navigate potential travails of the cloud world. Case in point: many SMB clients provision cloud solutions on their own. But when things go wrong with a specific SaaS application or uptime performance is spotty, for example, these self-procured cloud solutions can be a headache. And many SMBs have no idea whom to call, nor, frankly, the time or patience for finding out. That’s where the channel, and in particular MSPs, are finding ways to provide value, solving a crisis for clients and managing vendor relationships. It’s one way channel firms can cement relevancy in the era of cloud.

Despite the challenges of emerging business models and technologies, new competitors, and an aging base, the channel as we know it should not despair about the future. And as it turns out, most are not. Almost two thirds of channel firms across all business model types report feeling generally optimistic about the channel’s prospects for next few years. Some are confident that their close relationship to the SMB customers they serve will gird them against any direct sales threats coming from vendors and cloud providers. Others are confident that the complexity and number of technology choices in today’s market will also protect their status as indispensable consultants and advisors. And some are citing a bounce in customer demand for managed services as another factor providing comfort to many traditional channel players. The channel is changing, but there remains a place – especially in the SMB space – for solution providers to continue to sell on premises equipment/software and operate conventionally.

Workforce dynamics continue to evolve. Many factors play a role: basic demographic shifts, the growth of telecommuting and remote work arrangements, and more team-oriented organizational hierarchies. At every stage, technology has been both a driver and facilitator of these workplace changes. Of late, an ever-increasing array of new collaboration and communication tools has further changed the equation. Mirroring the BYOD trend, organizations have not always embraced these new tools at the same rate as their employees’ desire to use them. Workers eager to move beyond legacy corporate email systems, intranets, or project management applications can often be up and running on cloud- or mobile-based alternatives with little more than a simple registration. As with any “shadow IT” scenario, however, organizations must balance the potential benefits of greater worker productivity and job satisfaction with security and corporate IP risks.

The blended workforce – the mechanism of using temporary or contract workers alongside permanent full-time employees – has been a mainstay in the world of work for years. Historically, these arrangements have been driven by the desire for flexibility, or the need to meet short-term project demands or tap specific expertise. But today, new elements are poised to reshape the concept of the blended workforce. “Match-making” platforms such as Upwork are already well established, but the rise of niche sites such as Upcounsel, suggest employers and freelancers will have an ever-expanding set of options and tools for connecting. Beyond the blending of different types of workers, blending may increasingly involve the use of artificial intelligence, bots, virtual assistants, and other types of knowledge-based systems. Experimentation is well underway in incorporating these tools into workflows.

The debate over the impact of technology on employment has ebbed and flowed for more than 200 years. In the 1930s, one of the giants of economics, John Maynard Keynes, introduced the term “technological unemployment” to convey the concept of jobs displaced by electrification, farm mechanization, mass transportation, refrigeration and more. Looking back, most find it amusing to think about the concerns of horse manure collectors displaced by the automobile. While technology routinely destroys jobs – often those with dirty, dangerous, or dull characteristics –the historical record is one of job creation offsetting the losses. Is the situation the same today? The consultancy McKinsey & Company calculates 60 percent of all current occupations have duties that could potentially be automated to some degree. This, of course, is not necessarily a bad thing. Consider the countless hours wasted by a typical worker trying to find needed information, fill out the right form, or complete a repetitive task. While early-stage examples of automation – from vehicles and grocery stores to journalism and medicine, provide a glimpse of a future where technology mostly complements and multiplies human effort, there are still many unknowns. The year ahead will see new questions and new entrants into the debate, but it will be some time before these issues come into focus.

Characterized as the variance between what employers expect and need from their workers and what the labor force is able to deliver, skills gap is a seemingly straightforward concept. Below the surface, however, there are many nuances to the story. Given the breadth and pace of innovation, all signs point to a widening skills gap in many areas and for more types of workers. CompTIA workforce research consistently reports concerns among employers in finding candidates with the right combination of technical and soft skills. This is not a one-sided problem, though. The data shows many employers lag in hiring or professional development best practices. Only 1 in 4 IT professionals believe their employer utilizes their talent and skill to the fullest extent. In the year ahead, expect a renewed effort to explore ideas such as always-on learning, immersive learning, apprenticeships and other means to expand the pipeline of non-degree credentials, talent management systems and more.

Digital transformation is driving the dynamics of the IT industry. Companies are starting to grasp the disruptive nature of this new era in enterprise technology, and they are using the tools of the cloud era to redefine their organization and expand their IT capabilities.

In the past, technology served more of a supporting function, especially at the SMB level. IT equipment and operations served the needs of business units, which in turn drove business results. As such, IT took on qualities of a cost center, where the notion of support was a fixed quantity and providing that support at lower costs was a common goal.

Over time, businesses have moved to a much more strategic view. The correct application of technology can enhance productivity, provide insights, or create new revenue opportunities. IT now has to take an approach that considers broad business demands, especially as various business units are able to drive their own technology initiatives.

Businesses today are starting to recognize the critical role that technology plays in advancing corporate objectives. Nearly every goal — from identifying new customers to hiring a skilled workforce to exploring new products — now requires technology to move forward at a modern pace. Companies may have originally viewed transformation as an avenue for growth, but it is becoming a requirement for survival.

Furthermore, this recognition is happening across all industries, including industries that have traditionally not been aggressive adopters of technology. The creation of new products relies more on digital techniques (especially as those products are intelligent and connected), and customer experiences in digital spaces are now crucial for maintaining relationships. Regardless of the work a company is doing, no one can afford to ignore the trajectory of technology.

However, there is a big difference between knowing that strategic IT is needed and being able to implement it. Very few companies are “extremely confident” in their ability to apply modern technology to their business goals, with the smallest firms trailing medium-size and larger corporations in their internal assessments.

Becoming a digital organization certainly involves a wide range of skills. Foundational layers like networking, security, and application development lead to more advanced tactics such as cloud architecture, risk analysis, and mobile optimization. And that’s just the IT department—business units are quickly increasing their digital literacy as they own larger pieces of the puzzle.

Beyond tech skills, though, becoming a digital organization requires new processes. One of the main examples is related to business units becoming more independent: most companies are figuring out that pure rogue IT is unsustainable, and that is driving a need for new partnership models between the lines of business and the IT function. Roles and responsibilities need to be sorted out, and each side must learn the language of the other side.

With the right partnership model in place, other processes can be built. How can business units choose digital tools to suit their needs? How does the workforce get education on technology so that they can maximize productivity? How is everything done in a secure manner? Many questions exist for businesses entering the new economy, and those that successfully navigate the transformation process will reap the rewards.

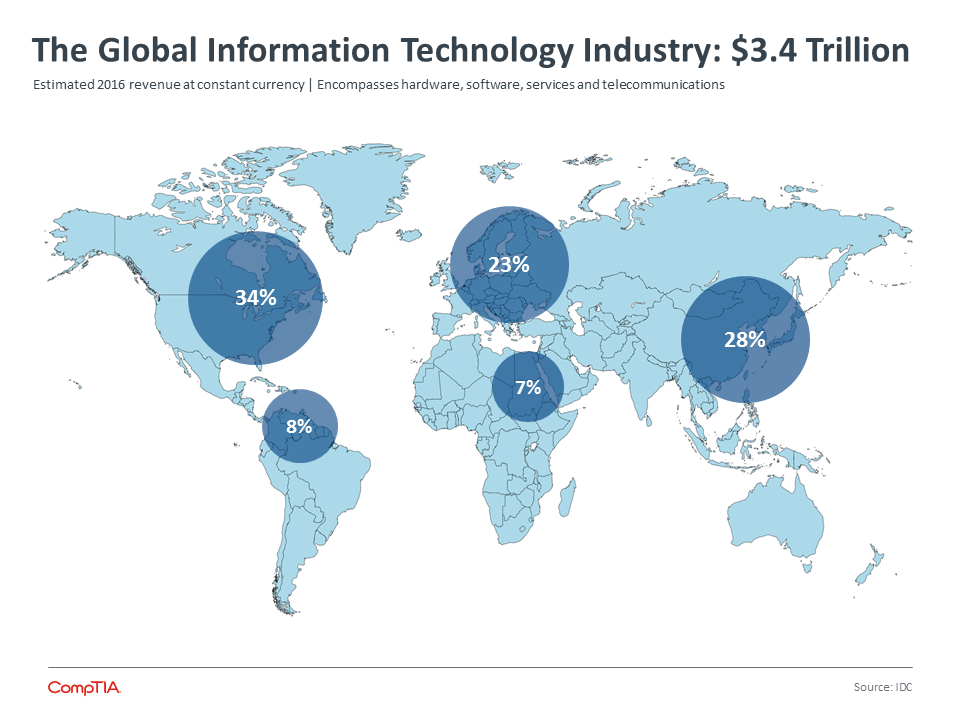

The global IT industry surpassed $3.4 trillion in 2016, according to the research consultancy IDC. If growth expectations materialize, the industry will push past the $3.5 trillion mark in the year ahead (Source: IDC).

The vast majority of IT spending stems from purchases made by business or enterprises, with a small portion coming from household spending. With the increasing blurring of work and personal life, especially in the small business space, along with the BYOD phenomenon, it is difficult to classify certain types of technology purchases as being solely business or solely consumer.

The U.S. market represents 28 percent of the worldwide total, or slightly over $1 trillion. The next largest market is the Asia-Pacific region, which encompasses Japan, China, Australia, India, and surrounding countries. The share of the Asia-Pacific region has increasingly accounted for a larger share of the global IT pie. This has mostly come at the expense of a Western Europe market growing at a slower rate and thereby reducing its proportional share over time.

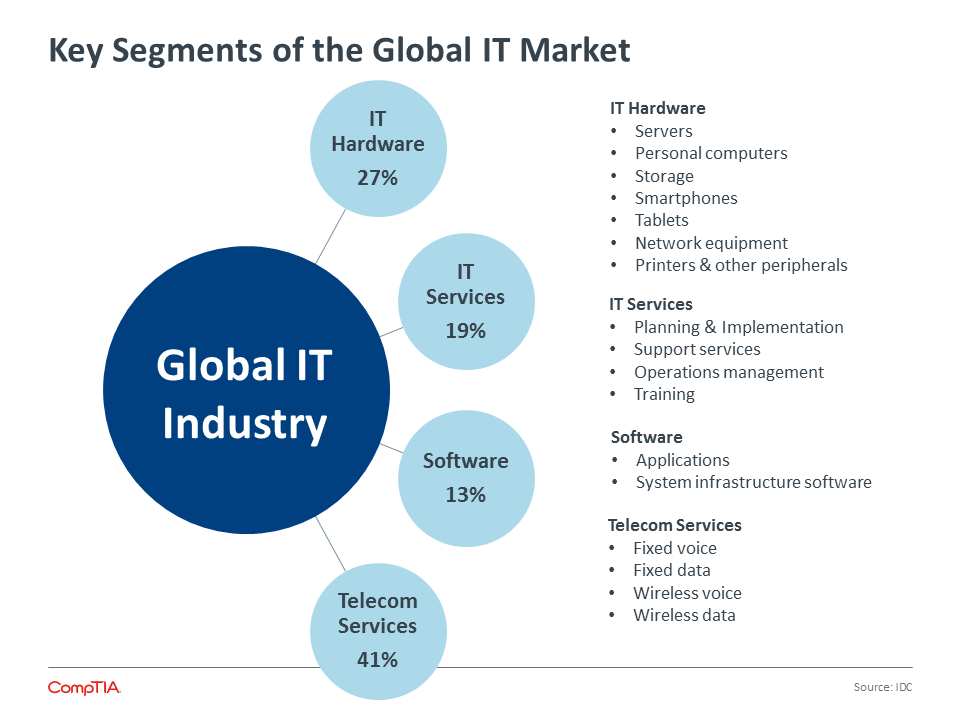

Breaking the IT market down into its core IT components, the hardware, software and services categories account for 59 percent of the global total. The fourth element, telecom services, accounts for the remaining 41 percent.

The allocation of spending tends to vary from country to country. Some markets may be relatively immature in the traditional categories of computers and software, and yet relatively advanced in the areas of mobility and wireless communication.

The U.S. market features a large installed base of hardware, software and services. Not that telecom services are unimportant in the United States, but rather the spending on the aforementioned categories is much higher relative to the global benchmark. In the U.S. market, IT services and software capture larger shares compared to the global market: 25 percent vs. 19 percent and 21 percent vs. 13 percent, respectively.

When analyzing the IT market, it is worth noting that other sectors are steadily incorporating more information technology elements into their products and services, blurring the lines between the IT sector and other industries. In some sectors, the use of technology has become so prevalent that terms such as FinTech, EdTech, AdTech and FarmTech have emerged.

Similar to most sectors, the U.S. IT industry follows a classic pyramid shape, with a large base of small firms. In total, there are nearly 384,000 IT business establishments with payroll; plus a large number of self-employed firms.

| Large Firms | 1,107 | 0.3% of total |

| Medium Firms | 7,363 | 1.9% of total |

| Small Firms | 57,671 | 15.0% of total |

| Micro Firms | 317,527 | 82.8% of total |

After several quarters of sluggishness, CompTIA’s IT Industry Business Confidence Index sprang to life with a jump of 6.5 points heading into 2017. All three components of the Index experienced gains, propelling the BCI to a record high. Executives from large vendors to small solution providers shared similar levels of positive sentiment, reflecting an industry on solid footing.

Corroborating this optimism, the Conference Board’s Consumer Confidence Index reached its highest level in 15 years. Relatedly, the Institute for Supply Management reported its Manufacturing Index ended the year on a strong note, revisiting a level not seen in more than two years.

On the macroeconomic front, the U.S. Bureau of Economic Analysis reported a notable uptick in U.S. GDP growth: a 3.5 percent annualized growth rate during the third quarter. This closely parallels the growth projection from the IMF. The organization forecasts global economic growth of 3.4 percent in 2017.

A note of caution, the Q1 reading of many indices, including the CompTIA IT Industry Business Confidence Index, have historically been positive, which then sometimes diminishes as the year progresses. This may stem from the optimism many companies experience with the start of a new year – the clean-slate mentality.

Moreover, in an interconnected global economy, what may appear to be a minor blip in one country can quickly cause problems for trading partners elsewhere. With the ever-present challenges of commoditization, currency fluctuations, demanding customers, and new competitive pressures, IT industry growth is never a given.

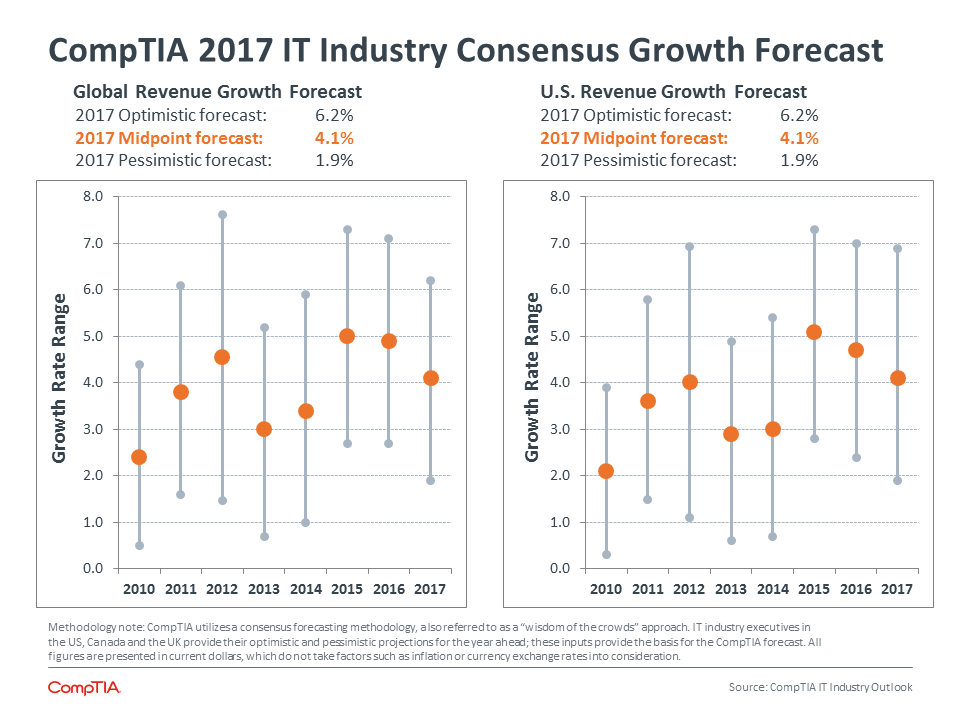

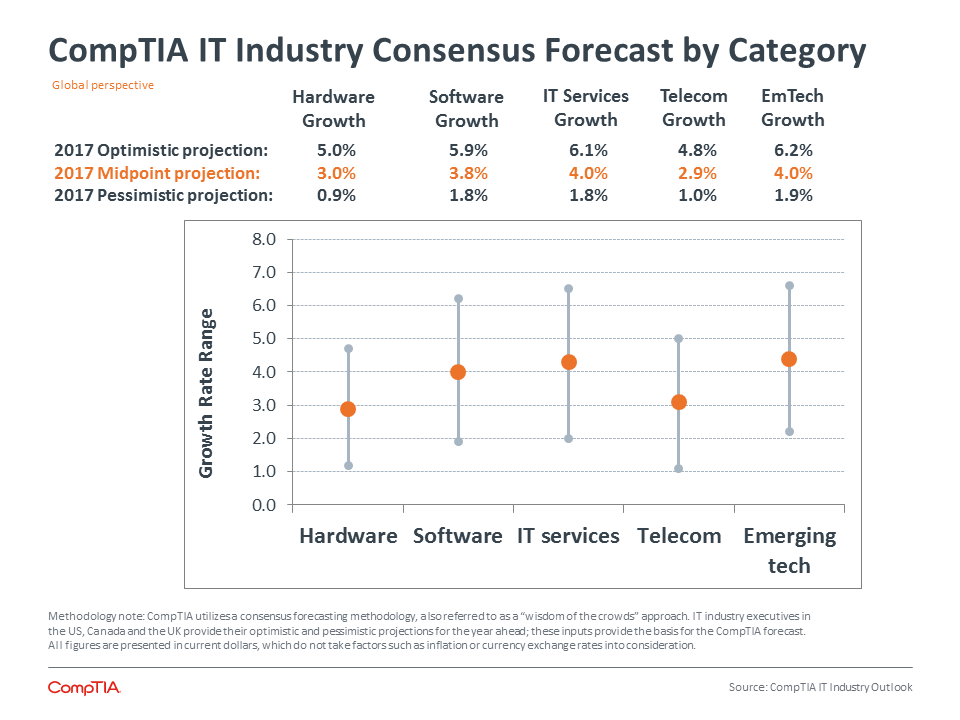

Following the pattern seen over much of the last decade, IT industry growth is projected to outperform overall economic growth in the year ahead. CompTIA projects a global IT industry growth rate of 4.1 percent, with upside potential of 6.2 percent and a downside floor of 1.9 percent. Despite the optimism voiced in the CompTIA BCI, these figures are slightly lower than the projections from a year ago.

Growth expectations for the U.S. market are in line with the global projection. As the largest market in the world for IT products and services, U.S. forecasts and global forecasts will always be inextricably linked. IT industry executives in Canada and UK expect growth to come in at 3.9 and 4.2 percent, respectively.

CompTIA uses a consensus forecasting approach. This “wisdom of the crowds” model attempts to balance the opinions of large IT firms with small IT firms, as well as optimistic opinions with pessimistic opinions. The results attempt a best-fit forecast that reflects industry sentiment.

| Gartner | 2.9% worldwide forecast |

| IDC | 2.6% worldwide forecast |

| Forrester | 5.1% U.S. forecast |

Note: research consultancies tend to update their forecasts periodically to reflect new information, so these figures should not be viewed as static. Additionally, differences in forecasting methodologies, such as using current or constant dollars, should be taken into account.

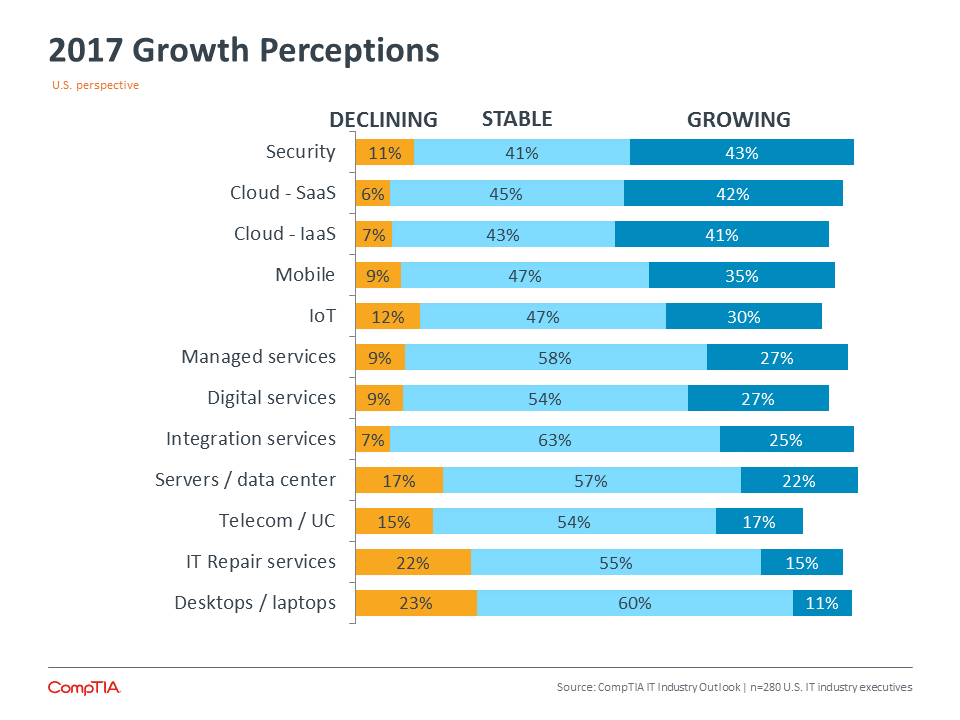

Top-level industry forecasts set the stage for an examination of the underlying factors contributing to growth. At a category level, IT industry executives are most bullish on IT services. A trend that began many years ago, the everything-as-a-service phenomena has maintained its momentum. While certain facets of technology are becoming easier to manage, the overall complexity of managing technology ecosystems often exceeds the capabilities of many customer segments, especially small businesses. With traditional managed services providers embracing new opportunities in areas such as managed security, data, and IoT, hitting the upside of the forecast is not unrealistic.

Straddling the hardware, software, IT services, and telecom categories is cloud computing. Expectations are high for another year of robust growth for cloud applications and cloud infrastructure. This sentiment is corroborated by other CompTIA research of end users and channel partners. Customer demand for IaaS and SaaS cloud components will accelerate as they pursue digital business strategies.

Another category well positioned for upside potential is the umbrella category of security. This category is no longer narrowly defined in the traditional sense of firewalls or antivirus, but rather, a broad suite of tools and safeguards designed to combat the ever-expanding universe of security threats. Similar to cloud, expectations are already high for security so it is notable that 43 percent of IT industry executives believe there is the potential for the security category to outperform in the year ahead.

Relatedly, the broad category of software can be difficult to assess. Because software is now woven into the fabric of every device, system, or service, it can be challenging to identify where the software category ends and other categories begin. There will undoubtedly be software gazelles that generate growth rates well into double digits. However, there are also offsetting factors. Customers increasingly have a range of options to meet their software needs, including open-source solutions, lower-cost alternatives to traditional enterprise applications, freemium solutions, and building block-like API components that allow users to stitch together their own custom solutions.

For hardware, industry executives expect another year of status quo growth. Because PCs and mobile devices account for about half of the revenue generated in the hardware category, any softness in these segments will limit growth upside. As a reminder, this is a revenue forecast, so even if the number of units sold increases, if prices fall at a faster rate, revenue will be negatively affected.

According to IT industry executives, the factors most likely to contribute to reaching the upside of the forecasts include reaching new customer segments, a pick-up in business from existing customers, and successfully launching and selling new product lines.

Additionally, consultative sales and new approaches to customer engagement will be key. With a number of emerging product categories transitioning from the early adopter phase to a more mainstream adopter phase, tech companies must be acutely aware of the critical need to align technology solutions with business objectives. CompTIA’s research into the small and medium-size business market reveals a range of perceived shortcomings in the return on investment of technology expenditures. Somewhat paradoxically, 4 in 10 SMBs indicate they believe their level of spending on technology is too low. The takeaway: there is work to be done to bridge the disconnects between technology providers and users.

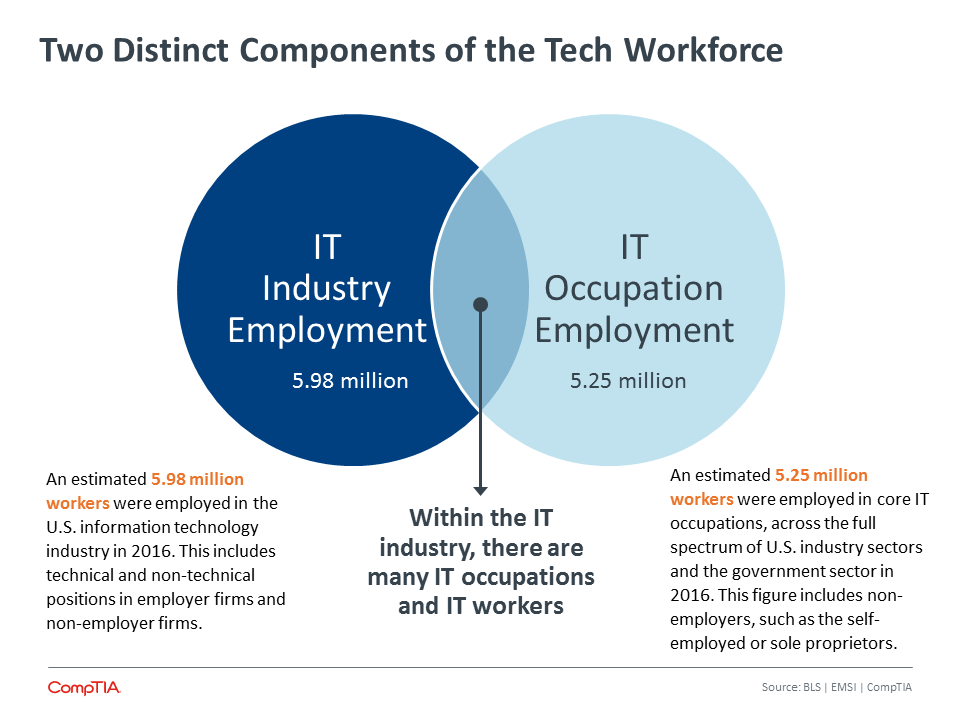

Analysis of the tech workforce begins with an important distinction. As depicted in the Venn diagram below, there are two components to the tech workforce.

All workers employed by technology companies represent tech industry employment. In 2016, an estimated 5.98 million workers were in this category. This includes technical positions, such as software developers or network administrators, as well as non-technical positions, such as sales, marketing, and HR. Note: CompTIA includes workers employed by companies with payroll, also known as employer firms, and self-employed or sole proprietor workers.

Within the tech industry employment category, IT and software services is the larger employer, accounting for 2.6 million jobs. Telecommunications is the second largest employer at 1.6 million, with tech manufacturing holding the third slot at 1.1 million jobs.

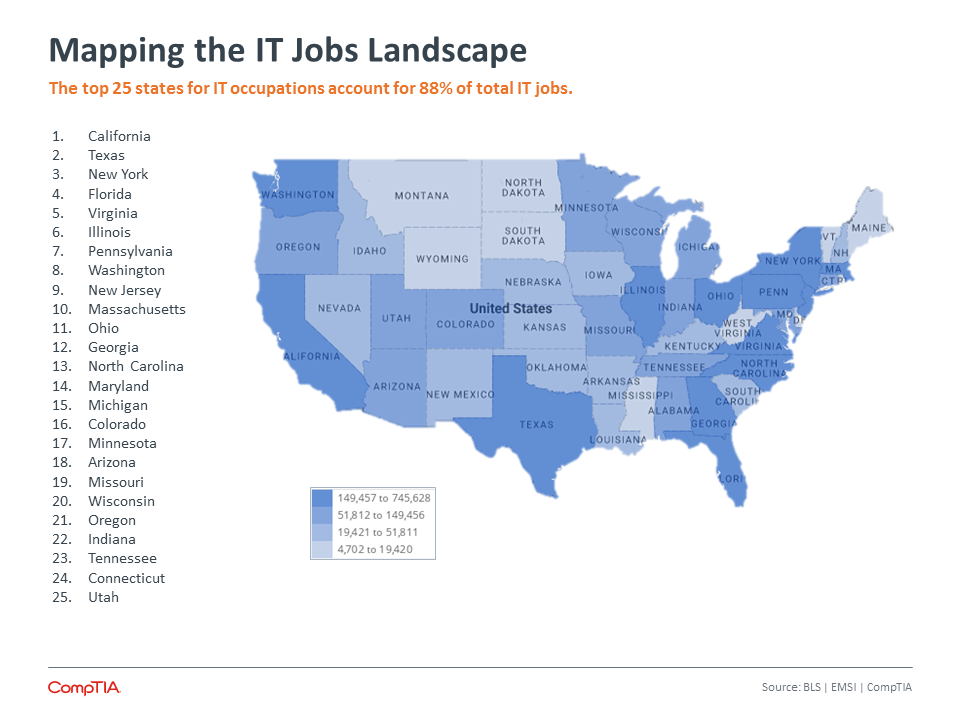

The other component of the tech workforce consists of the technology professionals working outside of the tech industry. While the tech industry is the largest sector employer of technology professionals, with 44 percent of its workforce meeting this criteria, the majority of technology professionals work in other industry sectors, such as healthcare, finance, media, or government. California leads the nation in the number of IT workers, followed by Texas, New York, Florida, and Virginia. The top 10 states account for 56 percent of IT workers employed in the United States.

At the time of publication, final 2016 data was not yet available from the U.S. Bureau of Labor Statics. Based on available data, it appears about 130,000 new tech-occupation jobs were created during the year, yielding a year-over-year growth rate of 2.5 percent. This was slightly lower than the 2015 growth rate of 3.1 percent. Looking ahead to 2017, preliminary estimates suggest a growth rate on par with 2016.

| Tech Occupation Categories | 2016 Jobs | YoY % Change |

| Software Developers, Applications | 850,246 | 3.5% |

| Computer User Support Specialists | 702,037 | 2.3% |

| Computer Systems Analysts | 666,901 | 3.4% |

| Software Developers, Systems Software | 437,816 | 2.8% |

| Network and Computer Systems Administrators | 402,830 | 1.5% |

| Computer and Information Systems Managers | 390,298 | 3.1% |

| Computer Programmers | 373,820 | 0.8% |

| Web Developers | 278,776 | 4.5% |

| Computer Occupations, All Other | 274,516 | 1.5% |

| Computer Network Support Specialists | 217,897 | 1.6% |

| Computer, ATM, and Office Machine Repairers | 176,821 | 0.9% |

| Computer Network Architects | 157,692 | 1.2% |

| Database Administrators | 121,338 | 2.0% |

| Information Security Analysts | 93,690 | 3.1% |

| Computer Hardware Engineers | 80,129 | 1.6% |

| Computer and Information Research Scientists | 27,976 | 2.6% |

| TOTAL | 5,252,783 | 2.5% |

Source: BLS | EMSI | CompTIA

Note: includes employer + non-employer workers

Forty-one percent of U.S. IT firms report having job openings and actively recruiting candidates. Among hiring employers, more than half indicate it’s due to expansion, while a similar percentage indicate the need for new skills in areas such as software development, IoT, or data is driving the hiring at their firm. Thirty-eight percent do acknowledge the hires are replacements for workers that voluntarily or involuntarily left the company. Not surprisingly, during a strengthening economy, workers feel better about leaving their existing employer to pursue new opportunities.

Seventeen percent believe hiring will be significantly more challenging in 2017, while 30 percent expect it will be moderately more challenging. The remaining group expect the hiring landscape to be similar or slightly better than 2016.

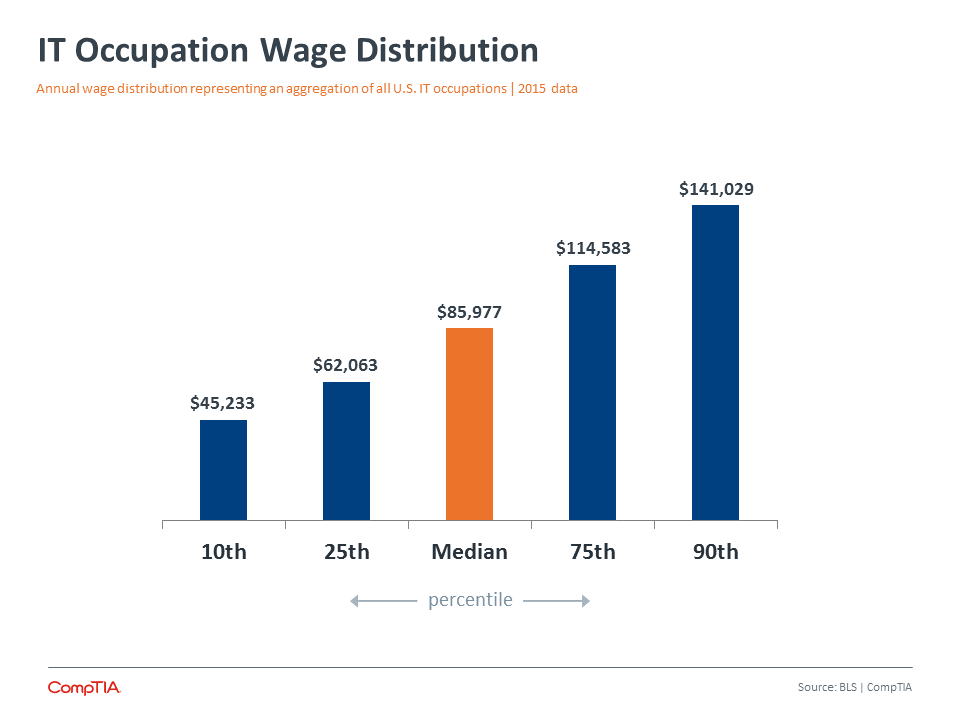

Over the past three years, median wages for U.S. IT occupations have increased an average of 2.1 – 2.3 percent annually. Factors such as location and employer size can greatly impact wages, so this data should be viewed as top level guidance only. The data suggests the most experienced and skilled IT workers – those in the 90th and 75th percentiles, realized the largest gains in compensation over the past three years.

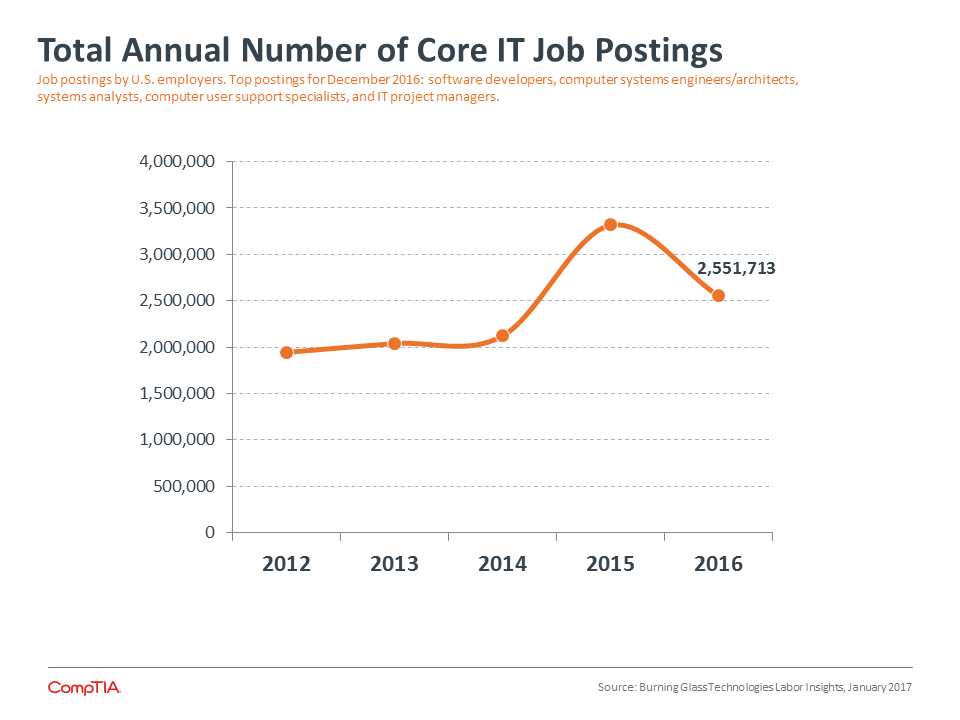

Job posting data is a useful, but imperfect proxy for job demand. Not every posting translates to a new job; hiring firms may change their plans, post multiple times for the same job, hire internally, try different approaches to find the right candidate and so forth. Also, one ad may be posted for multiple openings. Burning Glass Technologies Labor Insights addresses many of these issues, but not all. CompTIA recommends using job posting data in conjunction with BLS data to get a more complete picture of labor dynamics for a given occupation category.

While job postings are down from their high point of 2015, the data indicates the number of employers actively recruiting for tech talent remains in a healthy range.

Note: this is not meant to be a comprehensive list, nor is it based on the actual number of job openings. The list provides examples in various categories for illustrative purposes.

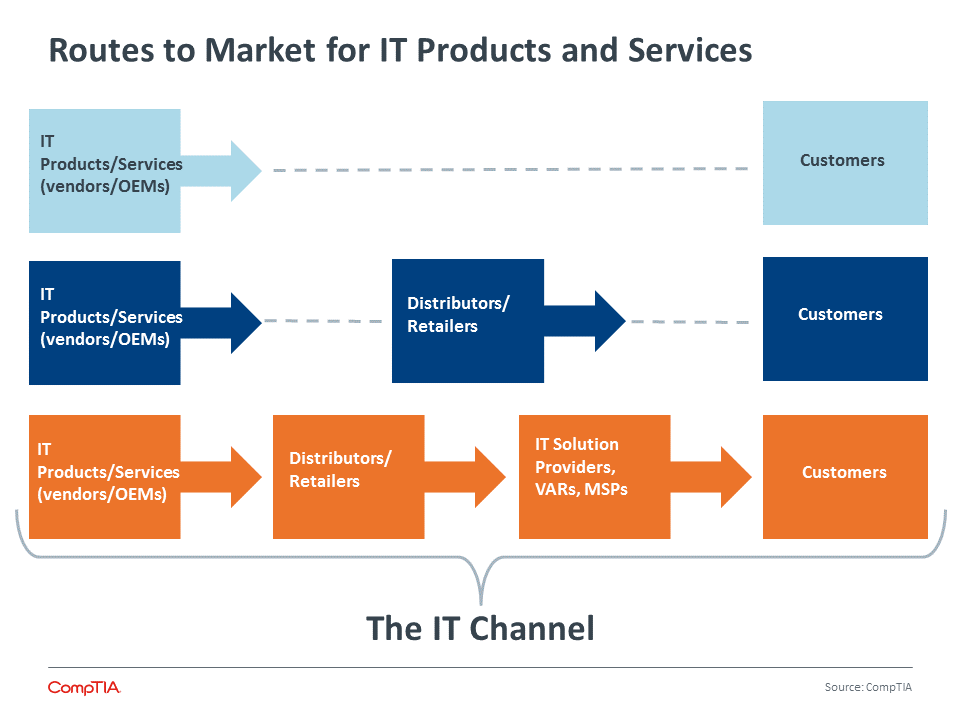

Every industry sector has a mechanism to get products and services to their customers’ hands. While some producers or manufacturers of goods sell direct to customers, most rely on intermediaries, or indirect channels, that can more efficiently or effectively deliver products and services to customers. Automotive manufactures rely on dealerships, pharmaceutical companies on drugstores, insurance firms on agents, and so on.

In the technology sector, this mechanism is referred to as the IT channel. The creators of a product – typically a technology vendor or OEM – may find it advantageous to work with intermediaries, such as a distributor or value added reseller (VAR), to get its products to market.

Among those outside the IT industry, it is not uncommon to wonder why vendors do not simply sell directly to customers. In some cases, vendors do sell directly to customers. A small software vendor may sell direct to customers via the software-as-a-service model. Or, a hardware vendor may sell a large order of servers for a datacenter directly to an enterprise level customer. In many cases, though, vendors see value in working through their channel partners. Estimates suggest upwards of two-thirds of core IT products, representing an estimated $200 billion-plus, flow through or are influenced by indirect sales channel.

The key reasons for the channel model include:

Implementation / Integration – many IT products require set-up, integration, testing and in some cases, custom development. Even for sophisticated customers, this can be a challenging endeavor. By relying on channel partners, such as solution providers, for implementation, vendors can focus on innovation and design. This is especially critical for small customers, such as a small law firm, that need IT expertise, but do not have the scale to be able to work with a large IT vendor.

Support / Management – customers expect a lot from their IT investments. They demand maximum uptime, ease of use and security safeguards. Even with advances in remote monitoring and support, a technical problem may require a visit to a customer’s office. The large number of solution providers and MSPs spread across the country are well equipped to meet customers’ need for local service.

Specialization – IT has entered the era of specialization. The needs of one customer segment are often quite different from another segment (think healthcare technology vs. manufacturing technology vs. retail technology). Because vendors cannot be experts in every sector, solution providers fill this gap. Channel partners are often well-positioned to develop deep expertise of a sector’s operations, regulations and challenges, resulting in technology solutions optimized to meet customers’ needs.

Size estimates of the U.S. IT channel vary. This could be a function of definition, methodology or limitations in the ways technology companies are classified.

Using the U.S. Commerce Department’s North American Industry Classification System (NAICS), there are three primary categories associated with the IT channel. The sum of these categories, as outlined in the chart below, equates to 133,114 establishments with employees. This can be viewed as one interpretation of the size of the U.S. channel by the count of establishments.

| 186 | Large Channel Firms [500+ employees] |

| 1,493 | Medium Channel Firms [100-499 employees] |

| 14,783 | Small Channel Firms [10-99 employees] |

| 120,959 | Micro Channel Firms [1-9 employees] |

| 137,421 | Est. Total for 2016 YoY growth estimate: 3.2% |

+ 203,380 self-employed, sole proprietors working in a capacity that could be related to the IT channel.

+ N number of firms with a NAICS classification that makes it difficult to assign directly to the IT channel. A percentage of these firms are likely involved in reselling or influencing IT products or services sales (e.g. custom software development, distributors, consulting firms)

The channel is at an inflection point. New business models and alternative routes to market for technology are proliferating. And a growing number of non-IT line-of-business buyers are flexing their spending muscle and forcing the channel to rethink sales and marketing messaging and shift how they do business – and in many cases, with whom.

And let’s not stop there. Last year ushered in the rise of non-traditional partner types such as digital marketing agencies and an army of SaaS-based resellers. These companies are establishing their own beachhead in the channel and quickly expanding the competitive landscape. Their numbers remain elusive at present, but consider alone that more than 100,000 SaaS partners attended Salesforce’s Dreamforce conference in 2016 and you get the picture.

What can you expect to see as the channel evolves? The balance of power between vendors, solution providers, distributors and end customers will shuffle and flow. New cloud vendors with no channel presence at launch will recognize the need for indirect partners as they mature. The types of partner programs, benefits and incentives those companies design will differ significantly from legacy vendor programs. And finally, we will continue to see IT and business consulting take a lead role in channel firms value proposition and revenue stream.

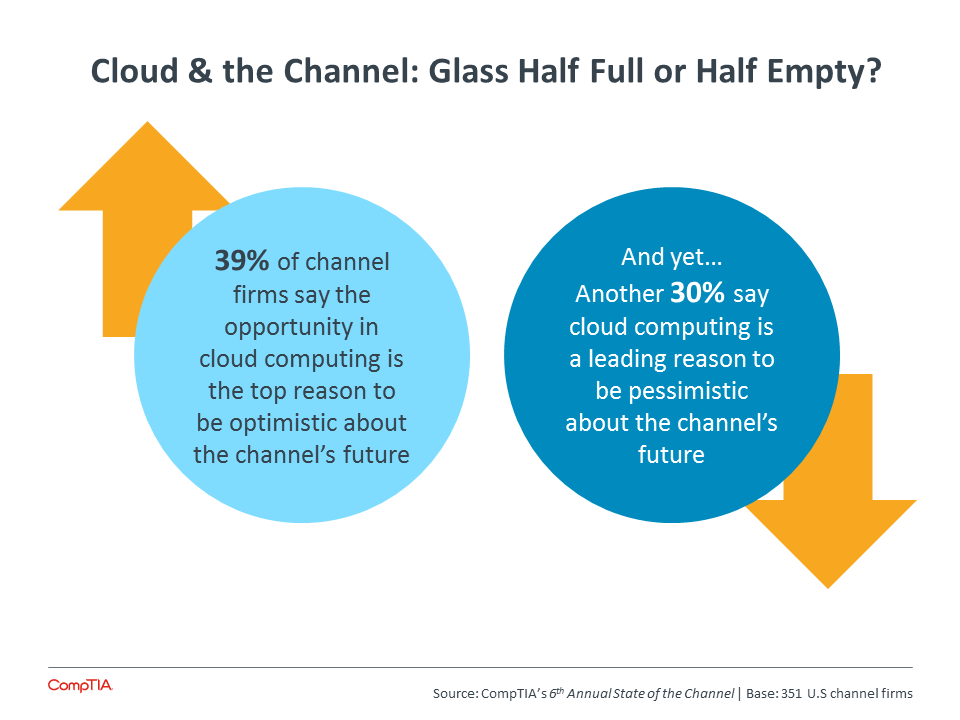

It’s a lot to mull over. But in the face of it all, the channel has remained mainly upbeat, though not naïve, about the future. Case in point: 63 percent of folks say they are generally optimistic about the channel’s prospects in the next two years. But other data from the very same CompTIA 6th Annual State of the Channel research expose a clear undercurrent of uncertainty and wariness percolating from within the ranks. Much of this sentiment stems from cloud computing and its impact, which is seen as both a grand opportunity by some and a reason for pause by others. In 2014, 63% of respondents believed cloud had had an extremely positive effect on the channel. That assessment dropped to 37% of channel firms in 2016.

At face value, such a decrease could be construed as the channel pulling a 180 on cloud. But it’s more nuanced than that. Growing pains are a more likely reason for the decline in optimism. As the channel has gained experience working with cloud over the past several years, they have begun seeing cloud’s problem areas and their own weak spots. This may be leading them to revisit expectations around ROI, cost and business model. This is essentially a “refinement” process, analogous in some ways to what Gartner refers to as technologies that enter the period of "disillusionment" before advancing to the "slope of enlightenment.”

What’ important is that despite these refinement activities, the channel is embracing cloud, as is evidenced in the rate of cloud-related growth and profit they are seeing compared with that of their traditional hardware and/or software portfolios. That promises to continue.

CompTIA’s IT Industry Outlook 2017 provides an overview of the trends shaping the information technology (IT) industry and workforce. Portions of the insights found in the report stem from an online quantitative survey of IT industry executives. The survey was fielded during December 2016 – January 2017 and generated a total of 530 responses, distributed as follows: United States n=310, Canada n=98, and the United Kingdom n=122.

The margin of sampling error proxy at 95% confidence is +/- 4.3 percentage points. Sampling error is larger for subgroups of the data. As with any survey, sampling error is only one source of possible error. While non-sampling error cannot be accurately calculated, precautionary steps were taken in all phases of the survey design, collection and processing of the data to minimize its influence.

Forecast methodology note: CompTIA’s industry growth projections are depicted as current dollar forecasts. They do not factor in the effects of inflation or currency movements, which can impact the relative value of goods sold from year to year. As a forecast of revenue, other distortions may occur as well. For example, scenarios where unit sales of a product may increase significantly, but the average selling price falls, could result in flat revenue growth even though market share is expanding.

CompTIA is responsible for all content and analysis. Any questionsregarding the study should be directed to CompTIA Research and Market Intelligence staff at research@comptia.org.

CompTIA is a member of the Market Research Association (MRA) and adheres to the MRA’s Code of Market Research Ethics and Standards.

Read more about The Business of Technology.

Tags : The Business of Technology